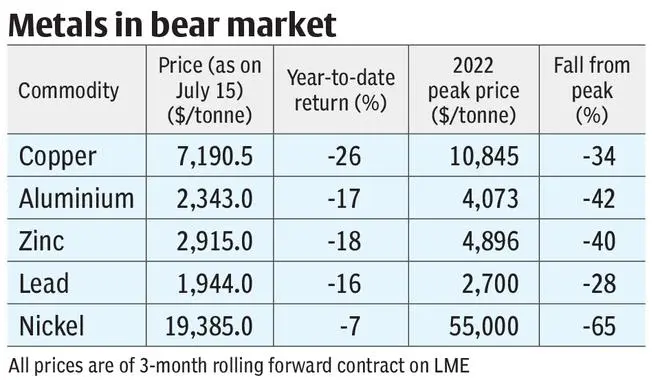

The adage “Sell in May and go away” would have made sense had someone gone short on commodities in May. Results would’ve been even better had they sold in March as most of the commodities peaked in that month! Specifically, all base metals are now in the bear market territory after falling over 20 per cent from their peak (see table).

In our yearly outlook published in early-January when all metal prices were continuing their bull run, we projected that the prices could top out in the first quarter and could see a drop for the rest of the year. While the price moved in line with our expectations, the fall was so sharp that all metals have now dropped to the levels we expected them to reach only by the end of 2022.

What kept the bulls going early this year? What led to the sudden change in trend and the subsequent slump in prices? Will the bears punch more?

Here are our answers.

War-led rally

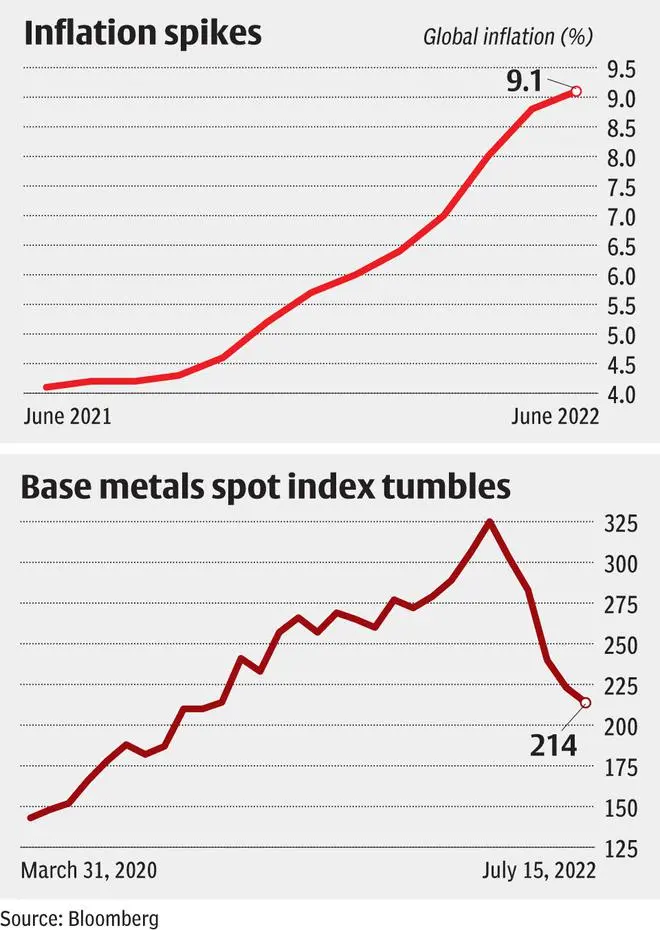

The year 2021 was a great one for metals. The prices rallied significantly on the back of supply disruptions caused by the pandemic, central bank liquidity and the economic recovery following easing of lockdowns. The Bloomberg Base Metal Spot Price Index was up nearly 33 per cent for the year.

Also read

In early 2022, expectations of the central banks — especially the US Fed, embarking on a rate hike cycle and then pulling the plug on liquidity, were gaining traction. One would expect such steps to weigh on asset prices including metals.

But then, the Russia-Ukraine war gave the bulls one last push, as supply concerns propped up again. Metals went on to hit further highs. At its peak, on March 7, the Bloomberg Base Metal Spot Price Index was up 27 per cent year-to-date. However, the rally did not sustain as several headwinds came to the fore.

Inflation, the Fed, and the dollar

Among all, inflation became a major point of discussion as it started spiking above the upper limit of central banks. What was thought to be transitory at first, proved otherwise across geographies.

Global inflation continued to rise in 2022 and hit 9.1 per cent in June, according to Bloomberg data. The US inflation, too, was in an upswing and, notably, hit a four-decade-high 9.1 per cent in June. Similarly, Euro area inflation shot up to 8.6 per cent in June.

So, concerns of inflation staying at elevated levels nudged central banks, especially the US Fed, to turn hawkish. The policy changes in the US are critical for the global economy and the saying, “When the US sneezes, the world catches cold,” stays true till date.

Faster rate hikes were carried out and the Fed raised the policy rate from 0.25 per cent in January to 1.75 per cent in June. Consequently, treasury yields shot up from 1.5 per cent by the end of last year to 3 per cent in June. Since the tightening has been quicker than anticipated, fears that the Fed might tighten far too quickly pushing the economy into a recession, and hampering demand for commodities, pulled metal prices down.

At the same time, investor sentiments weakened, and they turned to safety. The US dollar, being a safe haven, surged, and rising US treasury yields resulted in higher demand for the dollar. The dollar index, now at around 108, has gained nearly 13 per cent so far in 2022. This too hit metal prices as they are quoted in dollars in the international market.

Recessionary concerns have also shifted the narrative for metals to ‘weaker consumption’ rather than ‘tight supply’ which dominated in the first quarter of this calendar year.

No growth push

The International Monetary Fund (IMF) expects the global growth to slow significantly in 2022 to 3.6 per cent from 6.1 per cent in 2021 as a consequence of the Russia-Ukraine war.

The IMF expects the economic growth rate in China, the world’s biggest producer and consumer of commodities, to be at a much lower 4.4 per cent this year compared to 8.1 per cent in 2021. Even if China recovers and the consumption of metal improves from here, it may not counterbalance the potential demand drop from the US and Europe as they go through monetary tightening.

Growth in the US and Euro area is expected to drop to 3.7 per cent and 2.8 per cent in 2022 as against 5.7 per cent and 5.3 per cent, respectively in 2021, according to the IMF.

Slowdown in major economies like China, the US and Europe means weak demand for base metals and thus, consumption for key commodities is expected to lag supply in 2022.

The International Copper Study Group (ICSG) projects the global refined copper balance to be at a surplus of 1.42 lakh tonnes in 2022 and the International Nickel Study Group (INSG) estimates that the global nickel balance will be at a surplus of 67,000 tonnes this year.

Similarly, the International Lead and Zinc Study Group (ILZSG) expects the demand for lead to fall short of supply by 17,000 tonnes by the end of 2022. Zinc supply is anticipated to be at a deficit of 2.92 lakh tonnes. Yet, zinc was not spared of the commodity market onslaught as they fell along with other non-ferrous metals, likely, on concerns about global growth.

Weak economic growth will not only impact the demand for base metals, but it can also result in suppressed demand for crude oil, another key commodity.

Crude uncertainty

As global oil consumption outpaced supply since mid-2020, the prices of crude oil soared. Higher demand led to inventories decreasing by an average 1.4 million barrels per day (MMbpd) between the third quarter of 2020 and first quarter of 2022, according to the Energy Information Administration (EIA). But they forecast the inventories to increase by 1.2 MMbpd in the second half of this year due to increase in oil production and slowing growth in consumption. So, EIA expects the average price of crude oil, which was at $123 in June, to drop to $97 in the final quarter of 2022.

However, there are a lot of uncertainties such as how much Russian oil will reach the global market in the coming months and how well can the OPEC Plus countries meet their production targets.

Nevertheless, at this juncture, it appears that crude oil could gradually decline in the coming months, as demand is expected to weaken because of slowing growth. A fall in crude oil prices can be good in a way, as it can help cool down the inflation.

Outlook

Although the current sell-off in metal prices could slow down, the lack of demand and strong dollar will continue to put downward pressure. If this happens, users of metals as inputs may get some breather from the margin pressures that they have been facing. However, while metal producers have been profiting from rising commodity prices in the last couple of years, they might see a dent in performance in the upcoming quarters.

Possibility of a downside in crude oil prices can be a supportive factor for metal prices because of the savings in energy costs which go into the production of metals.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.