I hold F&O long positions on Nifty futures (two lots) and Reliance Industries (one lot). Need your views and targets for the same.

Mayoor Patel

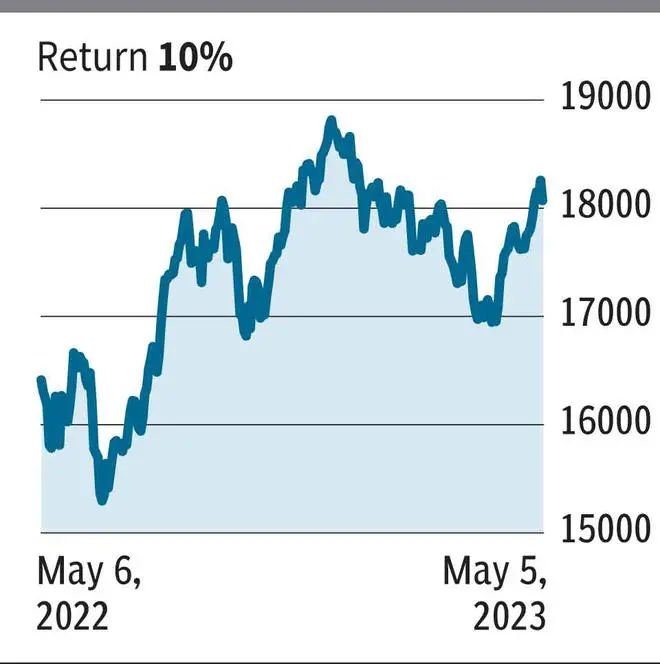

Nifty 50 (18,069): The trend has been bullish for the index of late. The Nifty futures, at 18,130, is at a premium to the spot price of 18,069, which is a positive signal. However, last week, it faced some downward pressure towards the end, and we could see some bearish indications with respect to derivatives data (refer F&O Tracker column to know more). While the overall trend is still bullish, as it stands, there is a chance for a correction — the Nifty 50 might dip to 17,800.

Consequently, Nifty May futures could see its price moderating to 17,950. So, we suggest holding the longs but buy a put option as a hedge. You can buy two lots of 18000-strike put, preferably monthly expiry. But when the Nifty futures decline to 17,950, exit the put and continue to hold the futures long. Because after such a correction, we expect the index to resume the upside. However, if the Nifty 50 index sees a daily close below 17,800, exit the future long positions too at the prevailing price.

Reliance Industries (₹2,441.8): The May futures of Reliance Industries closed at ₹2,454.95 on Friday as against the spot price of ₹2,441.8. Thus, the futures is at a premium, a positive sign. However, this does not guarantee a rally as the stock faces a crucial resistance. The underlying, currently at ₹2,441.8, has a 200-day moving average resistance at ₹2,475. So, this level should be breached for the stock to continue its uptrend.

That said, there is a support at ₹2,415. Therefore, we suggest holding the futures long but with a tight stop-loss — keep a stop-loss at ₹2,400. In case the stop-loss is triggered, wait for the underlying stock to break out of ₹2,500 before taking fresh longs.

Send your queries to derivatives@thehindu.co.in

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.