The logistics sector has been in focus in recent times for two reasons. One, government initiatives such as Gati Shakti, National Logistics Policy and setting up of Dedicated Freight Corridors; and two, the wave of technology disruptions in the sector.

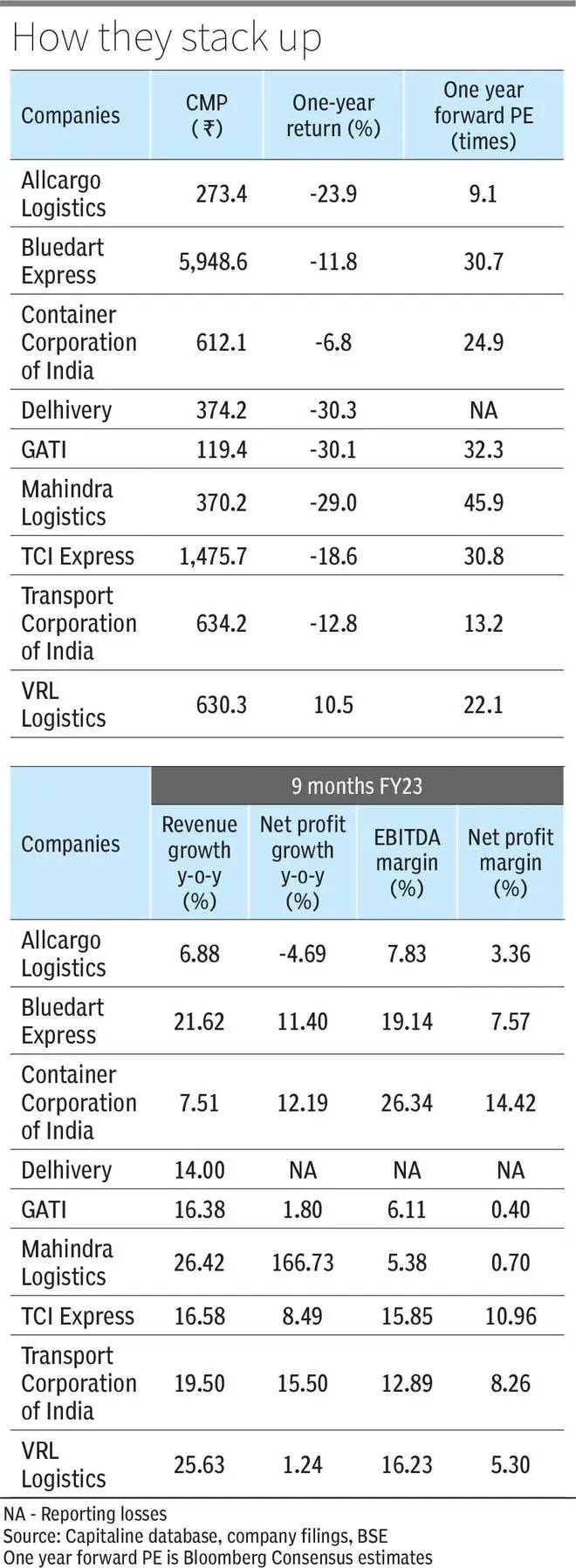

With long-term opportunity from government initiatives on the one hand, but a challenge to their business models, on the other, from new-age tech players, many logistics stocks have corrected and have under-performed the bellwethers as well as the broader Nifty/BSE 500 indices in the last year.

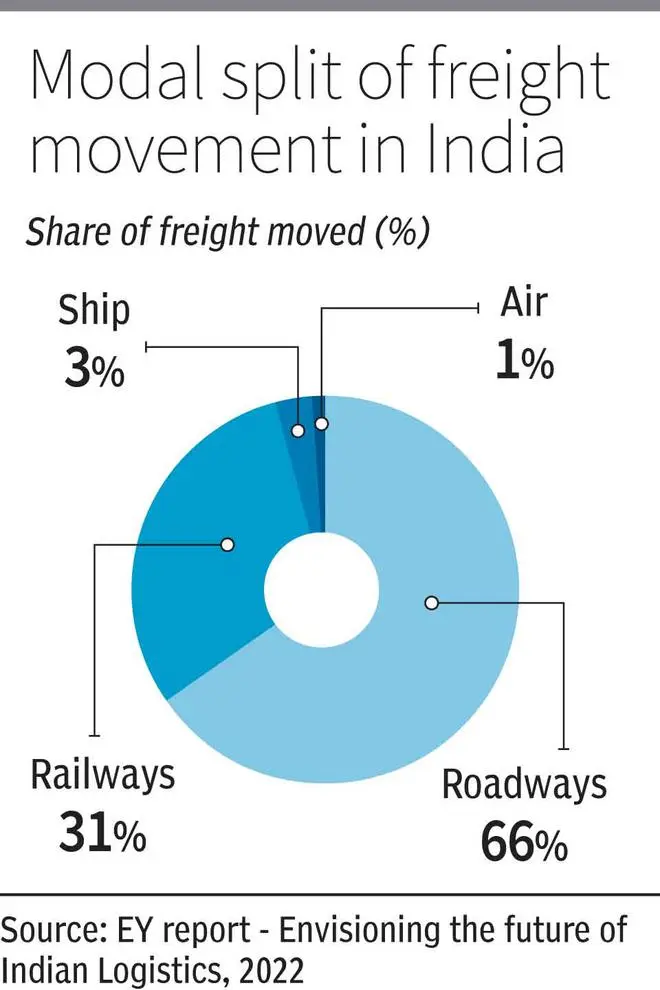

Here’s a lowdown on two key segments of the sector – roadways (constituting over 60 per cent of total freight) and railways (about 31 per cent of total freight) and how listed players are tapping into the opportunities and riding out the challenges.

Roadways

The road transport space is highly fragmented, with only 4 per cent of the market held by organised players and the remaining with the unorganised ones .However, the government regulation on e-invoicing – which mandates that operators with turnover above ₹10 crore will have to generate e-invoice — is leading to increased compliance, moving the market more towards an organised play.

Truck transportation is of two types: Full truck load (FTL) and Part truck load (PTL). FTL is the arrangement where the complete truck carries a single consignment. In PTL, it carries load of various consignors.

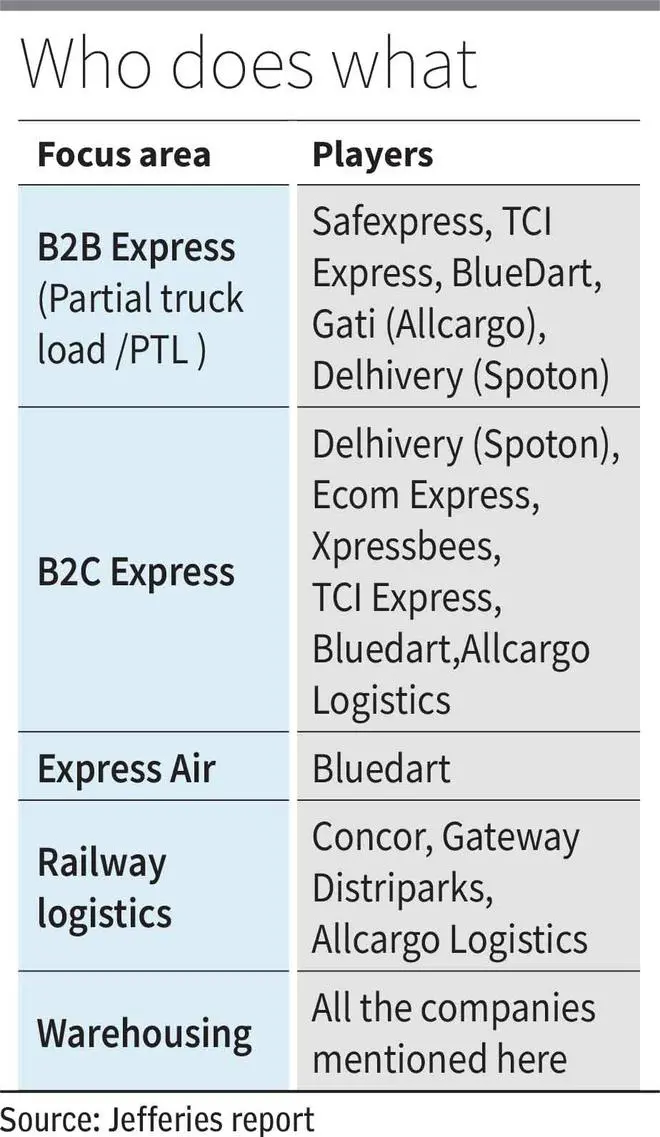

VRL Logistics, Gati, TCI Express and Delhivery are a few players who are into the PTL space. PTL consignments require more planning, halts, unloading operations and the per unit and per mile cost will be higher than FTL. This gives scope for higher margins in PTL over FTL.

According to a Jefferies report released last year, 88 per cent of total road transport is FTL, 10 per cent is PTL and 2 per cent is express parcel (EP). The Transport Corporation of India is a company with greater tilt towards FTL, with 64 per cent of its freight revenue coming from this space. However, with the rise of e-commerce industry, the express parcel segment is now in focus.

Express parcel

Express parcel is basically where non-bulk goods are moved. Blue Dart has been a major player in this industry for a while now — it initially started express service for documents and later entered the air cargo and surface express distribution services.

One factor that differentiates this segment from others is the share of organised players, which stands at 75 per cent (as per Aviral Research report on express logistics in India).

The business model of express logistics is that of hub-and-spoke. Consignments are picked up from the shipper via a local pick-up vehicle and unloaded at the nearby branch. Branches subsequently ship consignments to a nearby transshipment hub.

These transshipment hubs connect consignment to next hub as per route. From there, the materials are connected according to the delivery branches and finally delivered from the branch.

The main players in this space are Gati, Blue Dart, Delhivery and TCI Express. A major boost to express parcel segment is from e-commerce. Among other listed players, Gati had 92 per cent of revenue in 9 months FY23 from surface express business.

The margins for established express parcel players are closer to PTL business. Blue Dart reported an EBITDA margin of 13.54 per cent for 9 months FY23 and TCI Express 15.8 per cent for the same period. Similarly, VRL Logistics, which is a PTL player, reported an EBITDA margin of 15.2 per cent for 9 months FY23. On the other hand, Transport Corporation of India, with its tilt towards FTL business, reported an EBITDA margin of 12 per cent for 9 months FY23.

Rail transportation

Railways is the cheapest mode of transportation for long distances, but even then it accounts for a lower share in the total transportation market.

Though freight traffic generates higher revenues for the Railways, passenger trains and freight trains share the same infrastructure and hence, there has been a limitation on usage of this mode. This is why the government came up with the idea of a Dedicated Freight Corridor (DFC).

According to Jefferies estimates, road transport is time and cost-effective if the distance is below 330 kilometres. Since only 36 per cent of the total freight in India has a lead distance of less than 300 km, 64 per cent of freight traffic may shift to railway transportation with the establishment of DFC, says the report.

TCI Express offers Rail express consignment services. It has expanded its customer base from 250 to 1,750 since inception. It has also increased its presence from 10 routes to 125 routes now. Other players who provide rail services are Concor and Gateway Distriparks.

Drivers for the industry

Multi modal Logistics Park (MMLP) is a policy initiative wherein the government plans to develop logistics parks in a hub-and-spoke model under which these parks can act as aggregation points. Currently, since the logistics sector is fragmented, there are smaller warehouses with lower space and amenities.

MMLPs will help cut warehousing costs and provide spot for freight consolidation. This is expected to result in efficient utilisation of the fleet and reduce point-to-point freight cost. In November 2022, Reliance Industries bagged the contract to establish the country’s first MMLP near Chennai at Mappedu. Three more MMLPs are also being put up to tender at Bengaluru, Indore/Pitampura and Nagpur.

Companies like Gati have also been working on this model and establishing their own strategic hubs across the country in order to bring operational efficiency in business. Gati recently announced the launch of its superhub in Mumbai, which is a consolidation of three hubs at one place.

The second driver for the industry is the improving infrastructure in the country. In recent years, the government has been focussing on overall infrastructure development. Budget 2023 allocated ₹10 lakh crore towards capital expenditure out of which ₹2.7 lakh crore is for road infrastructure.

As already noted, Dedicated Freight Corridor is another initiative by the government to promote freight movement through railways. According to a Jefferies report, it is estimated that the EXIM container traffic may move from road to rail. Currently, only 20 per cent of EXIM containers move on rail, which is expected to touch 31 per cent by FY25.

Companies like Container Corporation of India (Concor) and Gateway Distriparks are major players in the Container segment and are expected to benefit from the commissioning of dedicated freight corridors.

Challenges

The logistics sector is still highly fragmented in the country with majority of market share with unorganised players. Prior to GST, complex laws, paperwork, and other regulatory requirements made the sector’s operations time-consuming. This led to a lot of players in this space remaining regional without much scope to scale, leaving them inefficient.

Investment in technology and adoption of automation will play a key role in remedying this, in improving operational efficiency and increasing market share.

Taking cognisance of this, listed players are upping the ante. Allcargo Logistics stated in its recent earnings call that it is working on automation, data science-based network optimisation, and other initiatives, to become lean and efficient. Gati, in its Q3 FY23 earnings call, disclosed that it has completed 100 per cent deployment of digital dockets (web-based electronic filing system that allows access to electronic records) with retail customers, which brings about better visibility, transparency and compliance with processes.

For the traditional players, value-added services being offered by new-age companies such as Delhivery are another challenge. Delhivery, which is an express parcel and PTL player, also provides value add services like inventory management and supply chain services.

The company had announced acquisition of Spoton Logistics for $300 million in August 2021. Spoton logistics is a multi-modal and express parcel service provider, along with air express service. The company has a strong technology and engineering base too.

However, some traditional logistics players have also been providing integrated supply chain solutions and value added services. Mahindra Logistics, for instance, offers comprehensive supply chain solutions such as warehousing, transportation and in-plant logistics.

The company also provides services like freight forwarding, express delivery and other value add services like kitting, bulk breaking, bundling and customised packing.

Pointers for investors

The logistics sector is transforming with the increased usage of technology and the developing infrastructure of the country. According to a McKinsey report (‘Startup funding in Logistics’, June 6, 2022), global funding for Logistics has grown at a CAGR of 70 per cent from fiscal 2014-21.

The total funding of logistics start-up in 2021 was $24.6 billion, which is almost double of 2020, indicating the opportunities as well as the rapidly changing face of the industry. Traditional logistics players will need to adapt to the new trends or else they may stand to lose market share.

Companies with integrated operations offering contract logistics and supply chain management services like warehousing, transportation, freight forwarding, etc., along with presence in higher-margin segments like express parcel and PTL, can be on investors’ radar.

These companies have a wider scope of operations, and with multimodal mix their growth prospects look promising. The direct operating expenses of road transport companies are fuel cost, hiring charges, toll charges, line haul, etc. Players who manage to get higher tonnage can optimise the cost on this front, resulting in better realisations.

Another aspect investors must keep in mind is that tech-savvy companies might have the advantage, going ahead, since data-driven decisions will bring efficiency into the business.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.