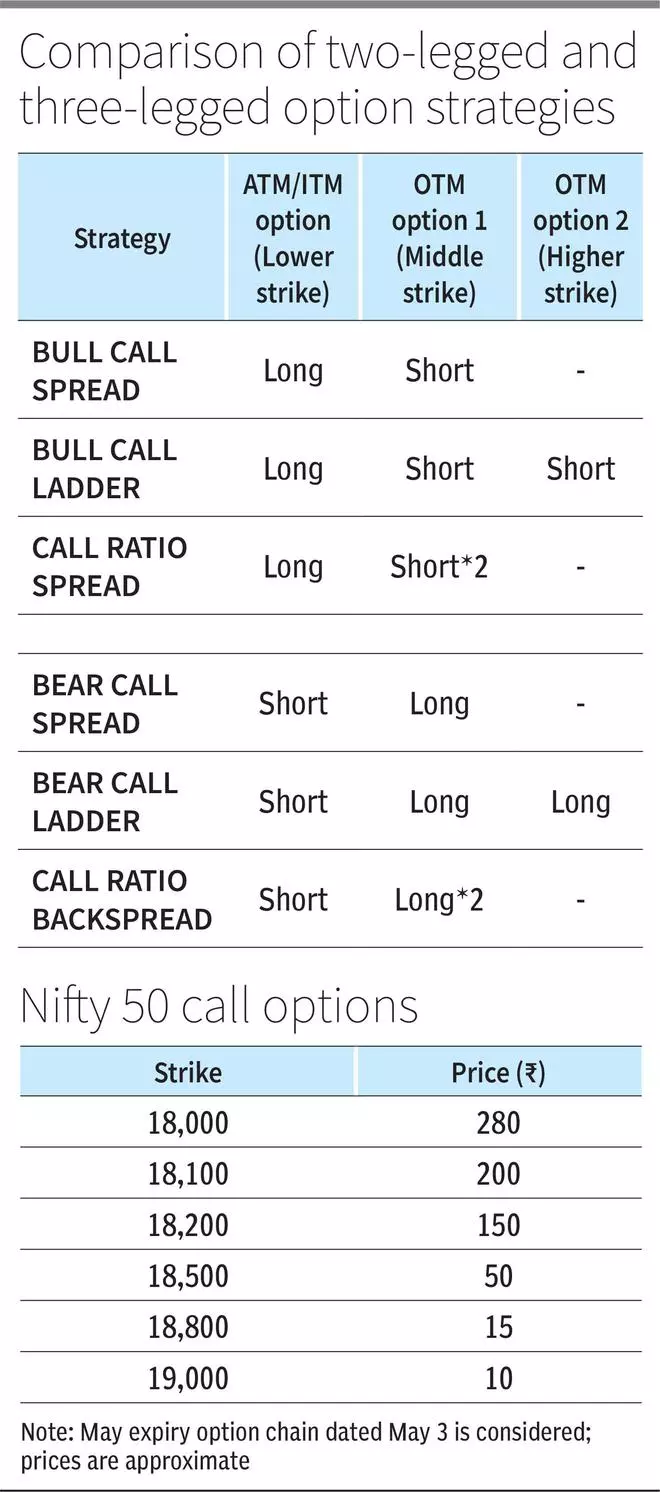

In our Big Story dated February 26, 2023, we discussed how to set up an options trade and the importance of forming a view on both direction and volatility of the underlying asset. We also talked about two-legged strategies such as bull call/put spread, bear call/put spread, strangles and straddles.

In this edition, we will delve into strategies with some modifications, which will take us from two-legged to three-legged option strategies. Particularly, we will be discussing here strategies that are extensions of bull call spread and bear call spread.

The interesting aspect of options is that it gives scope for numerous strategies one can develop/execute based on market outlook and risk tolerance.

Bull call spread is a trade when you buy at-the-money (ATM) and simultaneously sell out-of-money (OTM) call option. Instead of ATM, the long leg i.e., the option that you buy can also be an in-the-money (ITM) call. This strategy is best suited when your outlook on the underlying security is moderately bullish i.e., a minor rally from the current level.

Bear call spread is where you short ITM or ATM call and simultaneously go long in an OTM call. Best suited when you believe that an asset has hit a resistance and it is likely to either consolidate or witness a minor decline in price.

Now, let’s see the variations of the above two strategies.

With bull call spread as base, we can execute bull call ladder and ratio call spread.

Bull call ladder

This is a three-legged strategy where, like in bull call spread, an ATM call is bought and simultaneously an OTM call is sold. In addition to these two options, one more call option, with higher strike price, will be short. In essence, there will be a lower strike, which is the long ATM call; middle strike, which is the short OTM call and higher strike, which is another short OTM call whose strike price is higher.

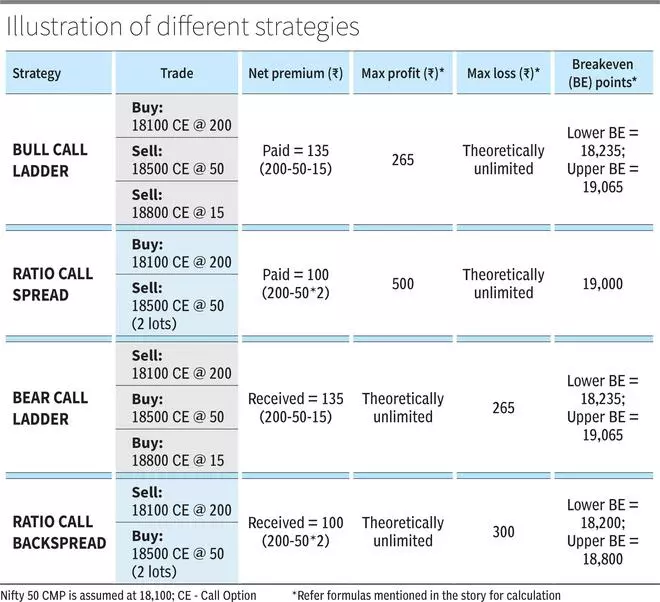

Generally, this is a net debit strategy and will work best when the underlying sees a minor rally and then stays flat. This can be set up for net credit as well.

So, when compared to bull call spread, it further reduces the cost of the long leg. However, it comes with higher risk. In case the security price sees a sharp rally, the losses can be huge. This happens because, out of the three legs, one long and one short will cancel out each other but the additional short that is taken will lead to losses if the price rises, especially beyond the upper strike. Notably, unlike most investing strategies which have a single breakeven point, this trade has two breakeven points.

Breakeven points:

Lower breakeven = Lower strike price + Net premium

Upper breakeven = Higher strike + Middle strike – Lower strike – Net premium

Thus, in an upward trending market, this strategy can move from loss to profit (when it crosses lower breakeven) and loss again when it crosses the upper break even!

Maximum profit:

Reward = Middle strike – Lower strike – Net premium

Maximum loss:

It is theoretically unlimited. Because one short call is hedged by a long call. But the additional call that is sold can increase the loss to the extent to which the underlying appreciates until expiry.

When to implement:

An asset is in uptrend, but you believe the rally is in its final phase and nearing its end, following which it is likely to consolidate for a while. Typically, the consolidation range will be between the middle and higher strike price.

Ratio call spread

Another strategy that can be implemented when your view is neutral with slight bullish inclination is ratio call spread. Here, one ATM call is bought and two OTM calls, with the same strike price, are sold, whereas, in the bull call ladder, the short calls were of different strike prices.

While this can also be set up for net credit or net debit, traders usually prefer net credit considering the risk profile. Since a greater number of calls are written, a sharp rally can result in higher losses.

This can sometimes be referred to as 1:2 call spread as one long call is initiated for two short calls. You can vary this ratio to 2:3 i.e., two long legs for three short legs depending on your outlook of the asset.

Breakeven point:

Breakeven = Higher strike + Difference between the strike prices + Net premium

Maximum profit:

Maximum reward = Higher strike – Lower strike + Net premium

Maximum loss:

Theoretically unlimited because of the higher number of call shorts.

Thus, under this strategy the trader will be at profit at the initiation of trade if set up for net credit, which will turn into loss if the underlying asset moves above the breakeven point.

When to implement:

A security has some more upside left but is likely to stay below the nearest key resistance. Typically, this resistance level will be the strike price of the short leg.

Like strategies discussed above, whose base was bull call spread, we can also build strategies like bear call ladder and call ratio backspread based on bear call spread. Here’s how to do it.

Bear call ladder

In this strategy, an ATM or slightly OTM call option is short, which is the lower leg. Simultaneously, two calls are bought with different strike prices. At initiation, this strategy is bear biased but beyond a point, this will become a bullish position i.e., when the underlying starts to rally quickly.

The name of this strategy can be misleading as a bearish one, but it can be profitable if the price of the underlying appreciates. This is because you hold two long call options and therefore, the profit potential is typically unlimited. Although this is commonly set up for net credit, we can also execute for net debit depending on the strike price that you choose initially.

Overall, traders can gain if the security remains range bound with bearish bias or if it witnesses a sharp upside.

Breakeven points:

Lower breakeven = Lower strike price + Net premium

Upper breakeven = Higher strike + Middle strike – Lower strike – Net premium

Maximum profit:

Potentially unlimited beyond the upper strike price. But if the security goes down, the maximum profit will be limited to the net premium received.

Maximum loss:

Risk = Middle strike – Lower strike – Net premium

When to implement:

The asset is hovering near a resistance (short call’s strike price is matched to this resistance) and is likely to stay below this level till expiry. But if there is a breakout, it could see a sharp rally. Note that the potential of the rally should be above the higher strike. This is for net credit. If you set up for net debit, you can be profitable only if the asset rallies.

Ratio call backspread

This strategy is employed by selling an ATM or ITM call and parallelly buying two lots of OTM call options with the same strike. Like all the strategies above, this can also be implemented as net credit or net debit strategy. However, since there are two long calls, inherently, there is a bullish bias. As there are two long calls for one short position, it is referred to as 2:1 call backspread. Similarly, you can execute in 3:2 or in any other ratio as you deem fit according to your risk profile. In a 3:2 spread, there will be 3 OTM long calls and two ATM/ITM short call.

This can be executed when you think the stock will either consolidate with a bearish bias or see a sharp rally.

Breakeven points:

Lower breakeven = Lower strike + Net premium

Upper breakeven = Higher strike + Difference between higher and lower strike – Net premium

Maximum profit:

Beyond the upper strike, the potential for profit is unlimited, like in bear call ladder. But in case the price falls, the maximum profit will be the net premium received

Maximum loss:

Maximum loss = Higher strike – Lower strike – Net premium

When to implement:

Suppose the asset is testing a resistance and you think it is either likely to end the ongoing expiry below this hurdle or see a sharp upswing from the current level. This is for net credit. If you set up for net debit, you can be profitable only if the asset goes above the long leg by expiry.

Initially, the above discussed strategies can appear complicated. However, if you take some time and understand how these strategies work and under what conditions they can yield the best and the worst result, it can help you implement these trades with ease. And since there are both long and short legs, the margin requirement can be lower compared to plain vanilla short position on options.

We reiterate that as a first step, traders should form an outlook on both direction as well as volatility and try to employ the strategy that is best suited.

One should also keep a close watch on trades with higher numbers of short legs as a single-sided movement against this can result in higher losses. So, always have an entry and exit plan.

In the next Big Story on options, we shall discuss strategies that are modifications of bull put spread and bear put spread.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.