At bl.portfolio, we had started taking a cautious approach to IT stocks since mid-2021 when valuations started getting frothy. Since then, there has been quite a significant time-wise, and also in many cases, absolute correction in stocks in the sector. In this context, HCL Technologies was amongst the few stocks we had a positive view on, given favourable risk-reward.

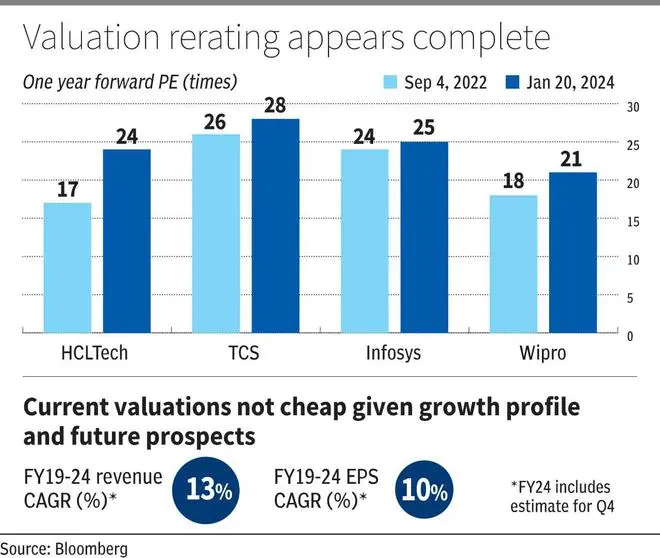

In our edition dated September 4, 2022, we had given an accumulate rating on the stock when it was trading at ₹924.85. Factors that worked in its favour then were attractive valuations with one-year forward PE at 16.9 times (vs Infosys trading at 23 times and TCS at 26 times in September 2022), EV/FCF of 19 times and attractive dividend yield of 5 per cent.

Typically, amongst the top-tier IT companies, EBIT margin levels make a case for difference in valuation — higher margins imply higher valuation unless differences in long-term growth potential are significant. While HCL Tech margins (18-19%) were lower versus TCS (24-25%) and Infosys (20-21%), given comparable long-term growth prospects , our view was that the discount in valuation versus TCS and Infosys was excessive. Our core expectation was that valuations will re-rate for HCL Tech.

Since then, HCL Tech is up 67 per cent versus TCS, Infosys and Wipro up 25 per cent, 13 per cent and 17 per cent respectively. Nifty IT is up 33 per cent in this time period. With this outperformance, we believe the valuation re-rating in HCL Tech is largely complete. Hence, investors can book profits and lock in on the gains.

HCL Tech now trades at 24 times one-year forward EPS, and almost on par with Infosys, which has better margins. Its discount in valuation with TCS (industry-leading margins) has also narrowed, from 35 per cent in September 2022 to 14 per cent now. On a relative and absolute basis, the stock of HCL Tech is not attractive anymore.

Recent performance

Amidst weak industry trends, HCL Tech’s December quarter performance, while reflecting the slowdown, was modestly ahead of consensus expectations, with revenue around 1 per cent above consensus and net profit 4 per cent above. The earnings beat was driven by better-than-expected EBIT margins which, at 19.7 per cent, were 70 bps above consensus. However, despite the beat in 3Q, the company maintained prior FY24 revenue (constant currency revenue growth of 5-5.5 per cent) and EBIT margin outlook (18-19 per cent) with minor tweaks. In FY23 CC revenue growth was at 13.7 per cent.

The company derives around 88 per cent of revenue from IT services (including 16 per cent from Engineering and R&D services) while its software products business accounts for balance 12 per cent. In December Q, the better-than-expected performance was driven by the products and ER&D segments.

Geographic and vertical trends were slightly contrary to peers, with HCL Tech seeing YoY growth in Finance vertical and in North America (around 60 per cent of revenue). For example, Infosys witnessed a 5.5 per cent decline in revenues from North America. However, it would be too early to conclude that trends have bottomed out in key verticals and geographies. The demand environment remains uncertain according to management, and as such there is no uptick in discretionary spending for now.

While the company remains well-positioned for the long term, including tapping opportunities in the field of generative AI, the medium-term outlook remains cloudy. After a couple of years of double-digit constant currency revenue growth exiting FY23, HCL Tech, TCS, Infosys and Wipro are seeing mid-single digits to flattish revenue performance in FY24.

Given looming macro headwinds with inflation yet to reach central bank target levels in developed economies and interest rates remaining high, even if there is revival in FY25, returning to double-digit revenue growth appears to be two years away (likely in FY27). In this context, the valuations are not cheap. With HCL Tech shares delivering solid returns in a year of slowdown, recovery prospects are already priced in. This, combined with the shrinkage in valuation discounts, makes the risk-reward unfavourable from here.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.