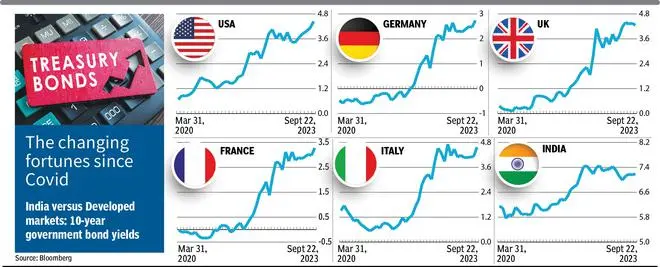

The week gone by was eventful for India’s bond market as the much-awaited inclusion in JP Morgan’s Emerging Market Index finally happened. Investors in India’s government bonds cheered, but not the investors in developed markets bonds. The week gone by saw a lot of tumult in bond markets in the US, France, Italy, Germany and Japan as a hawkish US Fed added fuel to fire resulting in bond yields spiking by about five per cent in these countries.

Sharp contrast

Also, the yields of the US 10-year bond spiked to levels last seen in September 2007, and that of German instruments were at June 2011 levels. For a country like Germany, with negative interest rates (that is, investors paying the German government to invest in its bonds) even as recently as December 2021, this reflects a stark contrast especially at a time when its economy is technically in a recession.

Thus, as India’s bond investors and government celebrate the benefits of long-term fiscal and monetary consolidation (including being measured in Covid-19 stimulus), global bond investors are grappling with enormous losses and governments with unprecedented interest burden. Take this for example: As yields have spiked, bond investors who bought US 30-year bonds in 2020 amidst flight to safety will have to exit at a 50 per cent loss to principal if they encash today.

Why bother?

The spike in global bond yields comes with risks of igniting unknown factors. For example, when Silicon Valley Bank collapsed due to losses in its government bond investments in March, the US 10-year yields were at 3.75 per cent. It is now at 4.43 per cent after cooling off from as high as 4.50. As yields keep spiking, losses for bond investors are mounting and investors must be vigilant about the possibility of more SVB like events and their impacts. In fact, many bond investors globally are split into two camps — those who believe the current yields are the new normal and the world will have to adjust to a higher cost of capital; while the other camp believes that with such volatility and spikes something will break in global credit markets. Either way, it would be prudent to start recognising the range of outcomes.

More importantly for India, any further reduction in the gap between 10-year bond yields in India and the US implies that global investors are betting on a very strong rupee as otherwise the incentive to invest may lower, given the narrowing yield difference. The gap can shrink due to various factors including US yields rising further or Indian yields dipping driven by flows due to inclusion in the bond index. A stronger rupee is good for our country in many ways as it can reduce our import bill. At the same time, for exporters, this may mean that other efficiencies will have to offset lack of currency depreciation that benefits them.

It is worth recollecting that in 2007 when India’s stock markets boomed, IT stocks sulked as appreciating rupee dented their profitability. Further, the global economy might also face an additional challenge. As developed countries grapple with higher fiscal deficits and unproductive interest payments, they will be constrained in their ability to deliver another stimulus, if another crisis happens.

Thus, the changes and arrival of a new normal will require recalibration of many past assumptions. For clues on the direction, look to the bond yields.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.