Navi Mutual Fund has launched Navi ELSS Tax Saver Nifty 50 Index Fund, a passive ELSS tax-saver fund. The new fund offer (NFO) concludes on February 28. With an expense ratio of 0.12 per cent (direct plan), this is India’s lowest cost tax-saving ELSS fund.

Last December, IIFL Mutual Fund had launched India’s first tax saver index fund—IIFL ELSS Nifty 50 Tax Saver Index Fund—with an expense ratio of 0.27 per cent.

Given the popularity of tax saver funds and the January-March period being a season for last-minute tax-saving deals, investors and taxpayers would like to explore cheapest ELSS funds available in the market. But, is the cheapest always the best? Let us find out.

About Navi ELSS

By investing in an ELSS, one can claim a deduction of up to ₹1.5 lakh from one’s gross total taxable income under section 80C of the Income-tax Act, 1961 every financial year. In fact, a taxpayer in the highest tax bracket can save up to ₹46,800 (inclusive of cess at 4 per cent) in taxes under the old tax regime by investing ₹1.5 lakh in an ELSS in a financial year.

Navi ELSS Tax Saver Nifty 50 Index Fund promises to give low-cost exposure to India’s top 50 companies across 14 sectors via its Nifty 50 based structure. This is an open-ended equity-linked savings scheme (ELSS) and has a higher returns potential if Nifty 50 does well.

In this fund, there will be no active fund management, which means there will be no fund managers to pick and choose investments on their own. Instead, the fund will mimic Nifty 50 index as efficiently as possible. In other words, the passive investment strategy of this ELSS index fund eliminates the risk of human discretion and ensures that the portfolio remains closely aligned with the performance of the index.

Being an ELSS, each investment in the fund will have a lock-in period of 3 years. ELSS enjoy the lowest lock-ins amongst various tax saving instruments under Section 80C.

Navi ELSS Tax Saver Nifty 50 Index Fund has no exit-load on withdrawal post the expiry of the lock-in period, just like other ELSS funds. Investors can start investing with as low as ₹500.

ELSS fund category

There are over three dozen schemes vying for investor attention in the ELSS category. Given the propensity to save tax, ELSS funds are a runaway hit among retail investors. In addition to tax benefits, ELSS funds offer good returns. ELSS funds provided 15 per cent CAGR in the last 3-year period, 10 per cent CAGR in the 5-year period) and 14 per cent CAGR in the 10-year period.

Some of the popular ELSS funds are Axis Long Term Equity, Mirae Asset Tax Saver, ABSL Tax Relief ‘96, SBI Long Term Equity, Nippon India Tax Saver, DSP Tax Saver, ICICI Pru Long Term Equity and HDFC Taxsaver. Most of the ELSS funds are actively managed. In recent times, there is some action on the ELSS passive fund scene.

However, as with a majority of equity fund categories, actively-managed ELSS funds are finding it difficult to beat their stated benchmark.

In three year period, 60 per cent of such funds have failed to beat their benchmark. In five year period, 62 per cent of ELSS funds have underperformed their benchmark. Actively-managed funds charge higher expenses and are expected to beat their benchmark.

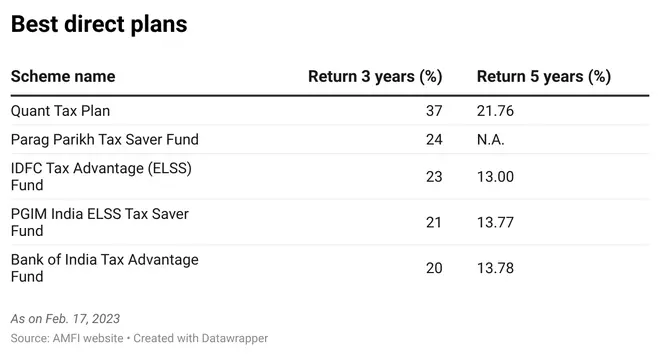

bl.portfolio Star Track MF ratings assigns 5 stars to Bank of India Tax Advantage Fund, Mirae Asset Tax Saver Fund and Quant Tax Plan. It assigns 4 stars to Canara Robeco Equity Tax Saver Fund, DSP Tax Saver Fund, IDFC Tax Advantage (ELSS) Fund, Kotak Tax Saver Fund and PGIM India ELSS Tax Saver Fund.

Costs and returns

Typically, direct plans of popular ELSS funds charge expense ratios in the range of 0.5 per cent to 1.25 per cent. In comparison, ELSS passive funds charge 0.12-0.27 per cent

Let us understand the impact of lower expense ratio with an example.

Imagine someone invested ₹12,000 every month for 5 years in Axis Long Term Equity Fund and got 13 per cent returns. The investor would have got 3 per cent extra returns in direct plan (cheaper cost) versus regular plan of the same fund. But one needs to note that a passively managed fund will not be able to beat the benchmark, while an actively managed fund can.

For instance, when Nifty 50 generates high return, an actively managed fund can give returns that are over and above Nifty. By generating a higher return, an actively managed fund can give you a larger corpus even if it charges a higher expense ratio than a passive ELSS.

No doubt, the lower costs of a passively managed fund help. But, they are also handicapped by the inability to beat their benchmark. By looking at the struggles of actively managed ELSS funds in beating their respective benchmarks, one may tempted to conclude that going the ‘passive’ way is the best. But do remember that about 40 per cent of actively managed ELSS funds are still beating their benchmarks. So, fund selection holds the key.

Our take

Costs, we believe, should not be the sole reason for investing in a mutual fund, or for that matter, any other investment.

If your goal is to maximise returns, actively-managed ELSS products are still your best bet.

Index-based products will at best mimic the index. If you are okay with the low cost and market returns trade-off, you can definitely consider passively-managed ELSS offerings.

Before jumping in, try to find out the tracking efficiencies of such funds. You need to wait for a few quarters to see how well the passive ELSS schemes are tracking Nifty 50.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.