The bond markets have stabilised after a turbulent October, when global and domestic government securities saw yields soar sharply. Inflation’s trajectory has been steadily downward over the past several months. Even the US Federal Reserve has been on pause mode on the interest rate fund. That there are unlikely to be any more rate hikes is almost a certainty in India and near-certain even in advanced economies.

Interest rates are peaking globally, and yields have stabilised after surging to record levels.

It may be a good time for investors in fixed-income instruments to make the most of the present high interest rates and coupons.

NBFCs (non-banking finance companies) are coming out with non-convertible debentures (NCDs) fairly high coupons and yields in recent months.

We now have a microfinance institution tapping the retail bond markets for raising funds.

IIFL Samasta has come out with an NCD offer that is already open for subscription. The company provides financial products, largely loans, to the unbanked sections of the society in rural and semi-urban areas.

The issue is rated AA- (Positive) by CRISIL and while Acuite has given the firm an AA (Stable) rating. These ratings indicate a high degree of safety in servicing principal and interest, and very low credit risk. This NCD comes in three tenors with periodic interest payout options. The coupons are fairly attractive.

Here’s more on IIFL Samasta’s NCD offer to help you take an informed investment call.

Robust yields

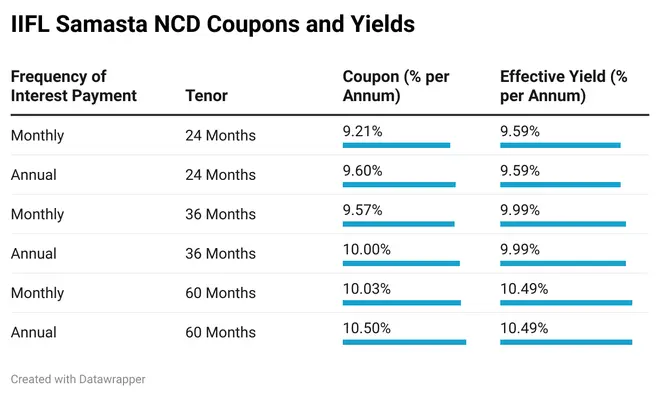

The microfinance company’s NCD offer comes in three tenors – 24 months, 36 months and 60 months. For each of these tenors, there are monthly and annual interest payout options. There is no cumulative option.

IIFL Samasta offers coupons in the range of 9.21 per cent to 10.5 per cent across the three tenors and interest payout options. The effective yields on the various options range from 9.59 per cent to 10.49 per cent. Though not comparable, these coupons are much higher than the interest rate offered by most banks and NBFCs for similar tenors.

Data from Axis Bank (sourced from ICRA Analytics) as of December 8 indicates that corporate bonds rated AA with three-year tenor trade at 8.47 per cent yield on an average presently, while the yield on 5-year bonds is 8.37 per cent.

IIFL Samasta’s NCDs with three-year tenor are available at 9.99 per cent yield for monthly and annual interest payout options, a good 150 basis points more than what is available in the corporate bond market. The five-year tenor NCDs with 10.49 per cent yield are a good 210 basis points higher than equivalent rated bonds in the market.

The minimum investment required is Rs 10,000.

Investors can consider the two and three-year tenors with monthly interest payout option so that the lock-in is relatively short and cash flows are regular

From April 1, 2023, tax is deducted at source on coupon payments in NCDs. In any case, all interest payouts are taxed at your slab.

Microfinance risks

As indicated earlier, IIFL Samasta is a microfinance institution (MFI). It operates in 21 states across the country. The firm primarily focuses on catering to the financial needs of economically backward women in rural and semi-urban areas. IIFL Samasta provides loans for tenures ranging from 6 months to 10 years with ticket sizes of Rs 5000 to Rs 25 lakh. The company provides loans for Cattle, products, water & sanitation, mortgages and so on. It also provides unsecured loans.

- Loans asset under management (AUM) rose 62.8 per cent over FY22 to Rs 10552 crore in FY23. In 1HFY24, the AUM was Rs 12195 crore.

- Return on average assets was 1.68 per cent in FY23, versus 0.94 per cent in FY22.

- Capital adequacy was healthy at 17.14 per cent as of FY23, though it declined at but from 17.83 per cent in FY22.

- Gross NPA fell to 2.12 per cent in FY23, from 3.07 per cent in FY22. In 1HFY24, GNPA was stable at 2.1 per cent.

- Net interest margin expanded to 9.15 per cent in FY23 from 8.8 per cent in FY22.

- Cost of funds increased as interest rates rose. In FY23, it was 10.52 per cent, up from 9.96 per cent in FY22.

IIFL Samasta’s business has considerable concentration geographically with 51 per cent of the loan portfolio coming from three states.

In general, microfinance is a risky business and therefore investors must exercise caution. Invest only tiny amounts in the NCD issue as a part of diversifying your debt portfolio.

With subscription amounting to about Rs 330 crore so far, the issue is oversubscribed. However, since the Rs 200 crore offer has the option to retain another Rs 800 crore of oversubscription, investors can still apply for the issue. The offer is open till December 15.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.