The Israel-Hamas war aside, crude oil prices are anyway going up due to supply-demand conditions. That said, the rally could hit a wall in the second half of calendar year 2024. This is because by then, the war risk premium could wane and the global growth concerns might come into play, weighing on the prices.

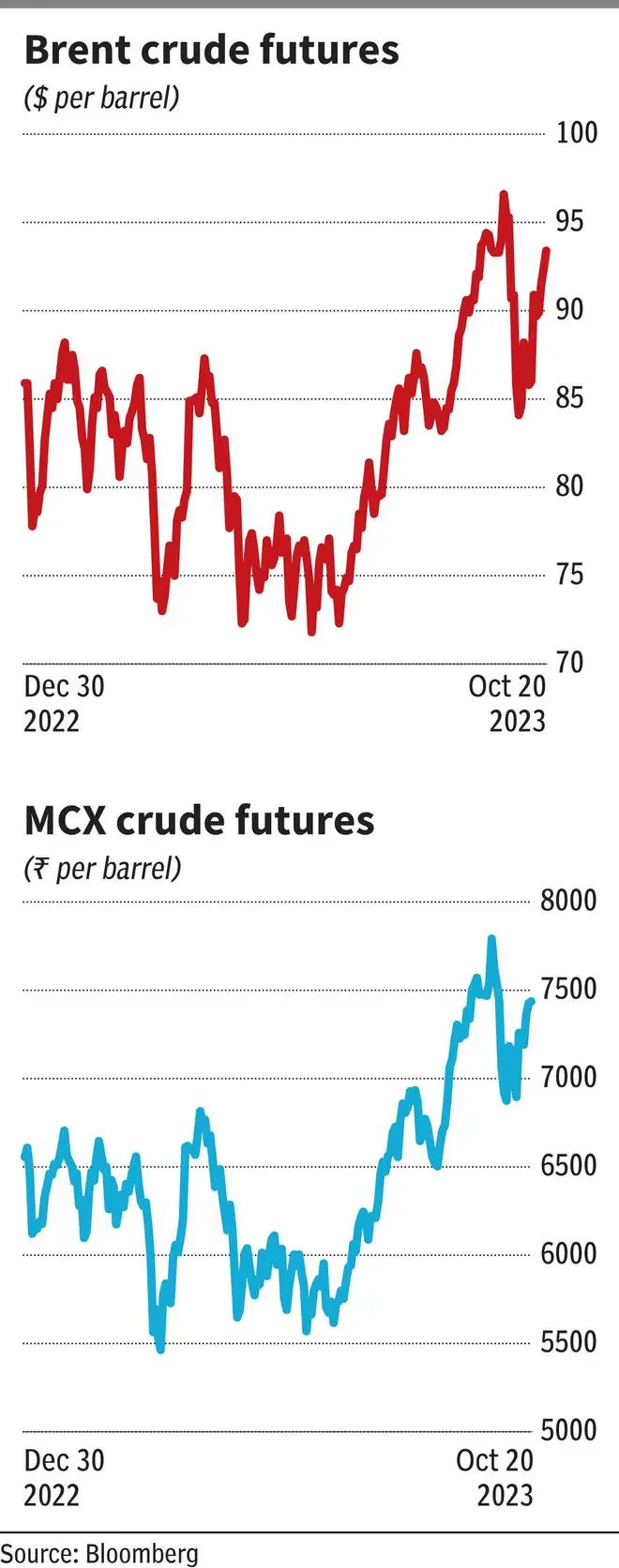

Since the war began, Brent crude futures and MCX crude futures have surged 9 and 7 per cent respectively. Year-to-date, continuous contract of Brent crude futures is up 7 per cent whereas MCX crude oil futures has gained 12 per cent as it closed at $92.2 and ₹7,330 per barrel, respectively.

At the moment, the market seems to have digested the war-related risk since there has so far not been an impact on the supply-demand dynamics of the commodity due to the war.

However, it is the fear of the war spilling over to the other parts of the region that is keeping investors on edge. Especially, as Iran has been a vocal supporter of Hamas. Iran’s moves will be watched for two reasons. One, the country’s crude oil output is nearly 3 million barrels per day (mb/d), which is about 3 per cent of the global production. Two, its geography, as it touches the Strait of Hormuz. Approximately 20 per cent of the total crude oil production is transported through this Strait, the gateway to the open ocean from the Persian Gulf.

That Iran produces 3 per cent of the global crude is not as much a threat to oil prices. For perspective, Russia’s production of over 10 mb/d is more critical to the global supply. Despite this, when Russia-Ukraine war began, crude oil prices shot up only temporarily in early 2022. For the rest of the year, the price gradually declined because of the supply glut. Brent Crude futures closed at $85.9 in December 2022 compared with the high of $139.1 made in March 2022 because the Ukraine war. The second factor is the bigger threat. The worst fear is that Iran could disrupt the oil flow through the Strait of Hormuz to have a bigger say in the war.

Besides, Iran’s closeness to Hezbollah is another concern. Hezbollah is a political party/militant group in Lebanon, which shares its border with Israel. Tensions have built up enough in Israel-Lebanon border as there have been exchanges of firing last week.

But since the big powers in the West stand with Israel, Iran cannot take a big risk by going all in. However, as it stands, everything is uncertain in the geopolitical equation in this region and its impact on the prices of crude oil.

The bottom line is that volatility in oil prices, which has reduced over the last week, can spike if the situation worsens. That said, this situation may be more transitory in nature, temporarily putting pressure on oil prices. Over the medium term, supply-demand dynamics will determine where prices are headed.

There has been significant development on this front in the recent months.

Saudi and Russia unplug

Crude oil was trading in the negative return zone until the big guns in OPEC+ (Organisation of Petroleum Exporting Countries +) group, Saudi Arabia and Russia, announced supply cut.

OPEC+ is the grouping of 10 OPEC countries and 10 non-OPEC nations. Being the top two crude oil producers in the group, Saudi Arabia and Russia are the key members. Also, they are among the top 3 producers in the world along with the US.

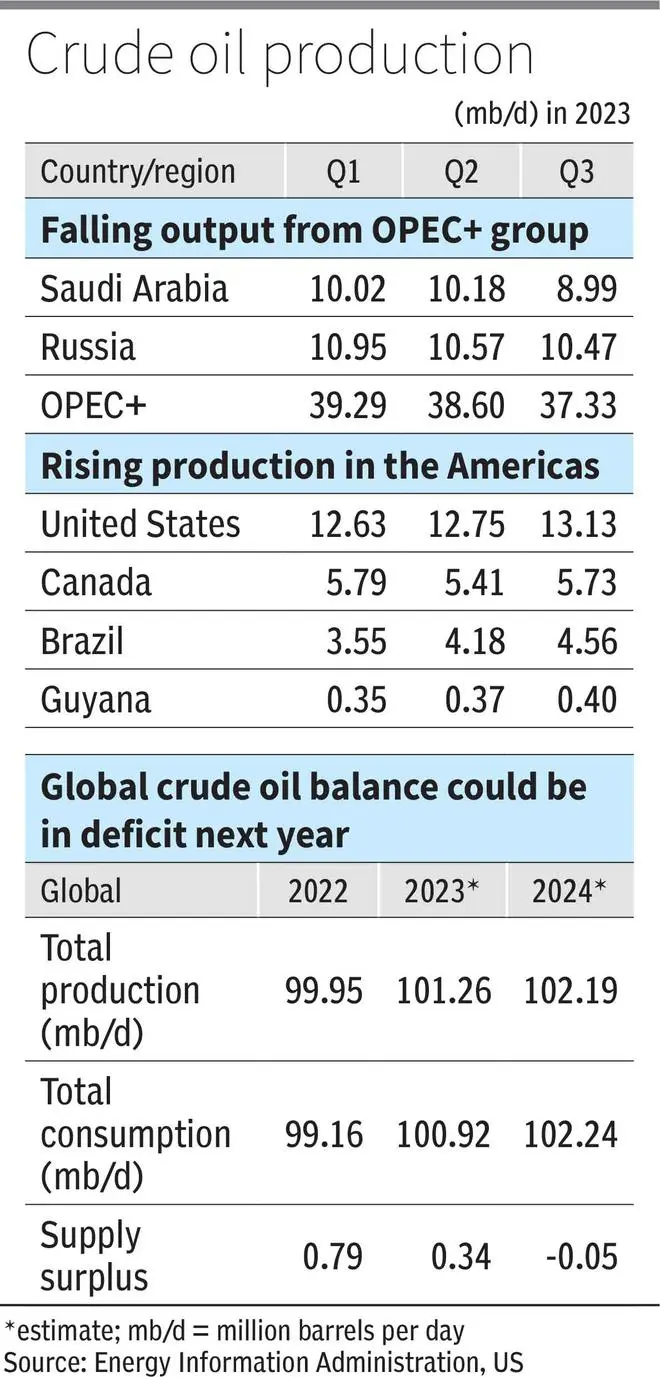

Saudi Arabia, in June this year, announced a voluntary cut of 1 million barrels per day (mb/d) in oil output in July. It has now extended this until December 2023. Hence, it could end up producing 9 mb/d this year.

On the other hand, Russia spoke in July 2023 of a reduction in oil export amounting to 0.3 mb/d until the end of the year. The country’s production is expected to be at 10.9 mb/d for 2023. Comparatively, the US is the largest producer as EIA (Energy Information Administration) expects 2023 production in the US to come in at 12.9 mb/d.

Importantly, Saudi and Russia together contribute to nearly 20 per cent of the expected global output of 101.3 mb/d and nearly 50 per cent of OPEC+’s 38.2 mb/d in 2023. This underlines the magnitude of impact these two countries can have on the global crude oil supply.

As supply decreased following the cuts by these two countries, the prices have faced upward pressure since then. The Brent crude futures has risen to $92.2 now compared with $74.9 in June, when Saudi first announced their cut to support prices.

Saudi and Russia took the measure even as many OPEC+ countries are struggling to meet their existing production targets. Notably, OPEC+ group’s current expected output of 38.2 mb/d for 2023 is lower than 2022 by 1.4 mb/d. Assuming some extension of Saudi’s production cuts into 2024, the group’s 2024 output could further drop to 37.8 mb/d, according to EIA. However, this is likely to be counter-balanced by improved output from North and South America.

Offset from Americas

In 2023, new project starts in the Americas, especially in Brazil and Guyana, is expected to more than offset the cut in OPEC+ supply. This is further supported by an increase in production by the US and Canada. In total, these four countries are expected to add 2 mb/d in 2023 against the cumulative cut of 1.3 mb/d by Saudi and Russia.

However, despite this, the increase in demand outweighed increase in supply for the first three quarters, having net positive impact on price. In 2023, the global supply is expected to go up by 1.3 mb/d to 101.3 mb/d; the global consumption is likely to increase by nearly 1.8 mb/d to 100.9 mb/d.

The increase in consumption is driven by the pent-up demand from China, the second largest consumer of crude oil, post the lifting of Covid-related restrictions. Also, there has been increased consumption in India and Brazil. The cumulative increase in demand from China, India and Brazil stood at nearly 1.2 mb/d this year.

As a result of higher consumption growth, the excess supply can decline to a little over 0.3 mb/d in 2023 as against 0.8 mb/d in 2022. Interestingly, as per the latest EIA projections, the oil market could face a minor deficit in supply in 2024, potentially leading to further depletion of inventories.

The main reason for the deficit next year could be the reduction in output by OPEC+. However, the easing of sanctions imposed on Venezuela’s oil sector for six months by the US could help keep the balance in marginal surplus. In the third quarter of this current calendar year, the South American nation produced about 0.8 mb/d crude oil. Hence, if all goes well, the total output from the Americas will be further boosted by Venezuela, easing the upward pressure.

Inventory movement

In the second half of 2023, the global crude oil inventories are expected to drop by 0.2 mb/d, according to EIA, mainly because of the supply cut from Saudi and Russia. The inventory draws are expected to stay at the same rate in the first quarter of 2024 because the OPEC+ production cut is likely to keep global oil production lower than global oil demand. For the remaining three quarters of 2024, the inventory is estimated to be balanced i.e., the rate of incoming and outgoing stocks could be more or less equal.

In the US, the largest producer and consumer of crude oil, the commercial crude oil inventories fell to 414 million barrels in September end. This is the lowest stock of crude oil since the beginning of this year. It stood at 481 million barrels in mid-March, the highest this year. The drop was because of increased domestic demand and exports.

Broadly speaking, the declining trend of inventories has also propped up prices. It might continue to do so in the first half of next year as stockpiles are expected to go down further. EIA has revised down the average inventory for 2024 in the US to 428 million barrels compared with the previous estimate of 440 million barrels.

Inverted-U price trajectory

Net-net, considering the above demand-supply dynamics, the crude oil price movement is likely to take an inverted-U trajectory. The production cut of OPEC+, led by Saudi and Russia, can keep up the upward pressure in the coming months. As per the EIA, the OPEC+ group is expected to trim crude oil production by 0.3 mb/d through 2024.

On the demand side, developing countries like China, India and Brazil, along with the US, are set to see a rise in demand. Therefore, this factor also points towards prices going up in the next few months. However, the potential slowdown in China and global growth concerns can slow down the demand for the energy commodity, particularly in the second half of 2024 (2H24).

In its recent Regional Economic Outlook, the International Monetary Fund (IMF) has noted slowing growth in China and the US, top two consumers of crude oil. China’s real GDP growth is expected to moderate to 4.8 per cent in 2024 versus 5.2 per cent in 2023. Similarly, real GDP growth of the US is projected to soften to 1.5 per cent in 2024 compared to 2.1 per cent in 2023.

Therefore, slowdown can lead to lower crude oil demand, putting downward pressure on prices in 2H24.

That said, our expected trajectory might go wrong if OPEC+ further reduces the output or Saudi opts to restore supply in early 2024. Also, the demand side of the equation can be disrupted if there is a severe slowdown. Not to mention the risk of Israel-Hamas war widening.

Hence, investors need to have a close watch on the actions of OPEC+ and the prospect of growth, especially in China and the US, the top two consumers of crude oil.

What the charts say

Brent Crude futures ($92.2) started rallying in July on the back of the support band of $70-72. After marking a high of $97.7 towards the end of September, the contract moderated and is now trading around $92. Until the support at $83 holds true, the bias will be bullish.

The price action in the daily chart indicates that the Brent crude futures could recover and is likely to rise to the $100-105 resistance band. A breach of this level is unlikely. Post moving to this barrier, the contract could consolidate for a while and then witness a gradual decline. But in case the contract breaches $105, the upswing could extend to $120 before falling.

As it stands, there is a good chance for Brent crude to rise for the next few months and then drop back to the region between $83 and $88 before the end of 2024.

MCX Crude oil futures (₹7,330) bounced off the support at ₹5,600 in July. The contract registered a high of ₹7,884 in the final week of September and then saw a decline. On Friday, it closed at ₹7,330. Although ₹7,700 is a hurdle, given that the trend is bullish, we expect crude oil futures to move above this level.

In the coming months, there is a potential for the contract to surpass the ₹8,000-mark and head towards the barrier at ₹8,300. Subsequent resistance is at ₹8,800. Like the Brent futures, the MCX crude futures too could stay sideways after reaching the ₹8,300-8,800 price band. But then, it could slip back to ₹7,000. The price band of ₹6,800-7,000 is expected to restrict the decline.

Infobox: Dynamics at play:

· Supply cut by Saudi Arabia and Russia can put upward pressure to the price.

· Increased demand from Asian majors like China, India and from the US and Brazil is expected to support prices.

· Israel-Hamas war continues to provide the risk premium for crude oil.

· A potential drop in demand in the second half of 2024 can weigh on the prices.

· Marked shift in production policy by the OPEC+ can impact prices on either side

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.