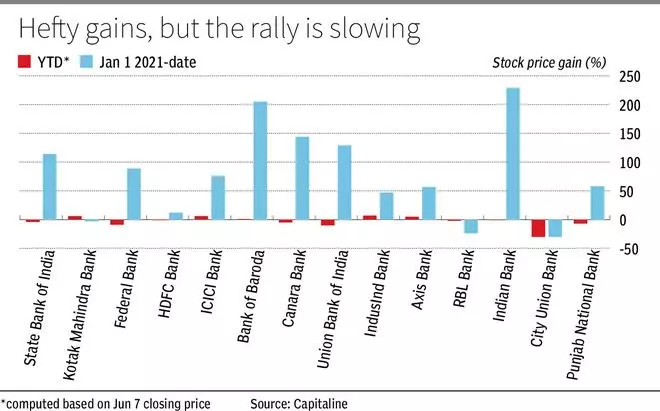

FY23 was an unexpectedly good year for banks. Whether in terms of growth, asset quality or profitability, it was undoubtedly one of the best performances across categories in over a decade. Ironically, though, the stock prices of banks aren’t reflecting evenly this great show. The positives are perhaps baked into the valuations, suggesting that the stocks are awaiting fresh upside trigger and the price appreciation from here on could be tempered. But why is this so?

In the recently ended March quarter, commentaries from most banks were quite non-committal on guidance with respect to loan growth and/or maintaining profitability and the hesitation is owing to the cost of money increasing by 250 basis points in just about 11 months, from May 2022 to March 2023; the steepest increase in repo rates the country has seen in many years. Though its impact was barely felt by banks in FY23, it may be difficult to ignore this pressure for long.

Here are the three main factors that could destabilise the show in FY24:

Product mix

Retail loans have long been the growth vehicle for banks and in FY23 as well. But it was a little different from the previous 2-3 fiscals. With borrowers even in the prime categories demonstrating comfortable repayment trends, banks played within the bandwidth of product mix. If FY21 - 22 were years of secured loans or asset backed retail loans pushing growth, FY23 belonged to the unsecured categories such as personal loans, credit cards and small ticket business loans.

These are products with short tenure; usually less than two years. What’s not clear is whether banks decided to push the pedal on these products because they saw the interest rates move up or whether to combat costs, they went gung-ho on these products. Unlike a home loan, most of these products are benchmarked to MCLR or marginal cost of fund based lending rate. The advantage of MCLR over EBLR or external benchmark lending rate (often linked to the repo rate) is the pricing cushion. Reset in MCLR has been slower than EBLR despite the repo hikes and since MCLR allows banks to price for the product cost efficiently, it has helped banks earn better margins even without passing on the repo hikes entirely.

But how long can these short-tenure products prop up the top line? The regulator is growingly uncomfortable with unsecured lines of business. For banks as well, it may not aid the balance sheet growth sustainably in the long run. If the banking sector liquidity is to get squeezed, which seems likely, it could impact the ability of banks to rely on these products for long; a factor that may become evident after the festive months of September-November 2023.

Favourable asset quality

Asset quality can have multiple implications on the financials of a bank. Lower provisioning helps banks post healthy net profits. It has a rub-off effect on the net interest margin or NIM — an indicator of profitability for banks. With much of the ageing-related provisioning done for across the banking system a further significant decline on this front seems unlikely in FY24. A back-of-the-envelope calculation suggests that margins could have been higher by 20-40 basis points (bps) because of this effect. Now with that petering out, the solace is that additions to non-performing assets and its consequent provisioning cost may be like FY23. What this means is that banks may not witness an improvement in return on assets or NIMs due to bettering asset quality in FY24.

Cost of deposits

This is a space which would be quite interesting to watch. Even if the repo rates have gone up by 250 bps so far, cost of deposits has increased, on an average, by just about 100-120 basis points; implying that the stock of liabilities at banks are enjoying the advantage of deposits raised earlier at much lower rates; one of the reasons why profitability of banks peaked to an all-time high in FY23. But this advantage may thin down as we move deeper into this fiscal.

For one, in the last 5–7 years with liquidity not an issue, there was a visible shift towards short to medium-term deposits. Very little of the deposit stock is currently locked in for even five years. What banks have resorted to is hike the share of bulk deposit – a relatively cheaper rate and shorter duration product, to meet the liquidity requirements of the past year. Take the case of Bank of Baroda. Its bulk deposits on a year-on-year basis have risen by over 80 per cent whereas growth of retail deposits was less than 5 per cent. To a large extent, most banks utilised this window of wholesale or bulk deposits, to the brim. Therefore, their shift to retail customers for deposits is almost imminent.

Secondly, with much of the existing book largely being shorter-term deposits, when they turn due for maturity, the price at which they would be rolled over would automatically increase. This is expected to reflect on the financials of banks by September 2024 and last till about mid-FY25. What works to advantage is the momentary pause on repo hikes and the expectation that systemically rates should either be capped at the current levels or start cooling in 3–4 quarters.

Either way, the implication that it would have on the profitability would be unavoidable for banks. For now, investors should pencil in at least 45–60 basis points decline in NIMs because of deposits repricing.

Profitability could possibly come back to FY21 levels. But that’s also under the assumption that banks could get cautious on the short-duration unsecured loan products. If that’s not the case, banks may be successful in maintaining FY23 profitability.

Managing higher costs

The overall outlook for FY 24 seems reasonably robust, barring the likely cost pressures and its implications on profitability. There are two things that one should keep in mind.

As mentioned above, the recent stock price movement of banks indicates that the Street isn’t factoring for an upbeat performance from the sector for the reasons cited above. That said, it’s not a factor, yet, which should prompt investors to stay away from the sector

One just needs to be careful in determining one’s choices based on the quality of the banking franchise and investor’s risk appetite.

Banking on bank stocks?

Representing over 35 per cent of the indices and popularly seen as the proxy to any country’s GDP growth, banking stocks are hard to ignore. But delve into them carefully!

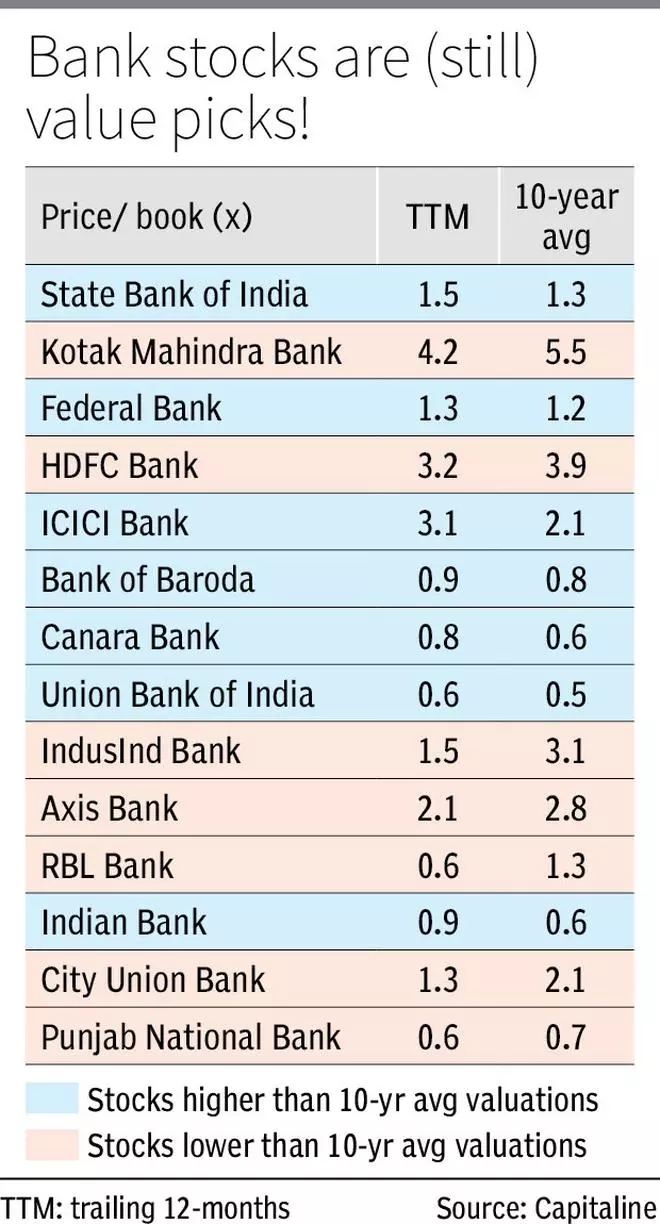

With FY23 performance being where it was, PSU banks have made a statement that their financials can be just as sparkling as their private peers’. Therefore, taking a generic call on PSU banks versus private banks may not work any longer. Instead, it may be prudent to basket them into three categories – the safe bets, risky ones and the avoid list.

Safe bets: The country’s top four banks – namely State Bank of India, Bank of Baroda, HDFC Bank and ICICI Bank are stocks that investors can consider buying/ accumulating without much downside risk. To a large extent their balance sheet is reasonably clean and they offer steady-state growth without much of surprises. But these stocks, having appreciated significantly in the last three years, which arguably has been the best period for banking stocks, must now be viewed as options which might just about mirror the performance of the bellwether indices or slightly outperform. Kotak Mahindra Bank could also be added to this list.

Risky ones: The candidates in this list could be longer. From the PSU banks space, Union Bank of India, Canara Bank, Indian Bank, Bank of Maharashtra seem attractively, purely from valuations standpoint. Also, given their consistent improvement in financials, markets may start appreciating their performances, thus reflecting in the stock price. Although these stocks too have seen a massive rally in the past two years, they are yet to touch their historical high prices, hence leaving upside potential for investors.

Within the private basket, Ujjivan Small Finance Bank, IDFC First Bank, RBL Bank and Federal Bank are worth considering. Ujjivan and RBL are instances of turnaround from stressed situations while IDFC First Bank could gain from the corporate action (merger with IDFC Limited, its parent company) under way. Federal Bank has faced elevated cost pressures and has pretty much succeeded in its efforts to revamp the bank. The downside factor could possibly be a slight detour from its slated plan caused by external factors, which is a likely for the bank.

What to avoid: Smaller franchises such as Dhanlaxmi Bank and Karur Vysya Bank in the private space and standalone PSU banks such as UCO Bank, Indian Overseas Bank, Punjab and Sind Bank and Central Bank of India fit into this list. These historically have been stocks which have seen bouts of good performances in the market, but they may not necessarily be driven by fundamentals. There is little to suggest that these banks can consistently deliver good financial results and hence be value buys.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.