Legendary investor Warren Buffett once said, “We’ve long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.”

Even if one has spent more than 25 years in the listed equity space, he cannot say with absolute certainty on what the market may be up to in the next week or month.

The idea that fund managers have a magic wand which may help them better predict how the market may operate in the next month, is a dangerous illusion. What’s worse is the faulty confidence that an investor may operate with, when they get lucky but mistake it for skill.

The market has the ability to swing from bouts of optimism to stints of pessimism in the blink of an eye. Being able to separate this “moody price” from the “true value” of a business is the challenge which all investors face. In our constant endeavor to better understand valuations, an input which has helped us map out risk-rewards at aggregate market levels is the price to book ratio.

The Price to Book multiple

Imagine a friend who has started a business with ₹100. That is the net worth or book value for that business. Now, let’s assume that she is earning 15% on that ₹100. If you were to buy her business how much would you pay?

While that is very little information to go on, so you would almost intrinsically look at the return the business is earning over a risk free investment. If a business was earning 6% you would probably not pay any premium at all. After all, you can earn that return by keeping money in the bank. The value of the business would be its book value which is ₹100.

However, our friend is earning 15% and so her business will be more valuable than ₹100. The premium one ascribes to the networth of a business (price to book value) often comes from the excess return above the hurdle rate (in this case 6%) and the ability of the business to maintain that excess return over time. Simply put, the higher the return on networth a company generates, the higher the price to book multiple that is given to that business.

As earnings can be very volatile, we have found price to book to be more stable than the price to earnings ratio. When looking at aggregate market valuations, we often rely on a simple framework which revolves around the price to book ratio. The chart below shows us the Sensex Price to book from 2000 to 2022.

In that period, Sensex had an average price to book of 3.10.

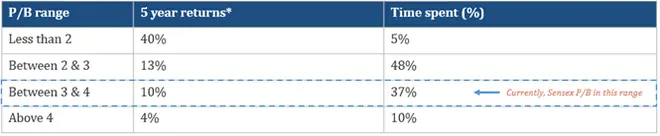

The 5-year returns data above is median 5-year CAGR for data from Jan 2, 2000 to Nov 30, 2022.

The table above shows rolling returns segregated by the time the market spends in a particular price to book range. Interestingly, Sensex spends close to 85% of the time between 2x and 4x. Close to normal returns can be expected when investing in this range. However, the returns dramatically change when we move to either extreme.

The five-year return expectations after investing in the Sensex when the price to book is above 4x is a mere 4%. On the other hand, the five year return jumps to an incredible 40% (annualized) when investing in periods when the price to book was below 2x.

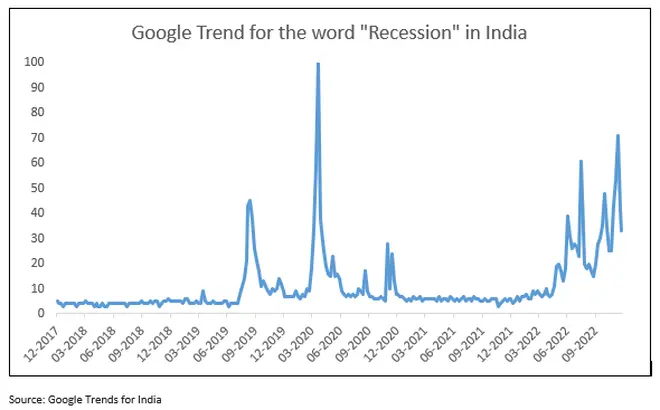

Looking at this may make it seem that investing when the market is at valuations close to or lesser than 2x price to book is a no brainer. While it has been so for the last 20 years, it only becomes evident in hindsight. Think back to March-April 2020. The market was languishing at valuations close to 2x price to book. The prevailing market sentiment though was anything but positive.

Rising Covid cases, country wide lockdowns, oil price volatility, supply chain disruptions, etc. all led to recession concerns. This is what makes contrarian investing difficult. It’s a constant battle between “This time it’s different” and “The risk reward makes it a no brainer”.

While our price to book risk-reward framework simplifies our thinking we are always cognizant of the fact that the Indian market is still very young. Twenty years of a study may unfortunately not be enough to cover every potential market dynamic.

All this brings us to the simple realization that fundamental investing is not a perfect science. Random speculation aside, even historical risk rewards are not the answer to everything. However, in times of uncertainty, they come in handy as they help build conviction to be more confident or cautious to take a contrarian bet.

Maheshwari is the Co-Founder and CIO at IIFL Asset Management, while Maniyar is Assistant Manager (Research)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.