It has traditionally been a bitter-sweet experience for investors with sugar stocks, with the fortunes of sugar producers linked not just to the domestic market but also to the international market. India is the world’s second-largest sugar producer and exporter, next only to Brazil.

The cyclical nature of the business and dependency on monsoon adds to the volatility in domestic and international prices, though some measures by the government and strong demand in the local and international market have helped the sugar prices rule firm in recent years.

However, the Indian sugar industry is poised for a transformation, which will not only cushion the operations of sugar producers from cyclicality, but will also help them significantly improve their finances — both in terms of revenue and profitability.

The big boost to the industry will come from the government’s resolve to implement the ethanol blending programme (EBP) rigorously. Having achieved 10 per cent ethanol blending ahead of schedule in May 2022, the government is all set to embark on a 20 per cent EBP plan, beginning 2023. With this, the medium-to-long term prospects of the industry are set to improve, as key players in this segment are on track with their expansion plans in the distillery segment.

Support for industry

Vagaries of monsoon have a direct bearing on the sugar prices in the home and global markets. That said, the government plays a vital role in ensuring the availability of sugar for domestic consumption through assessment of the overall domestic demand-supply scenario and accordingly deciding on the quantum of exports, during good years.

In the bad years, when there is a supply glut, the government offers export subsidies to make exports somewhat viable. However as per the WTO agreement, India will have to phase off subsidies by the end of next year.

Besides, in India, the State and Central governments fix the procurement price of sugar cane, to be paid to the farmer. The cane price in India is higher than in other sugar-producing nations, due to government intervention.

The Central government (Cabinet Committee of Economic Affairs chaired by the Prime Minister) announces Fair and Remunerative Prices (FRP) every year on the recommendation of the Commission for Agricultural Costs and Prices (CACP), which acts as the floor price for cane procurement.

In addition to this, the State Advised Prices (SAP) are announced by key cane-producing States such as Uttar Pradesh, which is generally higher than the FRP and is typically the price paid to farmers.

With a view to encourage and support cane-growing farmers, the government has ensured stable cane FRP even during down-cycles in the past. For instance, during 2011-15 when sugar price in the domestic and international market was on a falling spree, the government increased FRP by 58 per cent from ₹139 to ₹210 per quintal. Global sugar price, measured by the ‘sugar 11 contract’, went crashing to 10 cents (US) per pound levels in August 2015 from about 35 cents in February 2011. While this helps farmers, sugar producers bear the brunt of high prices.

However, two positive developments have kept the industry in good stead despite strong growth in sugar production over the last three years and record sugar production expected this year too. One, the government’s move to reduce the disparity between the input price and price of the end-product by introducing a minimum support price (MSP) for sugar in 2018 has been positive for the industry.

Under the scheme, the price is computed after considering various aspects such as FRP and the conversion cost of efficient mills. The MSP was last revised in 2019 and currently stands at ₹31/kg; the current spot price of sugar on NCDEX is ₹33.5 per kg. While the MSP has certainly provided some relief to sugar producers, the FRP increases have not always resulted in an increase in MSP. For instance, between 2019 and now, the FRP has been hiked by 5.5 per cent, while the MSP has remained unchanged.

Two, healthy demand for sugar in the home market and global markets, thanks to lower output from Brazil, has cushioned against price correction. For instance, in the current year, even as a bumper crop is expected in India (36 million tonnes, which is 15 per cent higher than last year), domestic consumption is expected to grow by 3 per cent.

Likewise, lower output from Brazil should support India’s estimated export growth of 27 per cent to about 9 million tonnes this year. Despite record production, closing inventory is expected to be at a new low of 7.1 million tonnes vis-à-vis 8.3 million tonnes last year, thanks to strong local consumption and higher exports. These factors have helped prices remain stable.

EBP, a shot in the arm

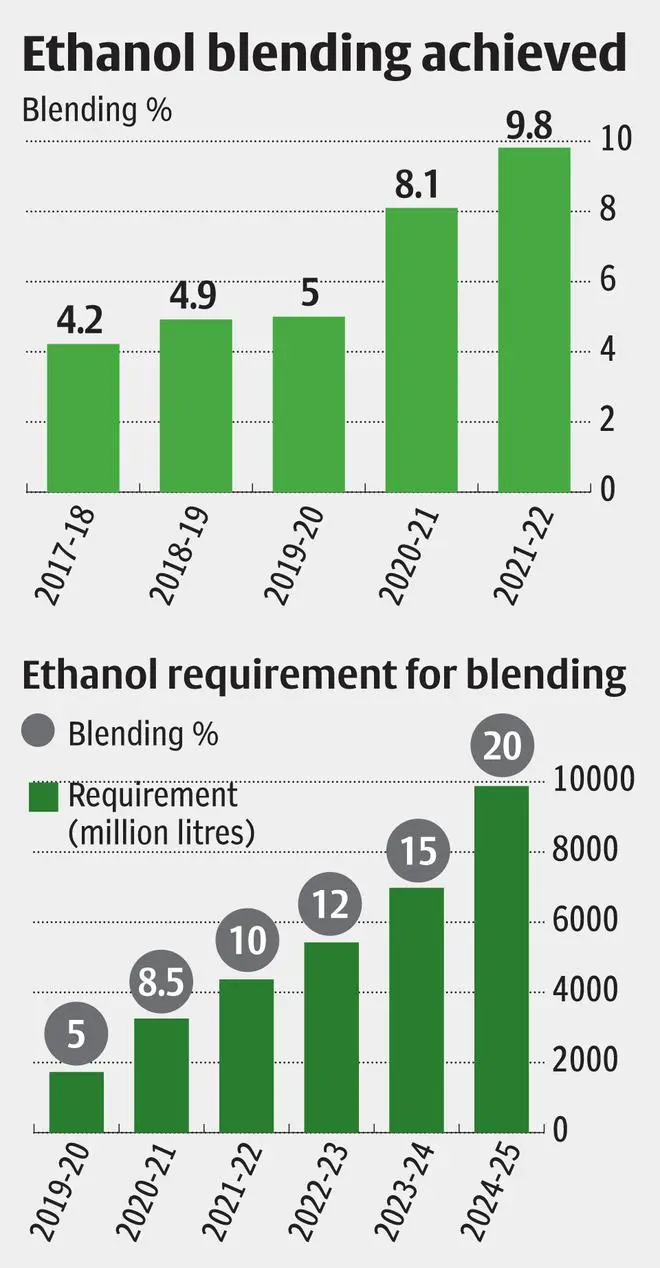

While the above measures have supported the industry during the last three years, the EBP has come as a shot in the arm. From about 4.2 per cent ethanol blending in 2017-18, India has made significant progress in the last two-three years to get to a national average of 9.82 per cent as of April 2022.

In early June, the Indian government announced achieving the 10 per cent blending target ahead of its planned date and has spelt out its next target of 20 per cent ethanol fuel launch, beginning FY23. It hopes to achieve 20 per cent blending by 2025.

Spiralling price of crude and the consequential impact on India’s subsidy bill, given that over 80 per cent of India’s energy requirement is met through imports, has made the EBP a long-term solution to reducing dependency on expensive imported crude.

According to a statement by the Minister of State for Environment, Forest and Climate Change, the country’s estimated forex saving on account of the 10 per cent EBP was about ₹41,000 crore. Successful implementation of the EBP of 20 per cent, beginning 2023, should result in additional forex saving of $4-4.5 billion every year from 2025, according to the government.

India’s commitment to declarations on emission reduction at the Glasgow COP26 UN climate conference, particularly with respect to meeting 50 per cent of the energy demand through renewable sources, has further necessitated speeding up of the EBP. Also, ethanol, being a cleaner fuel alternative, is a cheaper, indigenous and green source of energy.

The benefit from the EBP will be two-fold for the Indian sugar industry. Diversion of sugar cane for producing higher-margin ethanol should help boost the top line and operating profit margins for sugar producers. Even as ethanol prices are also fixed by the government, EBIT (earnings before interest and tax) margin on ethanol (distilleries) is significantly higher than that of sugar, even during sugar upcycles.

Consider Kolkata-based Balrampur Chini Mills, a leading sugar producer operating 10 units with a total crushing capacity of 76,500 tonnes per day in central and eastern Uttar Pradesh. The company’s EBIT margin from the sugar business has been about 15-16 per cent in the best case (in FY09 and FY17).

During bad years, the segment has made losses, while in a moderate year, the margins have been below 10 per cent. In contrast, the distillery segment, wherein companies manufacture ethanol and other potable alcohol, has been the consistent revenue and profit driver. In the last 15 years, EBIT margin in the distillery business has been in the range of 27-67 per cent.

Likewise for Triveni Engineering and Industries, which has seven units with a crushing capacity of over 61,000 tonnes per day, EBIT from sugar business was about 14 per cent in FY17, which was a bumper year for sugar producers. In bad years, for instance in FY15, the loss at EBIT level from the sugar business (₹167 crore) was about 11 per cent of the segment’s revenue of ₹1,541 crore. In a moderate year, the company made between 3 and 10 per cent.

In contrast, the distillery segment’s EBIT margin ranges between 14 and 62 per cent for the company. In a normal year, the company made between 20 and 25 per cent margin on the distillery business. Second, diversion of more cane towards ethanol production will lead to a moderation in the sugar output, which, in turn, should help sugar prices in India and global markets hold firm.

Capacity additions

As of FY22, ethanol production capacity was at 819 crore litres (molasses + grain-based) and is expected to increase 75 per cent to 1,430 crore litres by 2024-25, according to a data compiled by The Indian Sugar Manufacturers’ Association. This is thanks to various government initiatives like interest subvention for ethanol capacity addition, besides the EBP programme.

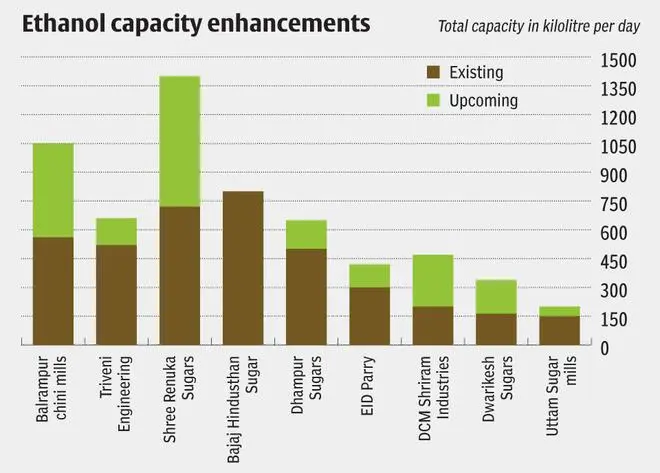

Sugar-producing companies have already embarked on a capacity expansion exercise for their ethanol (distillery) business. Balrampur Chini Mills, for instance, is expanding its distillery capacity from the current 560 kilo litre per day (KLPD) to 1,050 KLPD, about 170 per cent increase. This incremental capacity should become operational by November 2022.

The company’s existing facility at Gularia with a capacity of 200 KLPD is running at full capacity. New distillery expansions, at the Maizapur and Balrampur facilities, should result in the production of 350 million litres of Ethanol, which includes 50 million litres from grains and 20 million litres of ENA (extra neutral alcohol used for making alcoholic beverages), beginning FY24. Once the new projects are successfully commissioned and production stabilises, the company is likely to announce additional capex plans.

Triveni Engineering and Industries is also augmenting its distillery capacity from the current 520 KLPD to 660 KLPD, which at peak capacity can help the company double its distillery revenue.

Dhampur Sugar, a Uttar Pradesh-based integrated sugar manufacturer with crushing capacity of 45,500 tonnes per day and distillery capacity of 400 KLPD, is expanding distillery capacity by 100 KLPD in Asmoli at a cost of ₹130 crore. The company has also unveiled plans to add 150-KLPD distillery capacity at Dhampur (including 50-KLPD grain capacity)

EID Parry Ltd, South-based integrated sugar producer with interests in agri inputs and agri retail, is also adding distillery capacity. The company’s distillery capacity at Bagalkot (Karnataka) was augmented from 235 KLPD to 300 KLPD last year. The company is adding another 120-KLPD distillery capacity at Sankili (Andhra Pradesh).

Companies expanding in the distillery segment should see healthy growth in the medium to long term.

Re-rating possibility for stocks

While the supply side for the EBP programme seems all set, the government is working on the demand side too. For the auto industry, while the transition from 5 to 10 per cent blending was smooth, it is gearing up to support 20 per cent ethanol-blended fuel. Also, flex-fuel engines are also being considered; this will make the transition smoother. However, the impact of electric vehicles on the fossil-fuel-based vehicles and the EBP, remains to be seen.

Oil marketing companies (OMCs) have commenced work on doubling storage capacities and pipeline work for transportation. The OMCs are also getting dispensers for different grades of ethanol blended fuel ready at their retail outlets.

While the EBP will lead to significant savings for the government and have a positive rub-off on OMCs (given the blending of cheaper ethanol with expensive crude), the big impact on sugar producers can potentially result in re-rating for the sector, given the shield against cyclicality, the stability in operations that the EBP will bring as well as potential for significant margin expansion.

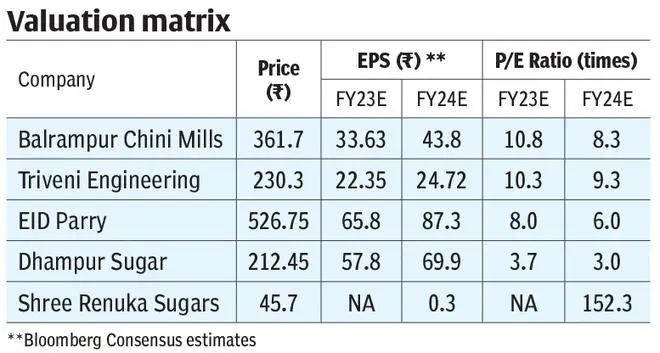

Stocks of sugar companies are currently trading at about 8-10 times one-year forward earnings. The healthy double-digit margins in the distillery segment and significant contribution from this segment in the medium term, strengthens the case for re-rating of integrated, low-cost sugar producers such as Balrampur Chini, Triveni Engineering.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.