Markets have corrected about 8 per cent since the peak on December 1 last year and the fall in some quality small-caps has been sharper during this period. This provides the opportunity for long-term investors to take exposure to those stocks whose prospects remain bright. Lumax Industries is one such small-cap from the auto component space.

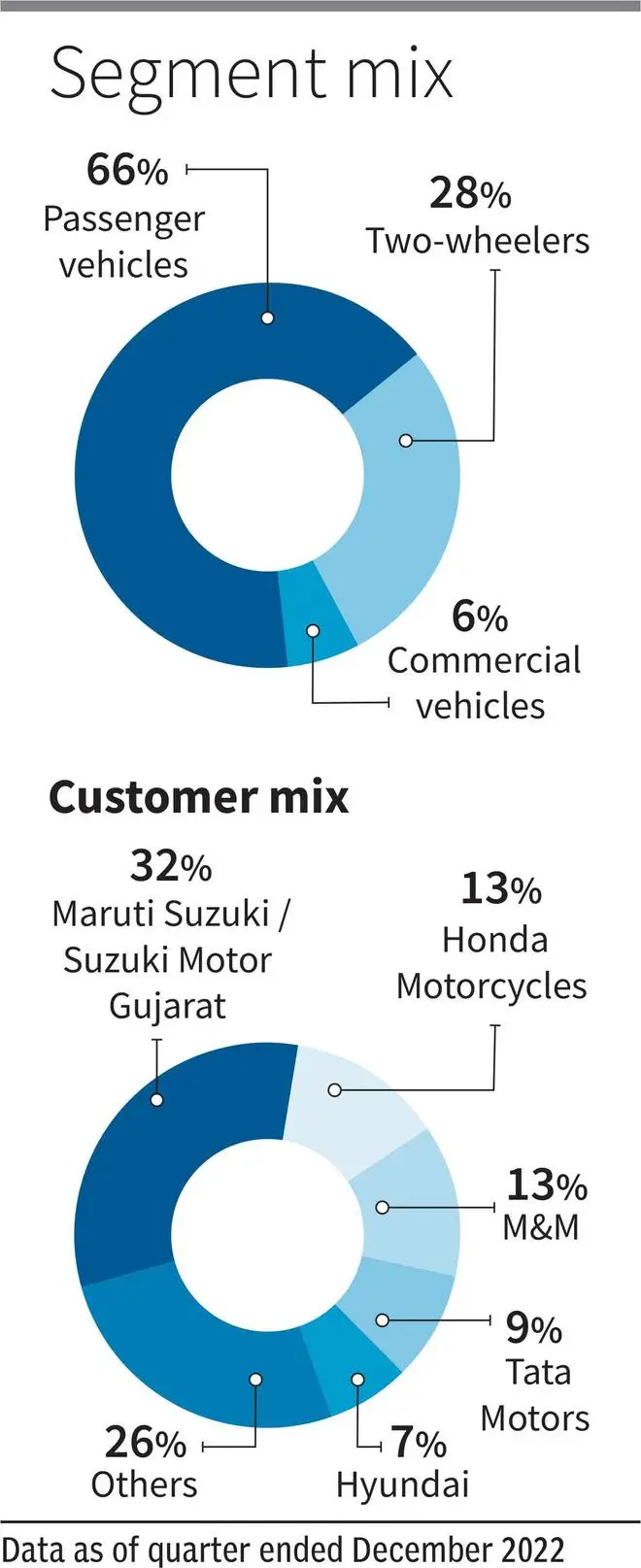

With the company supplying lights predominantly to the passenger vehicle and two-wheeler segments, the stock is a good bet on the cyclical upturn in the domestic auto industry. EV (electric vehicle) readiness, improving share of LED lighting and a diversified client mix are other positives.

The stock has corrected about 18 per cent from its one-year high in early December and is trading at 17 times its trailing earnings now. While this is at a discount to many other small-caps in the sector such as Jamna Auto, Sansera Engineering and Suprajit Engineering, it is at a slight premium to lighting peer Fiem Industries, on which bl.portfolio had a ‘buy’ recommendation in March 2021, followed by a ‘hold’ in July 2022. Lumax’s valuation has inched down from the 19-22 times seen since the June 2022 market lows both due to the price fall as well as robust earnings growth, presenting a good time to enter the stock. Investors with a one-to-two-year perspective can buy the shares.

Ride on auto upcycle

Despite continuing to be plagued by issues such as shortage of semiconductors and a rural slowdown in some pockets, domestic personal vehicle sales have been on a purple patch in 2022-23. Sale of new passenger vehicles, which was down 2.2 per cent year on year (yoy) in 2020-21, grew by 13.2 per cent in 2021-22 and further by almost 30 per cent in the first 11 months of this fiscal. More importantly, two-wheeler sales came back into the green this fiscal, showing a 17.8 per cent growth (yoy), vs. 11-14 per cent fall in the previous two fiscals.

Management commentary from Maruti Suzuki, Lumax’s largest client, indicates that demand for cars and utility vehicles remains robust, with an order backlog of about 3.63 lakh vehicles at the end of Q3 for the company. Among other OEM clients, Lumax has been roped in for recent models such as the Nexon, Punch and XUV 7oo. The pick-up in two-wheeler sales also augurs well for Lumax, which has added TVS Motors to its clientele, apart from Honda Motorcycles, its largest customer from the two-wheeler segment. As at the end of the December 2022 quarter, Lumax’s order book stood at about ₹1,150 crore, to be executed over the next three years. The company is adding capacities at Chakan, Pune. Phase I of the plant is expected to be operational in mid FY24.

Value additions

Apart from being a beneficiary of the cyclical upturn in auto sales, the company is well-placed to ride on two structural changes happening in the industry – one, the adoption of EVs and two, the shift to LED lighting from conventional lamps. Going by data from the Vahan Dashboard, EV penetration in two-wheeler sales has moved up from 2.6 per cent a year ago to 5.1 per cent now. The company is advantageously positioned to ride on this trend, having already won orders for e-2-wheeler supplies.

Besides, having Tata Motors for its client is an advantage too. Monthly EV sales data indicates that four-wheelers of Tata Motors sell the most. Out of the order book of about ₹1,150 crore, close to ₹475 crore is from EVs, largely driven by 4-wheeler and partially driven by 2-wheelers, according to the company. Another advantage of EV exposure is also that, being a sunrise segment, it is not subject to the cyclicality seen in traditional vehicle sales.

LED lighting is increasingly being used in vehicles for aesthetics as well as energy efficiency, be it through adoption of BS VI norms, the Café Regulations or EVs. While the company derives one-third of its revenues from the LED segment currently, it is expected to move up. About half the current order book is for LED lighting.

Financials

Thanks to the pick-up in auto sales, Lumax Industries has been able to post double-digit growth in revenues and profits in the last three quarters. For the nine months ended December 2022, net sales moved up by 42 per cent yoy to ₹1,711 crore, while adjusted profits zoomed to ₹62 crore from ₹16.5 crore in the same period last year. Operating margins fared better at 9.27 per cent for April-December 2022, vs 5.5 per cent a year ago.

While the company ideally aims to have margins of 12-13 per cent, in the next 12-24 months, it expects to stabilise double-digit margins, from operational efficiencies as well as ability to spread fixed costs over incremental revenues. Improving mix of LED lighting in revenues will also aid margin expansion.

The current debt to equity ratio is at 0.14. The company expects a spend of ₹175 crore for the new Chakan facility out of which ₹156 crore will be through borrowings. This may take the ratio higher to 0.5 -0.6 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.