A stellar rally in 2021, followed by the Russia-Ukraine war, saw metal prices peaking in the first quarter of 2022. However, prices tumbled thereafter. Aggressive rate hikes from the US Federal Reserve, strong dollar and weak demand dragged the prices lower. But things started to turn around in the last quarter of the calendar year 2022 as China prepared to open up, post its zero-Covid policy. High hopes for a quick economic recovery and a robust demand revival from China, the world’s largest metal consumer, triggered the price reversal.

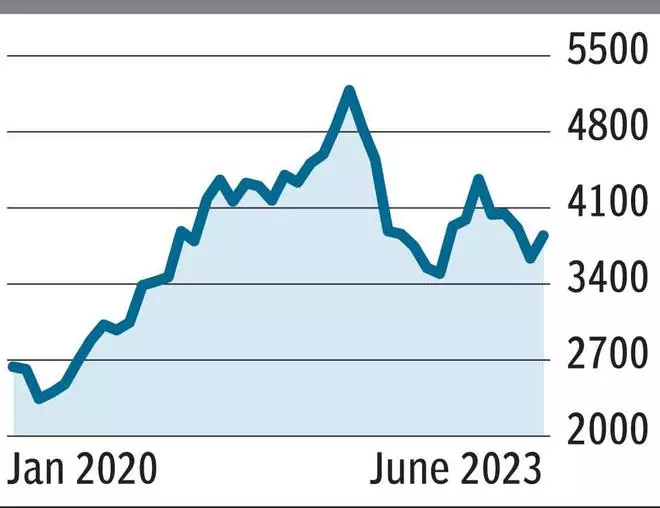

The London Metal Exchange Index (LMEX), a weighted index calculated from the closing price of the six base metals — Aluminium, Zinc, Copper, Lead, Nickel, and Tin — rose from a low of around 3,453 in end September 2022 to a high of 4,403 in January this year. But with growth and demand from China not picking up as expected, prices have moved sharply lower again. So far, the LMEX has tumbled about 13 per cent from its January high of around 4,403.

Among the individual metals, barring copper, which is marginally up for the year by a little over 2 per cent, other base metals are down for the year. Nickel has been beaten down badly, falling about 23 per cent. This is followed by Zinc, which sports a 16 per cent slip. The good news from this is the easing of raw material cost pressures for India Inc, even as commodity producers may face weak realisations. But, how much of a tailwind does the cooling off actually have? What’s in store, for the rest of the year, for base metals? Here’s our take, based on fundamental as well as technical analysis.

What lies ahead

The picture is not looking very rosy for the rest of 2023. Base metal prices are likely to see one more leg of fall before a strong revival happens. Weakness in the Chinese economy, high inflation and interest rates are some of the major factors that can continue to keep base metals subdued.

China: No signs of recovery

While the western world continued to increase interest rates, China has been on the other side. Even as recently as last week, the People’s Bank of China (PBOC) cut its short- and medium-term policy rates by 10 basis points (bps). While these measures are likely to take some time to have a rub-off effect on the economic recovery, for now, the economic condition in China is still anaemic.

China’s property and industrial sectors — the major consumers of base metals — continue to remain weak. China’s housing market has been in trouble since mid-2021. The data point on newly started houses shows that it has come down — from a high of 269 million units in June 2021 to 85 million in May this year.

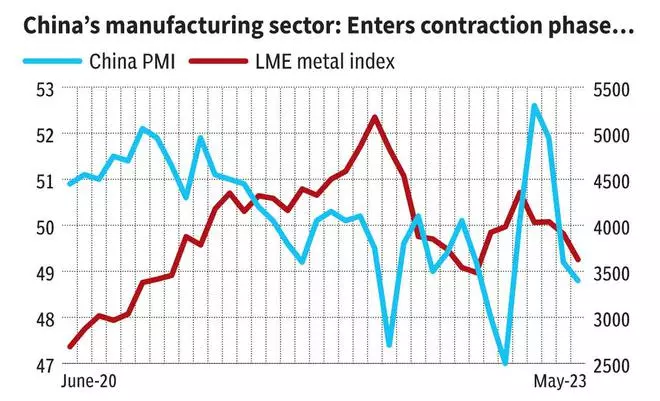

Similarly, China’s manufacturing Purchasing Managers’ Index (PMI) has come back into the contraction phase after briefly entering the expansion phase in February this year. The PMI is currently at 48.8. So, unless both the sectors recover, metal prices are not likely to rise this year.

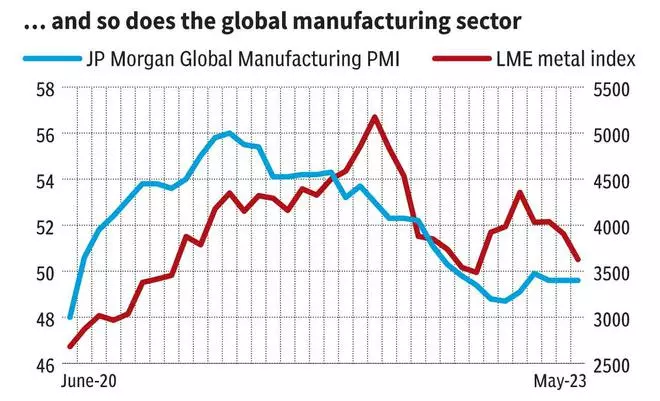

Even globally, the manufacturing activity is slowing down. JP Morgan Global Manufacturing PMI is currently at 49.6. Though it has risen from the low of 48.7 in December last year, it is still struggling to rise above 50 — the expansion phase.

High inflation, interest rates

Aggressive rate hike from the US Fed was one of the major reasons for metal prices to crash in 2022. After ten consecutive rate hikes, the Fed opted for a pause in its June meeting last week. However, the central bank has left the door open for another 50-basis points rate hike for the rest of the year. That is, in the next four meetings, the Fed could raise rates by 25-bps in two of them.

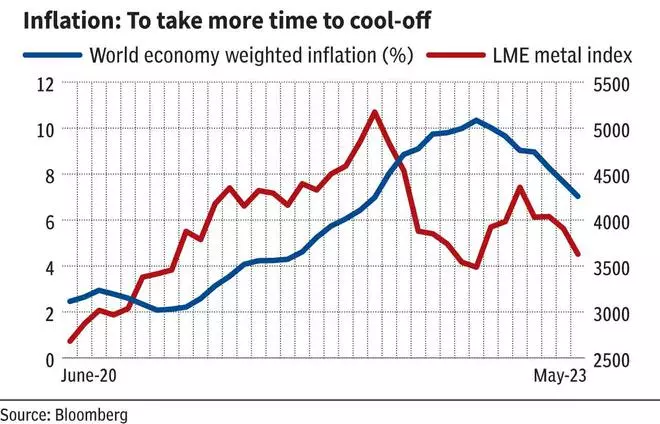

On the inflation front, there is more room left to reach the global central banks’ target, especially that of the Fed. Global Consumer Price Index (CPI) data from Bloomberg shows that inflation has cooled to 6.6 per cent after peaking at 10.4 per cent in November 2022. However, looking back at e history, the average global inflation rate during the pre-Covid period from 2015 to 2020 has been 3.5 per cent. So, for the global CPI to come down into its average zone, it will take time. Until then, interest rates are likely to remain higher.

So, both the high inflation and high interest rate scenario, which is likely to prevail for the rest of 2023 at least, will not allow metal prices to rally.

Demand-supply imbalance

Base metal complex is forecast to be in deficit — that is, demand is likely to exceed supply in 2023. However, this is not going to create a positive impact on the prices. Because the rate of increase in supply is going to be higher than that of the demand. For instance, the International Copper Study Group (ICSG), in its forecast released in April, expects a deficit of 1,14,000 tonnes in refined copper for 2023. However, this is much lower than a deficit of 4,31,000 tonnes witnessed in 2023. This is because the demand is likely to increase by just 1.4 per cent as compared to a 2.6 per cent increase in production.

Similarly, in Zinc, the demand is likely to grow by 2.1 per cent while the supply will increase by 3.1 per cent. Refined zinc market is forecast to end 2023 with a small deficit of 40,000 tonnes. So, slower pace of rise in demand as against a faster increase in supply can keep the upside capped in metal prices. Unless the demand picks up robustly, overshadowing the increase in supply, metal prices are not expected to increase.

Verdict

As seen from the charts above, the factors discussed above have strong directional correlation with the metal prices. Overall, base metal prices are not likely to move higher immediately. On the contrary, weak demand, sluggish Chinese economy, high interest rates and inflation scenario, all together, can drag base metal prices further lower in the second half of this year.

Technical Outlook

LMEX (3,837)

The outlook is bearish. The index has strong resistance in the 3,900-4,000 region. In the near term, the chances look bright for a rise to test this resistance zone. However, a rise past 4,000 is unlikely. As such, the LMEX can reverse lower again anywhere from the 3,900-4,000 region and resume the broader downtrend. That leg of downmove can take the index down to 3,400 and even 3,300 in the coming months. Thereafter the price action will need a very close watch — because 3,300-3,400 is a very good support zone. The downtrend can halt, and a fresh rally is possible from this support zone.

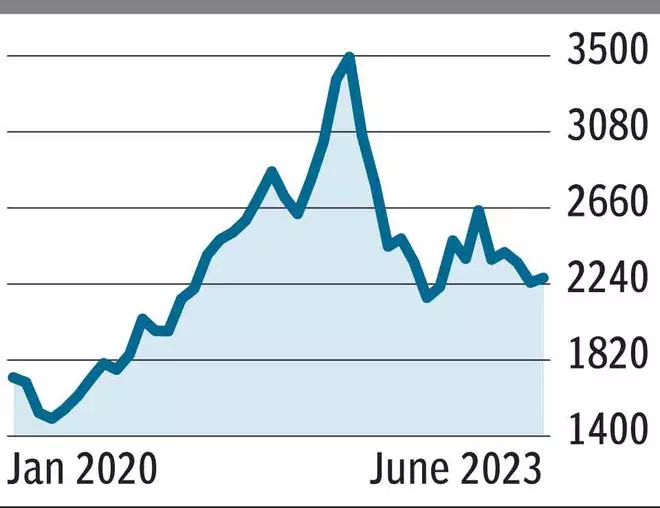

LME Aluminium ($2,271 per tonne)

The picture looks a little mixed. The broader trend is down. But the recent price movement on the charts leaves the structure less weak. But at the same time, there is no strong positive sign for a trend reversal as well. Important resistances are at $2,450-2500 and $2,600. Immediate support is at $2,200. Below that, $2,150 and $2,000 are the next important supports. So, overall, $2,000-2,600 will be the broad range of trade for Aluminium in the coming months. Within this, we can expect the price to fall and test $2,150-2,000 first from current levels. Thereafter a reversal is possible.

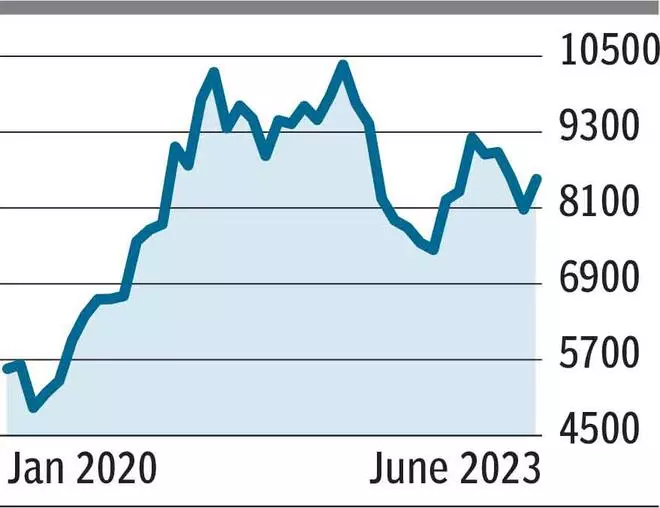

LME Copper ($8,566 per tonne)

The level of $8,000 is currently giving good support. A rise to $8,900-9,000 is possible in the near term. But thereafter, the price can reverse lower again. That can take it down to $8,000 levels again. A break below $8,000 can drag the price lower to $7,200. Thereafter the chances are high for the price to reverse higher. To negate the above-mentioned fall to $7,200, copper has to rise past $9,000 decisively first and then breach $10,000 subsequently. That will need some strong positive trigger, which looks very difficult currently. So, for now, the chances are high for copper prices to remain at $9,000.

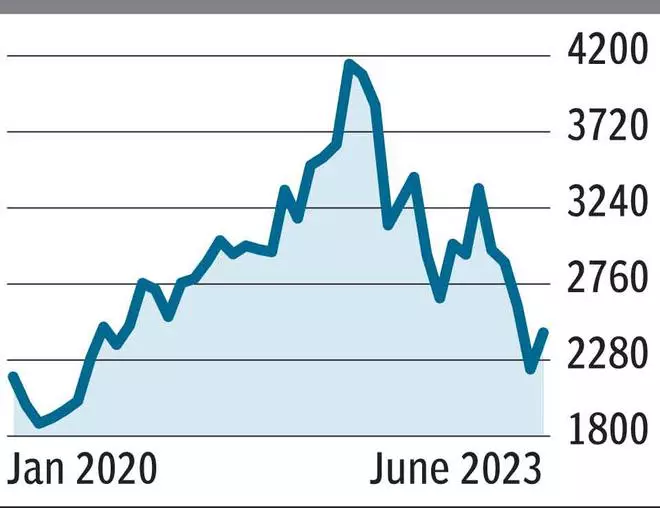

LME Zinc ($2,478 per tonne)

The overall trend is down and this downtrend looks strong. Among all the base metals, zinc looks the weakest. It has more room to fall from current levels than others. The recent bounce from the low of $2,215 is just a corrective bounce. Strong resistance at $2,700 can be tested now. But it can cap the upside as fresh selling can emerge again at that level. A fresh leg of fall from around $2,700 can drag the price down to $2,000-1,900. However, that could be the last leg of fall. From a long-term perspective, the $2,000-1,900 is a strong support zone. The current downtrend can halt there, and trend reversal is possible thereafter.

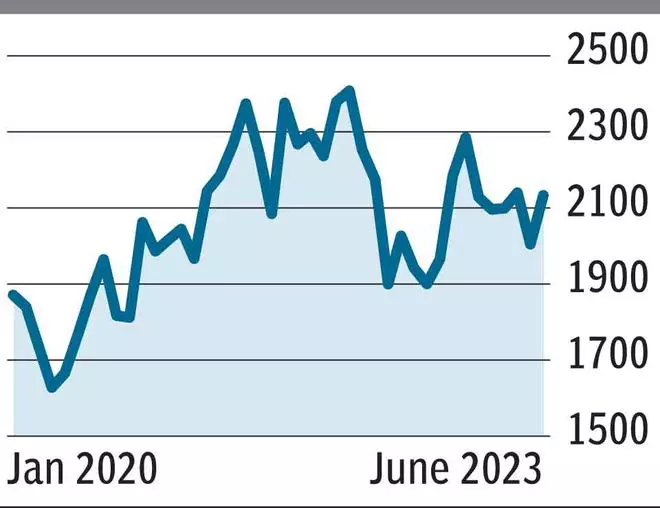

LME Lead ($2,141 per tonne)

The price has been in a prolonged sideways range for more than a decade. $1,500-$2,900 has been the broad trading range since 2010. Within this, the price is poised around the midpoint. So, this leaves equal chance for it to move either way within the range. Immediate resistance is at $2,200. Support is at $2,000. Failure to breach $2,200 from current levels can trigger a break below $2,000. Such a break can drag the price down to $1,700-1,600, going forward. On the other hand, a break above $2,200 can be bullish. It can trigger a rise to $2,400-2,500. Overall, it is a wait and watch situation. A breakout on either side of $2,000-$2,200 will determine the next move.

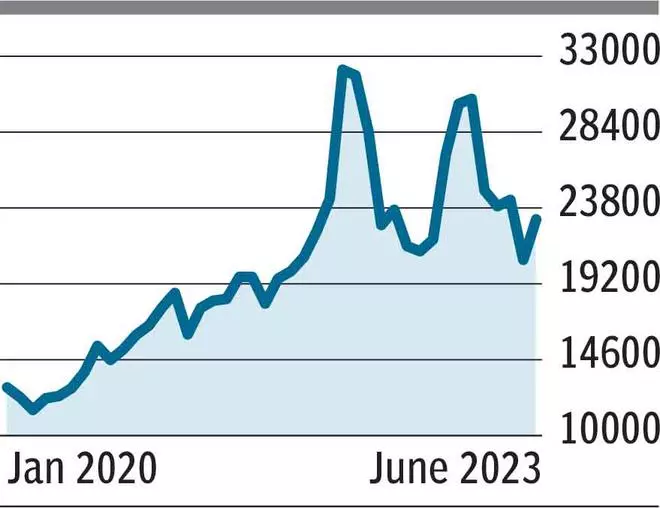

LME Nickel ($23,034 per tonne)

A strong bounce happened last week. But key resistance is at $23,500-$24,000. A rise in the near term to test this resistance zone is possible. However, an immediate break above $24,000 might not be very easy. It will need some strong trigger. So, the chances are high for nickel price to reverse lower again from $24,000. That reversal can take the price down to $20,000 and even $19,400. Thereafter the price action will need a close watch. The $20,000-19,400 region is a good long-term support zone. So, a fresh rally is possible from there.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.