The rumour mills were spinning overtime when Axis Mutual Fund ousted its fund manager and chief dealer Viresh Joshi from equity schemes last year and then sacked him. The term ‘front-running’ was repeatedly mentioned, although it wasn’t clear how Joshi did it. With market regulator SEBI publishing — on February 28, 2023 — its order related to front-running of Axis MF trades,the elaborate fraud that Joshi and his associates pulled off is clear for all to see. Read on to know what SEBI’s investigations have revealed.

Modus operandi

The SEBI order says that at Axis MF, the fund manager decides the crucial aspects of an order — namely, the specific stock to purchase or sell, the quantity and price limit for the stock, and so on. But it is the dealer who decides the timing and manner of execution of the order, depending on the liquidity aspects of the stock, flows available, volume, and so on.

So, Joshi had access to information on the forthcoming orders of Axis MF. The fund house placed orders through 25 different brokers. Joshi leaked this information ahead of the orders of Axis MF, allowing him and his associates to take positions early and benefit from the price movement once the large order from the fund house was executed. He is estimated to have made profits exceeding ₹30 crore, as per the SEBI order.

Thus, the professional freedom given to the chief dealer of the asset management company was misused.

The scheme

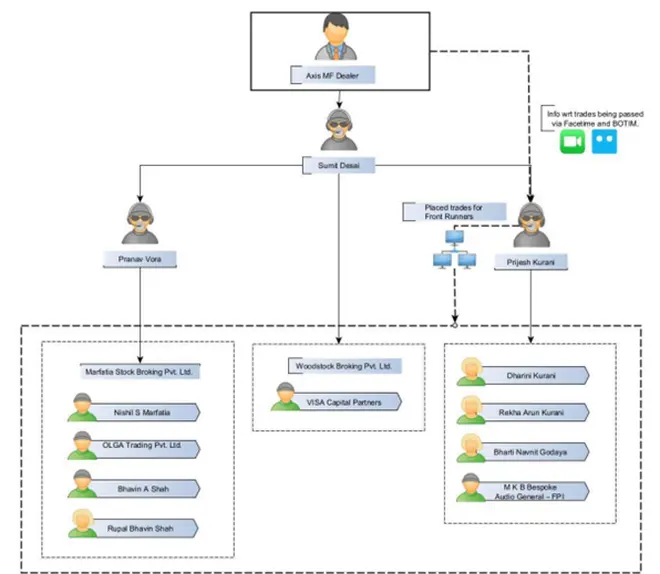

The scheme hatched by Joshi saw him approaching an individual named Sumit Desai (who then contacted another acquaintance, Pranav Vora) for ‘arranging’ trading accounts as conduits for the front-running trades. Desai helped arrange trading accounts and installation of trading terminal software in the computer system of a Dubai-based individual, Prijesh Kurani. Kurani used to punch the orders for executing the front-running trades initiated by Joshi. He had access to the trading terminals of Marfatia Stock Broking and Woodstock Broking. Kurani used his wife, mother and mother-in-law’s accounts to trade.

Three types of entities were involved in the scheme.

1. Information carrier — Viresh Joshi (also called by associates as Jadugar, Jadoogar, Asdfg)

2. Arrangers — Sumit Desai aka Pintu bhai; Pranav Vora

3. Enablers — Prijesh Kurani; Dharini Kurani; Rekha Arun Kurani; Bharti Navnit Godaya; MKB Bespoke Audio General; Marfatia Stock Broking; Nishil Surendra Marfatia; Bhavin Shah; Rupal B Shah; Olga Trading; Suresh K Jajoo; Visa Capital Partners; Woodstock Broking; and Vaibhav Pandya.

The front-running operation

The weak links

Several factors helped Joshi operate the front-running ring. One, the availability of a private or isolated work environment that helped him carry on undetected. At Axis MF, all dealers had Bloomberg installed on their laptops so they could route orders from their homes. Though this is not the usual practice, due to the pandemic the dealers of Axis MF not only had the option to work from home but were also given separate dealing rooms to ensure social distancing. Joshi, during the two-year period, was working from home as well as his separate dealing room in office. This ensured the absence of supervision.

Two, Joshi had to communicate information about the forthcoming trades of Axis MF to his accomplices. While he had declared only one mobile number to Axis MF, he used another number to pass on the information to his accomplices and stay in touch with the outside world even while discharging his official duties. SEBI rules bar cell phone access during market hours to MF dealers.

Whistleblower, Dubai link

Axis MF, during its internal investigation, had unearthed an email dated January 19, 2022, from the inbox of Joshi. The complaint alleged illegal trades by Joshi and was sent by a person named Bhavin Shah (who had lent his and his wife’s trading account to Vora). Shah alleged that Joshi alone was responsible for all the illegal trades in Shah’s trading account and that a Dubai IP address was used for them.

The email was addressed to nine different ids — six belonged to regulatory agencies, one belonged to Axis MF CIO Jinesh Gopani, and the remaining two were those of Joshi. But, interestingly, all the email ids were incorrect except that of Joshi’s official email. Whether the whistleblower wanted the mail to bounce is unclear.

According to the SEBI order, Joshi’s father and brother may have travelled to Dubai in December 2021 for the formation of a company named Vintage Capital Investment LLC, in which they were named as shareholders. Kurani prima facie facilitated transfer of funds on behalf of Joshi into Vintage Capital Investment’s account at Ajman Bank (Dubai). Joshi allegedly incorporated the Dubai company for transferring the wrongful gains.

Based on an analysis of the information furnished by Securities and Commodities Authority, UAE, it was found that between April 5 and May 10, 2022, AED 56,21,990.55 (₹11.62 crore) was deposited in the Ajman Bank account of Vintage Capital Investment LLC. The SEBI order says that Kurani, his brother Bindesh, and a connected entity helped Joshi in acquiring a part of the illegal proceeds.

The market regulator has barred 21 entities, including Joshi, from the securities market in connection with the front-running case at the fund house. In addition, it has ordered impounding their wrongful gains worth ₹30.56 crore across nine trading accounts belonging to Nishil Surendra Marfatia (₹3.08 crore), Olga Trading (₹3.01 crore), Bhavin Shah (₹1.98 crore), Rupal Bhavin Shah (₹1.41 crore), Visa Capital Partners (₹14.07 crore), Dharini Kurani (₹2.79 crore), Rekha Kurani (₹1.40 crore), Bhavnit Navnit Godaya (₹96.65 lakh) and MKB Bespoke Audio General (₹1.82 crore).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.