Investors with a two-to-three-year horizon can consider accumulating the stock of Maharashtra-based natural gas distribution company Mahanagar Gas (MGL). Promoted by GAIL and Government of Maharashtra, MGL caters to the piped natural gas (domestic and industrial) and compressed natural gas (auto) needs of Mumbai Metropolitan Region and adjoining areas.

The company is also expanding its presence in Maharashtra and also foraying into neighbouring States such as Karnataka through the acquisition of Unison Enviro Private Limited (UEPL), which will help the company sustain growth over the medium-term. Also, the Kirit Parikh report to review the natural gas price hike decision, if accepted by the Government, will augur well for MGL’s profits. At the current price of ₹985, the stock trades at 14.9 times its trailing twelve-month earnings.

Key positives

We believe MGL to be a good investment option to consider for investors with a moderate risk appetite for three reasons.

First, the company — which has a strong foothold in the Mumbai metropolitan area — is now expanding its geographical area. MGL currently caters to 2.1 million households through its piped natural gas (PNG) infrastructure. Likewise, its PNG business supports over 4,106 small commercial establishments and over 382 industrial customers that use gas as feedstock or fuel. In the compressed natural gas (CNG) segment, the company fuels over 0.91 million vehicles. The company also supplies to over 301 filling stations.

MGL has three geographical areas (GAs) in Mumbai, Thane Urban and Raigad. The acquisition of Unison for ₹531 crore will help the company add additional GAs – Ratnagiri, Latur and Osmanabad (Maharashtra) and Chitradurga and Davanagare (Karnataka). Unison had revenue of approximately ₹90 crore in FY22. With about 72 CNG stations to be added, the acquisition is expected to help the company’s growth in the medium-term. Further, with net cash in the books of ₹200 crore and hence no leverage concerns, MGL is well-positioned to capitalise on opportunities for consolidation in the CGD (city gas distribution) space. This has been the first acquisition by the company, and there is expectation that MGL will continue to pursue inorganic growth opportunities going forward, too.

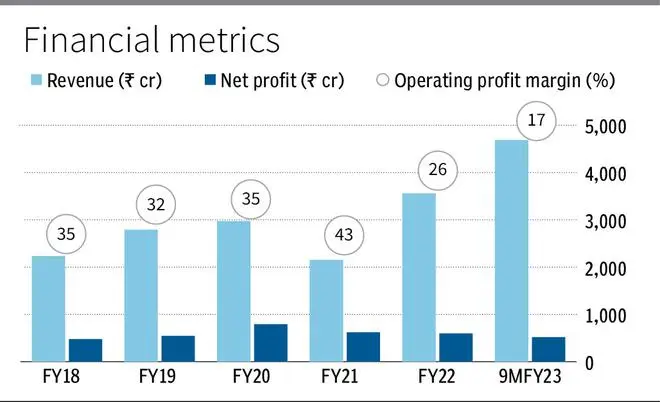

Second, with the unprecedented increase in global energy prices in 2022, thanks to the Russia-Ukraine crisis, the Government had to increase the domestic gas prices in line with the global trend. Increase in administered price mechanism (APM) gas price beginning March 2022, from $2.9 per mmBtu to $6.1 resulted in a moderation in profitability in 2022-23. From 43 per cent in FY21, the operating profit margin moderated to 17 per cent for the nine-month period December 2022. In addition to higher costs, companies could not pass on the input cost increases fully to end customers, due to inflationary pressure. However, with three price hikes taken in April, October, and November 2022, the company is better positioned to sustain profitability going forward. From ₹65 a kg in March 2022, the price of CNG increased to ₹72 in April and further to ₹86 in October and ₹89.5 in November last year. The full benefit of price increases should start flowing in January-March 2023 quarter.

Further, the Kirit Parikh committee recommendation, tabled in 2022, has recommended price cap on APM gas, which is supplied to CGD players such as MGL. If this happens, it will help MGL’s margins further. While the market has already factored in higher APM gas prices and resultant margin decline, any positive development on Kirit Parekh report will be incrementally positive for the company’s profitability and also stock price.

Third, the company’s strong balance sheet with no debt and healthy return ratios of about 20 per cent – return on equity and return on capital employed is also a positive. This offers sufficient legroom for the company to grow inorganically. This can be an added growth kicker. The company is a consistent dividend payer, with the current yield at around 2.5 per cent. On the valuation front, too, the stock looks interesting at current levels, trading at 14.9 times its trailing 12-month earnings. Given that the stock has gained almost 18 per cent on a YTD basis, investors can use any dips to accumulate the stock.

In the April-December 2022 period, MGL managed to grow revenue by 90 per cent, thanks to the price increases. However, its operating profit rose at a slower pace of 12 per cent on higher costs – APM gas prices. This led to a moderation in the operating profit margin from 29 per cent in 9MFY22 to 17 per cent in 9MFY23. However, now with the next round of price increases in November 2022, the margins should stabilise from here and gradually improve.

Pain points

While we do not foresee any significant increase in APM gas prices in the near term, any unexpected increase in gas prices can further risk MGL’s profitability. Also, the volume growth in CNG has been a tepid 3-5 per cent with conversions also growing at single digit levels; higher prices can also narrow the spread between petrol, diesel and CNG and may not support conversion to CNG, thereby impacting volume growth. However, this can be mitigated by the strong demand in the piped gas segment. While we do not foresee any near-term impact due to electric vehicles, the medium- to long-term prospects of CNG may be contingent on the penetration of EV in India. That said, we do not see any major risk to the existing business of MGL.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.