With the increasing expectations of RBI raising rates further , fixed deposits (FDs) become attractive, especially for conservative investors. Now, Hawkins Cookers has come out with 13, 24 and 36-month FDs. Despite spike in rates, the company offers FD with the same interest rates given last year. Given the changed rate scenario and the small premium for the higher tenures over better-rated deposits from non-banking financial companies, should you consider this offer? Here’s what you must know before taking your investment call.

Manufacturing company FDs

As is obvious, Hawkins Cookers is a manufacturing company. In FY22, the company’s revenues increased 24.5 per cent over the previous fiscal to ₹958 crore, while net profit rose 4 per cent to ₹83.9 crore. The recent June quarter results have also been reasonably strong. The debt-equity ratio as of March 2022 was a healthy 0.2.

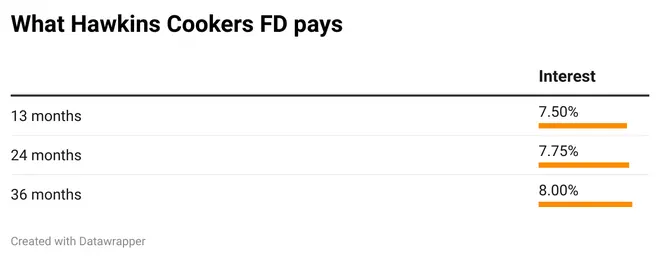

Hawkins Cookers’ deposits are assigned AA- by ICRA, indicating it is not a top rating. Despite the RBI increasing repo rate by 140 points over the last few months, the company still offers the same 7.5-8 per cent rate as it did in September 2021 . The pre-registration commences September 20 on a first-come-first-serve basis with ₹25,000 as minimum investment.

Other alternatives

Most AAA-rated deposits from NBFCs such as Bajaj Finserv and M&M Financial Services offer rates of 5.85 to 7.4 per cent for tenures ranging from 1-3 years. The premium of just 60 basis points in terms of interest for the three-year tenure is a dampener.

For perspective, going by the corporate bond yields in the secondary markets (Source: Citibank; prepared by CRISIL), AA- bonds trade at a 300 basis points over their AAA counterparts. Though not strictly comparable, it becomes clear that Hawkins Cookers FD rates aren’t high enough to compensate for a relatively lower rating.

Utkarsh Small Finance Bank offers 7.15 per cent interest on its one-year FD. For a three-year tenure, Jana Small Finance Bank, Bandhan Bank, Fincare Small Finance Bank and Utkarsh Small Finance Bank offer 7-7.5 per cent interest. The added advantage is that these deposits (up to ₹5 lakh) are covered under the deposit insurance scheme of the RBI (DICGC). The deposits of manufacturing companies are not covered by the DICGC.

As and when the RBI hikes the rate further, as is widely expected in its next monetary policy, bank deposit rates may increase further.

What should investors do?

Though Hawkins Cookers FDs appear offering optically higher rates on an absolute basis, they may not be enough to compensate for the lower rating and smaller spreads over other FD options available.

The 13-month fixed deposit alone may possibly be considered given that the rates are reasonably attractive compared to other options. Investors can opt for the half-yearly pay out option. Given that rates may increase over the next few months, investors can skip the other tenures as better rates may be forthcoming from higher-rated entities.

It is advisable to invest only smaller sums in these fixed deposits,

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.