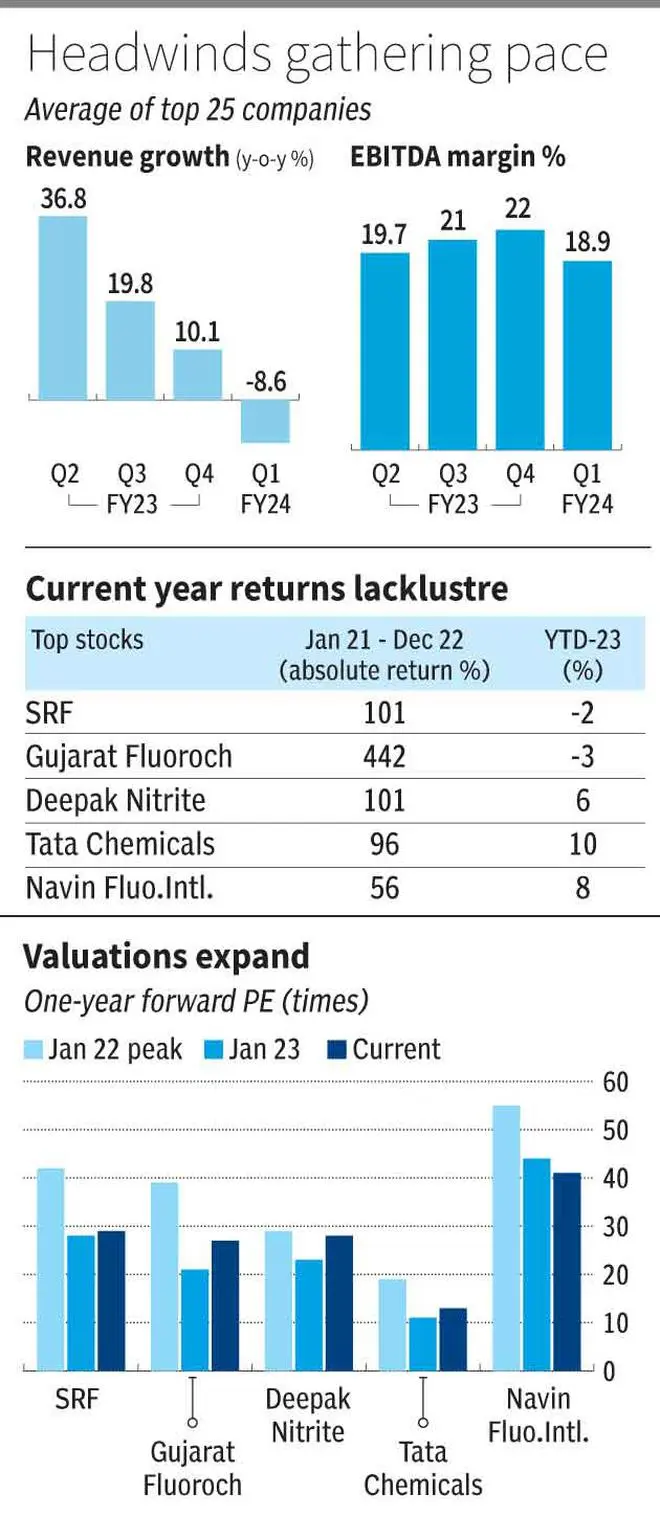

The Indian specialty chemicals industry gained in the last two years due to two factors: supply chain diversification from China and growing import substitution. As a result, stock prices of the top five companies by market capitalisation in this space grew by an average of 160 per cent in 2021 and 2022, even as average valuations compressed from 30 times on-year forward earnings in early 2021 to 25 times currently.

However, the sector seems to have reached an inflection point lately, with the top five companies seeing a 2 per cent decline in revenues year-on-year in the June 2023 quarter. This compares poorly with the 30 per cent YoY growth reported in the last three quarters. EBITDA margins declined on average by 375 bps YoY in Q1FY24. Despite such lacklustre performance, stock prices are holding firm and valuations have expanded (see charts).

This shows that markets are yet to factor in the short-term headwinds facing the sector. Even if some headwinds dissipate in 2-3 quarters, the impact of others can persist, and their impact will be felt across companies depending on their position in the value chain.

Recent headwinds

Revenue decline was led by volumes in Q1FY24, even as pricing was not encouraging. Facing uncertainty from the Russia-Ukraine conflict, Covid-related supply chain issues, and the partial closing of the Chinese economy in the last two years, clients in agro, pharma, and industrials, piled up inventories. As all three factors receded, the high cost of interest added to the cost of holding inventories and unwinding inventories started impacting order books recently. Slowdown fears in Europe and the US are also adding to the woes.

The Chinese economy could have absorbed an increase in Chinese production, but as domestic economic growth was not stellar, the ramped-up Chinese production glutted international markets, denting prices. From base chemicals to value-added products, from SRF to Atul, the impact of Chinese oversupply was visible across companies.

While lower input costs could have been a tailwind for companies, lower utilisation and pricing have more than offset any gains from lower costs, resulting in a compression in EBITDA margins. With crude prices starting to scale back up, the current lower raw material prices may not persist either.

Outlook

Inventory unwinding could be cleared by 1-2 quarters. But demand growth may continue to face fears of a global economic downturn until interest rates remain higher. A slightly longer-term headwind will be from Chinese supplies. Quicker pace of economic growth in China is critical to partially arresting international gluts and may be a longer-term headwind than inventory destocking.

The supply chain transition to India will remain a central support for the industry. The product/vendor relations nurtured in the last two years will hold good stead. This will be more pronounced based on the complexity of the product being supplied. Further, the Chinese glut may benefit value-added

Producers who will have access to lower-cost raw materials, but at the same time, base chemical manufacturers will be competing with them. Hence, players lower down the order may feel the pinch.

While capex momentum remains high, companies have planned to push capex spends from FY24 to FY25 and beyond, waiting for visibility on demand drivers.

For the long run, advanced intermediates, contract manufacturers, and CDMO producers may sustain higher growth compared to base chemical manufacturers. We have in the last two years recommended SRF, Gujarat Fluorochem, and Navin Fluorine and Tata Chemicals in the space and reiterated the calls. But investors can wait for the storm to pass over and a possible factoring of headwinds in stock prices before accumulating the stocks.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.