As infrastructure and its many sub-segments took off sharply over the past couple of years and continue to thrive with heavy government investments and initiatives, many companies have benefitted from smart execution of such projects.

In this regard, NCC is a company that has been a key beneficiary of the focus on improvement in infrastructure across the country.

The firm operates in segments ranging from building & housing, roads, water & environment, to irrigation, electrical works, mining and railways. These projects are executed for various State and Central government entities.

A track record of strong execution, diversified orderbook and a pipeline of lucrative projects to be worked on over the next few years make the prospects for the stock of NCC attractive.

The shares of NCC have doubled over the past one year, but are still reasonably valued. At ₹166.70, the stock trades at 18 times its trailing 12-months per share earnings and 14 times its likely per share earnings for FY24. Investors with a 2-3-year perspective can buy the shares of NCC.

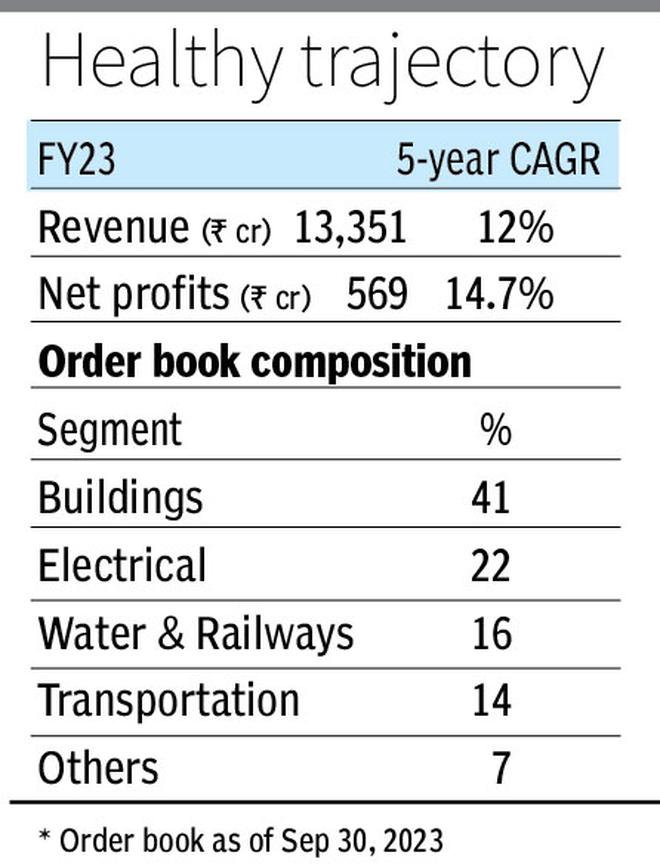

In the last five financial years (FY18-FY23), the company’s revenues have risen at a CAGR (compounded annual growth rate) of 12 per cent to ₹13,351 crore in FY23, while net profits grew at 14.7 per cent over the same period to ₹569 crore.

Strong execution record

NCC operates in multiple segments of the infrastructure theme, as mentioned earlier.

Industrial and commercial buildings, IT Parks, shopping malls, colleges, hospitals, metros, highways, water treatment plants, underground drainages, electrification, transmission & distribution lines and sub-stations, dams, reservoirs, tunnels, track-laying, signalling and coal excavation are some of its areas of expertise.

A sample of its projects executed includes, Nagpur Metro Rail, ESIC Hospital at Gulbarga, AIIMS Guwahati, Agra-Lucknow Expressway, SVAB, ISRO Sriharikota, Water Supply Project in Odisha, Rubber Dam on Falgu River, Airport at Agartala and Nagpur-Mumbai Expressway, among many others.

NCC is currently executing or has won orders from North Bihar Power Distribution Company, Brihanmumbai Municipal Corporation, Maharashtra State Electricity Distribution Co., Navi Mumbai International Airport, Haryana International Horticulture Marketing Corporation and the like. The size of these orders ranges from ₹1,144 crore to ₹5,755 crore, indicating deep client relationships. The UP Jal Jeevan Piped Water project is worth ₹16,500 crore.

Large, diversified order book

The company has witnessed a surge in its order book over the past couple of years. In the recent couple of quarters alone, it has won a total of over ₹20,400 crore worth of orders.

As of September 2023, NCC had an order book of a staggering ₹61,796 crore to be executed in the next few years. The order book translates to around 4 times its trailing 12-months’ revenues.

Being an EPC (Engineering, Procurement and Construction) player, the company is able to bid smartly for its projects and has generally been able to maintain an EBITDA (Earnings before interest, taxes, depreciation, and amortisation) margin of 10 per cent or more. This margin is healthy given the scale at which it operates. NCC is also increasingly taking on projects that contain escalation clauses to insulate the company from increase in input prices.

The company has constantly been able to tap into emerging areas and develop expertise to win orders. Smart metering is one such area, given the focus that many State electricity boards put into it to reduce revenue leakages and tighten subsidies.

NCC’s current order book is quite diversified with buildings (41 per cent), transportation (14 per cent), electrical (22 per cent), water & railways (16 per cent) and mining (7 per cent) being the main constituents.

Given the diversity of the order book, and the criticality of many projects that it is executing, there is considerable visibility on earnings and margins for the next few years without any fears of cutbacks from governments.

Debt and one-offs

Despite growing at a reasonable pace and with a fairly large scale of operation, NCC has managed to keep its debt level under control. Gross debt has decreased from ₹1,985 crore as of September 2022 to ₹1,470 crore as of September 2023. The company has cash and cash equivalents of ₹215 crore as of September 2023.

Though NCC has indicated that debt may go up a tad over the next couple of quarters, the levels of leverage are still comfortable.

The net debt to equity ratio is a little over 0.1, which is quite a healthy level to operate at.

In the first half of FY24, NCC’s revenue rose 36.2 per cent over the same period in FY23 to ₹8,121.5 crore, while net profits declined 4.3 per cent to ₹2,31.3 crore. The reason for the decline was a one-off arbitration issue. In September 2023, NCC received an arbitration award of ₹198 crore after five years (from a client, Sembcorp), while the expected claim was ₹606 crore. At the same time, the company also received a claim settlement of ₹152 crore from NHAI. These two claims together impacted revenue by ₹199 crore and net profits by ₹149 crore in Q2FY24 as impairment — no cash outflows, though. Otherwise, the first half net profits would have soared sharply.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.