Indian Railway Finance Corporation or IRFC is a mini-ratna PSU that functions as the primary fund-raising arm of Indian Railways (IR). The company raises funds from markets (bonds and borrowings) and finances Indian Railways projects (leases or project costs) on a cost of funds plus margin basis (35 bps currently) — the counterparty being the Central government through IR.

IRFC has a low-risk business model with zero NPAs. We recommended earlier that investors subscribe to the IPO (https://tinyurl.com/Buy-IRFC) and the stock has nearly tripled from IPO. We now recommend investors book profits as the stock price gains may be ignoring risks prevalent at the current levels — namely, NIM tightening, lower AUM growth visibility, diversification from IR implying risk factor going up and, finally, valuation expansion.

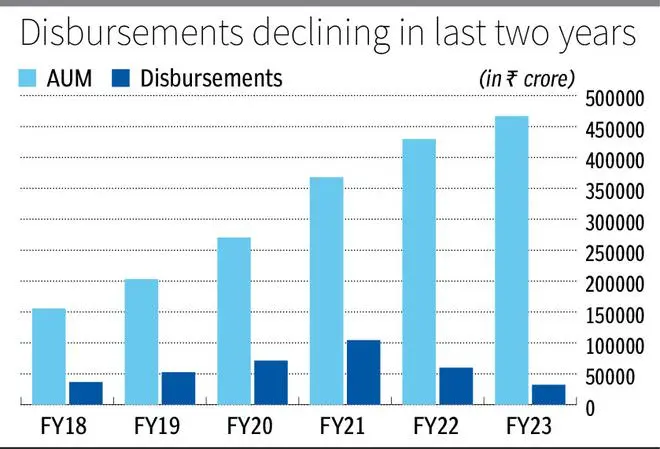

Credit off-take or disbursement at IRFC is slowing down visibly. The AUM of ₹4.66 lakh crore as of June ‘23 is plateauing, with only 8 per cent growth in FY23 as against 30 per cent CAGR during FY18-22. Disbursement has slowed from a peak of ₹1 lakh crore in FY21 to ₹32,337 crore in FY23. As budgetary provision for IR increased at 20 per cent CAGR over the last three years to ₹2.4 lakh crore in FY24, the commercial borrowing has reduced — leading to lower disbursements from IRFC to IR.

IRFC now is looking to diversify from funding IR alone. Haryana Orbital Rail Corridor project and funding of NTPC rolling stock in FY23-24 are small steps taken to build a framework for lending outside of the standardised lending contract used for IR so far. Though modest, the trajectory implies a shift in risk from the zero NPA assumptions currently. Underwriting ability for State and then private projects, counterparty risks and interest rate risk (spread so far, has been maintained at 35 bps) are the other factors that come up in this shift.

IRFC also gained from rising interest rate cycle. With an outlook of stable and then declining interest rates, the profits might decline even as profitability may not decline (35 bps spread maintained). This will impact the returns outlook. The spread itself has come off from 50 bps in FY17 to 35 bps currently. Any further decline will impact profit, and profitability as well.

IRFC shares gained from three factors at play in markets currently: credit growth story underlying financing institutions, infra push in IR and revival in PSU stocks. IRFC stock now trades at 2.2 times FY23 book value. This is at a premium to FY21 valuation at 0.83 times and compared to other financing PSUs, Power Finance at 0.9 times book and REC at 1.13 times trailing book value. Considering expected NIM contraction, large budgets to Railways (reducing borrowing requirements) and diversification risks to State/private projects, investors should book profits at the current elevated valuations.

RVNL

Stocks of companies in the infrastructure space have been seeing a lot of traction, thanks to the government’s focus on infra building.

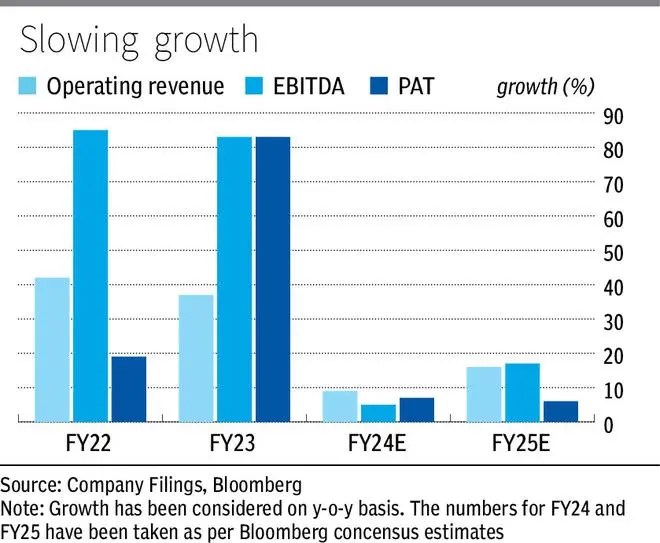

With budgetary allocation for Railways in FY24 shooting up 49 per cent year-on-year to ₹2.41 lakh crore, Rail Vikas Nigam Ltd (RVNL), focussed on end-to-end development of railway infrastructure, has surged 158 per cent since our ‘accumulate’ recommendation in end-February 2023. The trailing twelve-month PE of the company is around 24 times now, and is higher than its historical average (5-year) of around 8 times. The stock is also expensive compared to peer Ircon International, another Railway PSU, which is trading at a trailing twelve-month PE of 17.15 times.

While there are positives for the stock, the current valuation seems to factor them for now. We had earlier recommended partial profit booking at ₹130 levels in May 2023 at a trailing PE of 18.8 times. With stock price moving up further, and valuations too expanding, investors can now exit the stock entirely.

RVNL is involved in laying new lines, gauge conversion, doubling, electrification of railway lines and building workshops. It has commissioned more than 15,000 route kilometres of railway infrastructure till date. The company also takes up metro projects and has received orders from Chennai metro and Indore metro.

As on June 30, 2023, RVNL had an order book of ₹65,000 crore of which ₹35,000 crore worth orders were awarded on nomination basis and orders worth ₹30,000 crore achieved through bidding process. Some of the key projects it bagged in recent times are composite contract package from Haryana Rail Infrastructure Development Corporation Ltd worth ₹1,088 crore, NHAI contract worth ₹808 crore for rehabilitation and upgrading of Chandikhole and Paradip section from 4-lane to 8-lane, power infrastructure contract from Madhya Pradesh Poorv Kshetra Vidyut Vitaran Co Ltd, worth ₹ 149 crore, and a ₹322-crore project from Madhya Gujarat Vij Company Ltd.

In April 2023, RVNL was granted Navratna status, which also seems to have aided the rally in the stock. Navratna status gives central public sector enterprises enhanced financial autonomy. Navratna companies can invest up to ₹1,000 crore without seeking approval from the government.

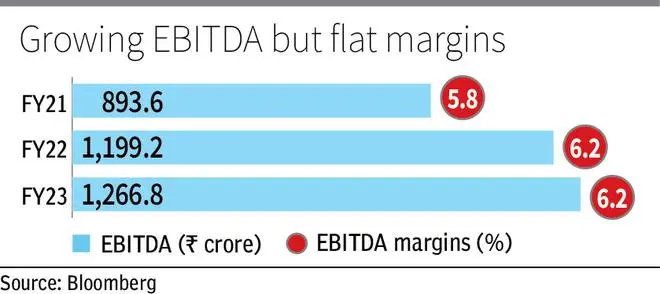

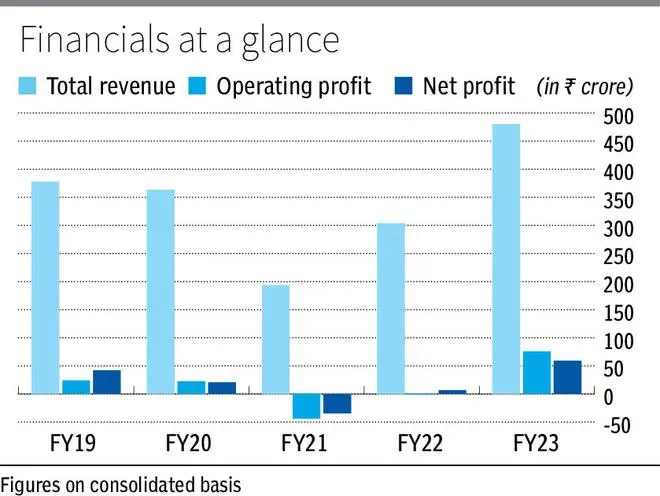

Revenue in June 2023 quarter was ₹5,571.57 crore, which is 20 per cent higher YoY. EBITDA grew 24 per cent in Q1 FY24 to ₹349.1 crore and the net profit for the same period was ₹342 crore, which is 15.2 per cent higher YoY. EBITDA margin in June 2023 was 6.3 per cent against 6 per cent for the same quarter last year. The net profit margin of the company was 6.2 per cent in Q1 FY24 against 6.4 per cent in Q1 FY23.

-

-

-

ITDC: Premium valuation difficult to sustain

Helped by the positive sentiment around G20 events tourism and sharp jump in FY23 earnings, shares of small-cap PSU firm India Tourism Development Corporation (ITDC) have galloped 26 per cent in the last six months and thus have outperformed many top listed hospitality companies. Despite its small size and historically thin profit record, the stock market appears to be ascribing premium valuation to ITDC based on its good show in FY23 and expectations of such a trend sustaining, going ahead.

Consequently, ITDC, which derives almost all of its profits from the hotels division, now trades at 37 times EV/EBITDA and 9 times price to book (based on 12-month trailing consolidated earnings). This valuation appears rich when compared to hospitality sector leader Indian Hotels, which trades at 34 times EV/EBITDA and 7.4 times price/book or second largest player EIH Ltd (26 times EV/EBITDA and 4.2 times price to book). Hence, investors who are sitting on decent gains may consider booking profit. We mention the reasons behind our argument in detail below.

One, be it revenue growth or margins, ITDC does not outshine IHCL or EIH. Its hotels division grew operational revenue by an impressive 58 per cent in FY23, but that pales in comparison to IHCL (85 per cent) or EIH (101 per cent) sales growth. ITDC’s 13 per cent net profit margin is also at the lower end of 15-19 per cent range for major hotel stocks. In Q1 of FY24 too, ITDC has not shown any major outperformance. One-off events such as the G20 and World Cup can only do so much.

Two, while ITDC is a debt-free company, its business suffers from high concentration risk. Seventy per cent of topline comes from hotels and of this pie, nearly 2/3rd comes from a single property: its flagship 550-room Hotel Ashok. Together with the 255-room Hotel Samrat, these 2 hotels (in New Delhi) account for 80+ per cent revenue/90+ per cent of PBT from the hotels division. Ageing properties and manpower are weaknesses. ITDC hasn’t added any major capacity (several properties in various stages of disinvestment) to ride the ongoing hotel up-cycle. There is also a proposal to monetise Hotel Ashok.

Three, ITDC has high dependence on PSU and Government business. Private-sector discretionary spending and international traveller occupancy traction is low. While ITDC enjoys government patronage, it may not be enough for sustained growth. PSUs in general suffer from lack of efficiency and productivity compared to private-sector peers.

Also, the government’s dividend-taking approach limits the financial muscle of PSU companies in capital-intensive sectors. In FY23, ITDC declared ₹18.9 crore as dividend (30 per cent of profit).

Four, the free-float of ITDC is extremely low at about 5 per cent, given very high promoter holding (IHCL also holds nearly 8 per cent stake). A very low free float can offer control benefits for company insiders but does result in illiquidity, limited investor interest, and potential valuation challenges.

Mazagon Dock

Since our ‘buy’ recommendation at ₹728 in the bl.portfolio edition dated February 12, the stock price has tripled to the levels of ₹2,217. The stock is currently priced at a trailing P/E of around 40 times up from its historical average of about 22.46 times since its IPO in 2020. The market appears to have shown extreme optimism towards the stock, considering the strong order inflows, indigenisation theme and growing share of defence capex. However, the risks relating to ordering and execution uncertainty might not have been priced in. While order pipeline relating to certain submarines appears strong, there has been uncertainty with respect to the timeline of ordering process. Also, the revenue growth which the company has been enjoying since last three years might not sustain, going by Bloomberg consensus.. Investors can take some profits off the table.

Conferred with Miniratna status, the company is engaged in the business of construction and repair of warships and submarines for the Ministry of Defence for use by the Indian Navy and other vessels for commercial clients. The company primarily operates in two business divisions — shipbuilding and submarine and heavy engineering. The shipbuilding division includes the building and repair of naval ships and the Submarine and Heavy Engineering division includes building, repair and refits of diesel electric submarines.

The company has an order book of around ₹39,117 crore as on June 30, 2023, translating into an order book to revenue of around 5 times. The book comprises orders worth ₹32,673 crore of shipbuilding, including P15B destroyers and P17A Stealth Frigates. However, order visibility in the near-term is impacted by uncertainty over order of six P75I submarines and three P75 submarines. .

Going ahead, management expects the current order book to exhaust by FY27 with peak revenue recognition in FY25. Investors need to keep in mind that the revenue visibility here is not exactly linear as shipbuilding projects have a minimum two-year gestation period after the order is awarded. After the gestation period, it takes anywhere between six and eight years to build a warship, and the company’s revenues are recorded based on the execution of projects. Hence, execution timeline remains uncertain in such a nature of business.

The company guides for a revenue growth of 10-12 per cent in FY24. As per Bloomberg consensus estimates, the company can achieve revenue growth at a CAGR of around 12.5 per cent and PAT growth at around 13 per cent CAGR for next two years. Valuation expansion, low to mid-teen growth prospects along with execution risks imply less margin of safety for investors. Further, around 70 per cent of the company’s earnings is attributed towards the interest income. Hence, adjusting cash from the market cap and adjusting interest income from PAT, one would arrive at an adjusted P/E of around 58 times attributable to its core earnings. This further makes the case for booking profits in the stock.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.