The Indian Capital goods sector has been in the spotlight in recent times on account of higher capex outlay by government, companies’ focus on localisation, private capex revival and strong order inflows. BSE Capital Goods Index has grown more than threefold since its April 2020 lows while it has surged about 26 per cent in the last one year. Siemens Ltd seems to be one of the key beneficiaries of the theme as its stock has shown strong performance by delivering returns of about 45 per cent in the last one year and is currently trading near all-time-high levels.

Siemens Ltd has been experiencing tailwinds such as strong order inflows and backlog and double-digit revenue growth but its pricey valuation calls for caution. The stock is trading at a one-year forward P/E of about 61.2 times (Bloomberg estimates), which is 32 per cent premium to its historical five-year average P/E.

In the last five years i.e. FY2018-2022, the company grew its earnings by about 38 per cent in absolute terms while the stock has shot up by nearly 200 per cent. Hence the upcoming growth prospects already seem factored in the stock.

Therefore it provides its investors very little margin for safety, which makes a case for booking profits in the stock.

The fundamentals of the company remain good. This is a valuation-based call.

Business

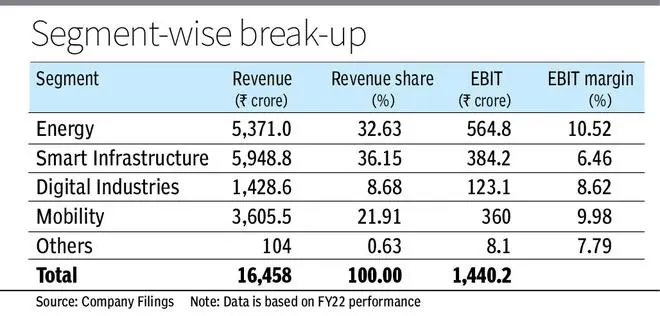

Siemens is an Indian listed subsidiary of MNC Siemens AG, which holds 75 per cent stake in the company. The company reports its financials on a October-September basis in line with its German parent. Its business comprises mainly four segments – energy (33 per cent), smart infrastructure (36 per cent), mobility (9 per cent) and digital industries (22 per cent).

Under the energy segment, Siemens provides products, solutions, and services across the energy value chain of oil and gas production, power generation and transmission. Here it caters to customer base including Oil and Gas companies, IPPs, utilities, transmission system operators and mining and chemical companies by providing them solutions such as decarbonisation and grid stabilisation, among others. Smart Infrastructure (SI) division’s portfolio comprises grid control & automation; low and medium voltage power distribution, switching and control; building automation, fire safety and security, HVAC control and energy efficiency solutions.

Digital Industries (DI) segment provides technologies for automation and digitalisation, for process and discrete industries. Here its portfolio comprises mainly software, drive and automation technology for industrial segment. Mobility segment offers hardware and software solutions for passenger and freight transportation. This includes rail vehicles, rail automation systems, rail electrification and IT solutions.

Government projects comprise 15-20 per cent of the company’s business while the export portion hovers at around 15 per cent.

Orderbook

As on September 30, 2022, the company has an all-time-high order backlog of about ₹17,180 crore. During FY22, it saw an increase in order inflows by about 43.1 per cent y-o-y to ₹19,420 crore. The energy segment contributes to about a third of the total order inflows, followed by SI, which comprises 27 per cent of the same while DI and Mobility contribute about 24 per cent and 17 per cent. In recent times, Mobility space has been in focus as it saw a huge increase of 136 per cent in order inflows y-o-y, mainly driven by a large order worth ₹900 crore, to develop Pune metro corridor.

Further in January 2023, the mobility segment received a huge order worth ₹26,000 crore from Indian Railways(IR) to design, manufacture, commission and test 1,200 locomotives of 9,000 HP. Deliveries are planned over an 11-year period including 35 years of operations and maintenance (O&M) and hence its immediate impact might not be seen on the company’s financials but it provides revenue visibility. Locomotives will be assembled in the IR factory in Dahod, Gujarat, and O&M will be performed in four railway depots at IR’s other facilities. The exact impact of this will be more quantifiable when management gives the next update during March quarter results.

Financials

During FY2022, the company reported about 22 per cent increase in revenue to ₹16,137.8 crore. It clocked EBITDA margins of 10.9 per cent i.e. 20 bps down y-o-y. However, adjusting for forex and commodity losses, the same is 12.4 per cent against 11.3 per cent y-o-y. The overall increase in margins is mainly due to better price extraction, which was tempered by higher input and logistics costs faced by certain segments.

In the last five years (FY2018-22), the firm has been able to grow its top line at a CAGR of about 6.4 per cent while maintaining EBITDA margins in the 10-13 per cent range.

During December ending quarter (Q1 FY23), the company witnessed a growth of about 17 per cent in its revenues and had margin expansion to 15 per cent, from 10 per cent levels, on account of better price extraction, higher volumes and positive forex and commodity effects.

Siemens has a robust balance sheet with net cash to the tune of around ₹5,500 crore. It has been able to generate positive cash flow from operations and free cash flow on a consistent basis. While fundamentals are decent, the prospects appear fully priced making the risk-reward unfavourable at current levels.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.