Investors can book profits in the stock of IT Services company Sonata Software (Sonata). Trading at a trailing PE of 25 times, its valuations are expensive at an absolute as well as relative level. Add to this the macroeconomic headwinds that are likely to intensify as a consequence to the banking sector turbulence in the US and Europe, there is a need to get incrementally cautious on expensive IT stocks.

Across the board, IT services stocks, including Sonata Software, had witnessed significant PE multiple expansion from pre-Covid levels, driving stock returns. This was propelled by three main factors – expectations of better global economy from Covid lows as governments and central banks stimulated the economy; digitisation theme that accelerated during Covid; and ultra low interest rates that made equities an attractive asset class.

But as you would have it in stretching anything beyond measure, the excessive exuberance of the past is hitting brick walls now and so have stocks. Recent banking turbulence significantly increases risks to global economy. Further digitisation theme is on the slow lane for now, and with stubborn high inflation, interest rates are likely to remain high for a while giving strong competition to equities as an asset class.

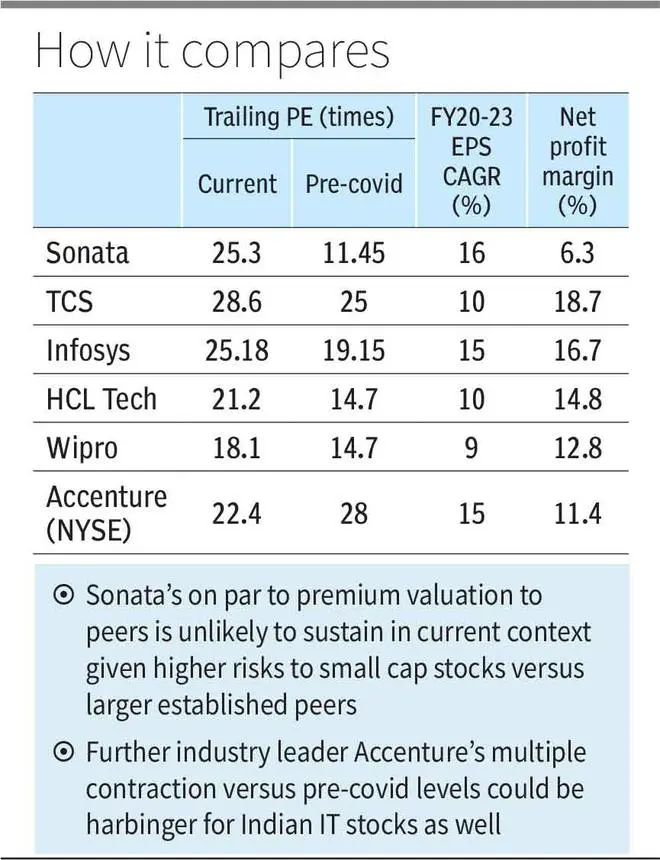

Thus, as compared to multiple expansion that IT stocks witnessed earlier, they now face risk of multiple compression and PE multiples may trend in the direction towards pre-Covid valuations. This is notwithstanding the fact that long-term prospects remain decent if one looks beyond the next year or so. To an extent, multiple compression is already under way in many of the large-cap and mid-cap IT stocks.

At 25 times, Sonata’s PE is around 30 per cent above its 5-year average and 120 per cent above its pre-Covid PE. In terms of forward metrics, it is trading at a 21 times, 40 per cent above its 5-year average. Given global headwinds, the forward estimates may be at risk. Thus, overall, the risk-reward is not favourable anymore and caution is warranted.

Business and financials

Founded over 35 years ago, Sonata is amongst India’s oldest IT services companies. It, however, took a while longer for the company to establish its space in the industry and amongst investors. After a euphoric run during the dotcom boom in sync with most tech stocks at the start of millennium, Sonata stock significantly underperformed many of its peers for a decade. But from around 2014, the stock had made up for lost ground and has been one of the best performers with stock CAGR of 42 per cent since then. Its underlying performance too was solid, with revenue and net profit growing at a CAGR of 19 and 22 per cent respectively during the same period.

Similar to peers, the company has executed well to capitalise on the digitisation thrust and witnessed some accelerated growth. Based on estimates for last quarter of FY23, its FY20 to FY23 revenue and net profit CAGR is likely to be around 25 and 16 per cent. Earnings growth during this period has been lower as margins came under pressure, a trend witnessed across many IT services companies in recent years. However, in the case of Sonata, the impact was higher due to its domestic business.

Sonata is differentiated versus peers due to its domestic business, much of which is unconnected to its international-focused IT services business. It derives lesser revenues from international business (27 per cent) and more from domestic business (73). Compared to this, its IT peers’ international revenues are 90 per cent or higher. The domestic business for Sonata includes distribution and reselling of products from global technology companies present in India. While this might make it appear as though Sonata might be less exposed to global risks, the key thing to note here is that the company derives a substantial chunk of 73 per cent of its net profits from the international business. The domestic business comes with significantly lower margins. Thus this makes Sonata’s profitability and stock performance highly levered to global economy.

Recent performance

In order to bolster its international services revenue and bring it to comparable level with peers, Sonata has embarked on a new strategy to grow this segment to a larger pie in its overall revenue. As part of the strategy, it recently acquired US-based Quant Systems for an upfront payment of $65 million and deferred payouts over the next two years that can go up to $95 million (deal value of $160 million or approx ₹1,328 crore). The company expects this acquisition to provide a fillip to its BFSI and healthcare verticals.

This acquisition bodes well for the long term. But in the near term this comes with the challenge of coping with a global slowdown. While most stocks have been correcting over the last year, Sonata hit its all-time high recently with Quant Systems deal kindling excitement in the stock.

At current valuation levels and global uncertainty, caution is warranted. Being a small-cap player with lower margins and with higher client concentration (top 10 customers accounting for 71 per cent of revenues) compared to large-caps, the risks are inherently high during global slowdowns.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.