Navin Fluorine and a slew of new projects is not new for investors. The company has traded at an average of 47 times one-year forward earnings in the last two years. This, on a track record of executing strategic projects successfully. While the next set of projects look to extend the streak, they will have to be executed under a new leadership (which is yet to be in place). The current MD, Radhesh R. Welling, will be leaving for personal reasons by December 2023. The stock has shed 18 per cent since the announcement in September.

In October 2021, we recommended holding the stock: long growth runway but trading at 47 times one-year forward earnings. With a steep correction and currently trading at 33 times forward earnings, we recommend investors accumulate the stock. Leadership change may impact the outcomes, but the growth levers are already in place. Investors can capitalise on the opportunity amidst current volatility.

Several avenues of growth

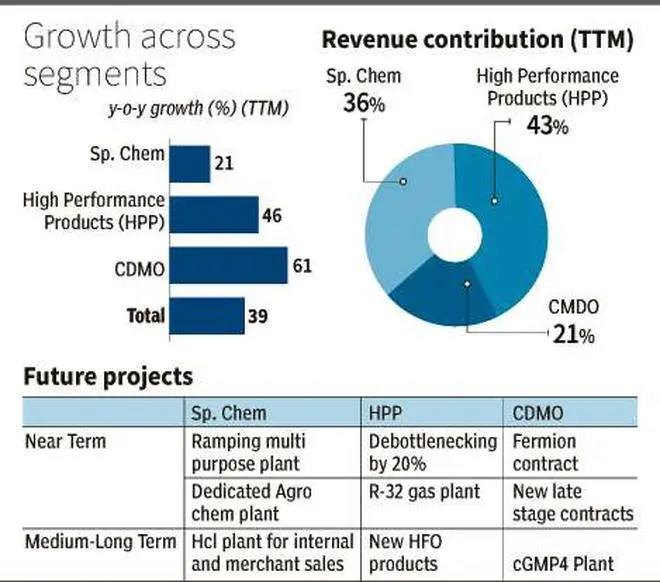

Post reorganisation in FY22, Navin Fluorine operates in three segments. Speciality chemicals segment that caters to intermediates in agro, performance materials and pharma, in that order of priority. These are largely generic projects. CDMO division handles late-stage innovation partnerships, largely in pharma. HPP segment caters one product to one client primarily, which is HFO supplies to Honeywell. All three divisions run on Navin’s fluorination expertise, but CDMO and speciality divisions are adding projects outside of it as well.

The speciality chemicals division will start commercial production from a plant dedicated to agro intermediate from FY25. This should add 15-20 per cent revenue growth to the division, assuming 1x asset turnover ratio as a large part of the output has been tied. A multi-purpose plant has also been ramping up from Q4FY23 with expected addition of two more products, after having started on three products.

The division also announced starting five new molecules from Q3FY24. The speciality chemicals division should generate 20-30 per cent yearly growth in the near term. The division is also adding a 40,000 MTPA hydrochloric acid facility at an outlay of ₹450 crore expected to commercialise in two years. This will be used for captive and external sales targeting new emerging sectors.

The next growth driver will be the CDMO division. The division started with early-stage innovator projects (in Phase 1 or earlier) but is now shifting to late-stage projects. This is to ensure visibility of order flows with developed projects but will trade off exclusive or near-exclusive status on offer with the former. The older projects will recur while the company is adding new projects to the portfolio. A three-molecule project with Fermion is expected to start from CY25, which are at late/commercial stage. To accommodate the visible order flow, Navin Fluorine will start work on cGMP4 facility having expanded cGMP3 facility by FY24-25. The relatively nascent division has established portfolio of clients/projects, which when matures to commercial stage, will ensure a base of visible revenue stream.

Navin Fluorine partnered with Honeywell to develop a dedicated facility for the production of HFO (Hydrofluoroolefins) a gas with refrigerant and other applications. The project started in FY22 and is under HPP division, which also includes inorganic fluorides and other refrigerant gases business. The segment has generated 46 per cent YoY revenue growth in the last one year as the dedicated plant reaches optimal capacity, which it has in FY23.

The next leg of growth from Honeywell will be from debottlenecking the facility (20-25 per cent revenue growth in FY25-26) and with exploring new products for the company. One more HFO and additional products are in the exploratory stage. A new plant dedicated for R-32 refrigerant gas (₹80 crore capex) should start from H2FY24 in the interim.

Recent issues

Across divisions, Navin Fluorine can generate 20-25 per cent revenue CAGR in the near term and is already exploring longer dated growth drivers as well: new HFOs, Hcl plant, cGMP4 and others.

The recent Q2FY24 results and management churn have impacted the stock. The company reported 12 per cent YoY revenue growth, missing estimates of 20 per cent. Two products in speciality chemicals were deferred, HPP was still progressively ramping up after plant closure in June 2023, and two large projects were moved to CY24 in CDMO. The lower prices for refrigerant gases also did not help. Facility underutilisation pressured EBITDA margins, which slid to 20 per cent from estimates of 23-24 per cent. This, amidst announced change in leadership, has impacted the stock.

While growth drivers are in place, execution risks and management risks are material aspects too. Investors must monitor the development of longer-dated projects, short-term recovery with new leadership while accumulating the stock. The company has a comfortable net debt to EBITDA of 1.37 times as of September-2023.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.