The past year has witnessed a flurry of launches in the mutual fund sector’s multi-asset allocation category, with prominent fund houses like ABSL, Baroda BNP, WhiteOak, Edelweiss, Shriram, and Kotak introducing their innovative investment solutions. In light of the cyclical and unpredictable nature of asset class performance, investors are increasingly recognizing the importance of maintaining a well-balanced and meticulously structured portfolio to secure both returns and peace of mind.

The latest addition to this growing trend is DSP MF, unveiling its ‘DSP Multi Asset Allocation Fund’, an open-ended scheme that encompasses investments in a diverse range of assets, including equity/equity-related securities, debt/money market instruments, commodity ETFs, exchange-traded commodity derivatives, and overseas securities. We delve into a comprehensive review of this new offering, with the NFO period set to conclude on September 21.

Right diversification

Many contend that diversification can be attained by incorporating multiple themes within a single asset class. While including various themes within the same asset class can indeed mitigate unsystematic risk, its relevance may diminish during a widespread equity market decline. So, does the inclusion of a defensive sector or active equity funds truly enhance diversification? To be candid, when there is a systemic downturn in equity markets, every sector, including defensive ones, and active equity funds, experiences a drawdown.

Hence, augmenting your portfolio with new funds may not necessarily result in effective diversification. To achieve that, one must seek out themes, sectors, or funds that exhibit either no correlation or a negative correlation with each other. When comparing themes or funds within the same asset class, a robust positive correlation is often evident, resulting in a minimal impact when a new fund is added.

A well-diversified portfolio is crafted by introducing funds with low or negative correlations. This implies the necessity of including different asset classes for true diversification.

Therefore, a well-structured multi-asset allocation portfolio has the potential to yield returns similar to equities but with only half the volatility. This is largely attributable to the ability of multi-asset allocation to restrain drawdowns effectively.

Fund strategy

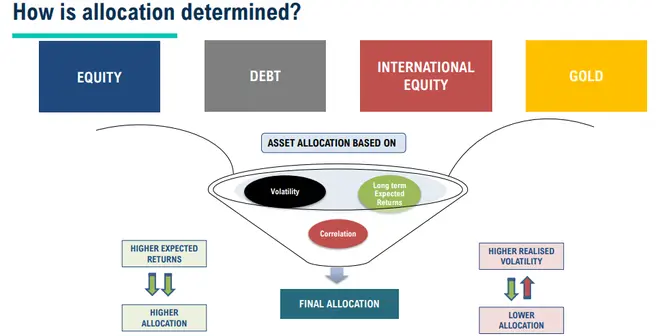

The DSP Multi Asset Allocation Fund will deploy capital into various asset classes, including domestic and international equities, debt/money market instruments, commodity ETFs, Exchange Traded Commodity Derivatives (ETCDs), as well as units of REITs & InVITs, all guided by a quantitative model. While the model dynamically allocates between asset classes as and when opportunity arises, fund managers retain flexibility to deviate from model suggested allocation. Aparna Karnik (Equity portion), Prateek Nigudkar (Equity portion), Sandeep Yadav (Debt Portion), Jay Kothari (Dedicated Fund Manager for overseas investments) and Ravi Gehani (Dedicated Fund Manager for Commodities) will be the fund managers of the scheme.

In its pursuit of optimal diversification, DSP MAAF has the flexibility to allocate between 35-80 percent of its portfolio to equities, with an allowance of up to 50 percent in international equities. Furthermore, it can distribute 10-50 percent of its assets into debt instruments, allocate another 10-50 percent into Gold ETF, designate 0-20 percent for other commodities through ETFs & ETCDs, and reserve up to 10 percent for REITs & InvITs.

Gains from the fund will attract debt scheme taxation with the benefit of indexation. The fund posits that for investors contemplating a minimum three-year commitment to such a fund, historical data demonstrates that, when factoring in the benefits of indexation, the variance in net returns stemming from debt or equity taxation becomes inconsequential in the hands of the investor.

While recognizing the diverse composition of the DSP Multi Asset Allocation Fund, it’s vital to understand that investors face inherent risks tied to various asset classes. These risks encompass market volatility, credit risk, currency fluctuations, and more. It’s important to be aware that during rapid market upswings, this fund may not keep pace with the equity market, and its performance could be tested if all asset classes simultaneously underperform, although such occurrences are infrequent.

Our take

Multi-asset allocation funds, with their diversified investment strategy spanning various asset classes, hold a distinct allure for investors in pursuit of heightened predictability and diminished volatility in returns. However, the fundamental key to unlocking the desired enhancement in returns lies in the precise calibration of the asset allocation blend, particularly in maintaining an optimal equity exposure.

Investors embarking on the journey of multi-asset fund selection must have utmost clarity regarding their investment objectives. For those already positioned in dynamic asset allocation, balanced advantage funds, or hybrid funds, the introduction of a multi-asset fund primarily introduces a subtle infusion of commodities or overseas equities into their existing investment portfolio. Will the addition of two asset classes alone lead to much-better diversification and investment outcomes?

New multi-asset allocation funds may have better intent, but they are, at the end of the day, greenhorns. Hence, prudent investors may opt to exercise patience, awaiting the new fund to amass a consistent track record before considering exposure to it.

For those contemplating their investment options, ICICI Prudential Multi-Asset and Quant Multi Asset funds emerge as commendable choices, given their established track records over the medium to long term.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.