Markets took a breather last week, providing some respite to investors, who were long waiting for a relief rally. Bellwether indices Sensex and Nifty closed the week in the green, gaining 0.6 per cent and 0.7 per cent, respectively.

The $1.87-billion investment by GQG Partners this week in Adani group stocks -- Adani Enterprises, Adani Ports and Special Economic Zone (APSEZ), Adani Transmission and Adani Green Energy, helped reinstate faith in the group’s ability to raise funds and, thus, triggered the rally in Adani group stocks. This, along with a strong mandate for the ruling BJP-led NDA government in the North Eastern states -- Nagaland, Tripura, and Meghalaya (through its ally NPP) -- were also taken favourably by the markets.

Banks led the rally this week, led by the PSU pack, gaining 9.8 per cent. Realty came a close second, soaring 8.3 per cent on a one-week basis, followed by Metals (4.1 per cent) and Private Banks (2.9 per cent).

Four of the Adani group companies’ stocks featured in the top five gainers’ list. Except for Adani Transmission, the other three stocks which saw an investment influx from GQG Partners - Adani Enterprises, Adani Ports and Special Economic Zone and Adani Green Energy - occupied the second, third and fourth place on a one-week return basis. Adani Wilmar, the other group company, ranked fifth.

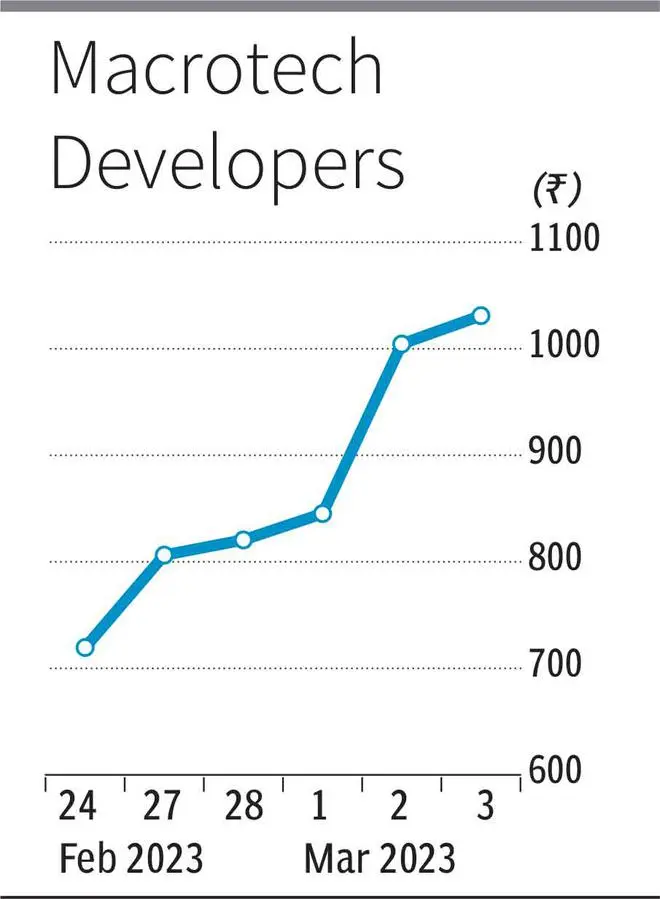

Macrotech Developers

However, topping the winners’ list last week was the stock of Macrotech Developers (Lodha), gaining a whopping 43.3 per cent in just the last five trading sessions. With its flagship Lodha brand, the company which has strong presence in Mumbai and Pune, recently forayed into the Bengaluru market. Besides real estate, the company is also eyeing strong growth in its facilities management business.

An improving demand cycle in Mumbai, coupled with newer launches in this market, should help Macrotech’s growth. In the latest December 2022 quarter, the company reported a revenue decline of 14 per cent to Rs 1,774 crore. Operating profit for the period declined 16 per cent to Rs 404 crore. However, the company managed to retire debt totaling to Rs 750 crore. The stock currently trades about 35 times its trailing 12-month earnings and about 4.3 times its book value.

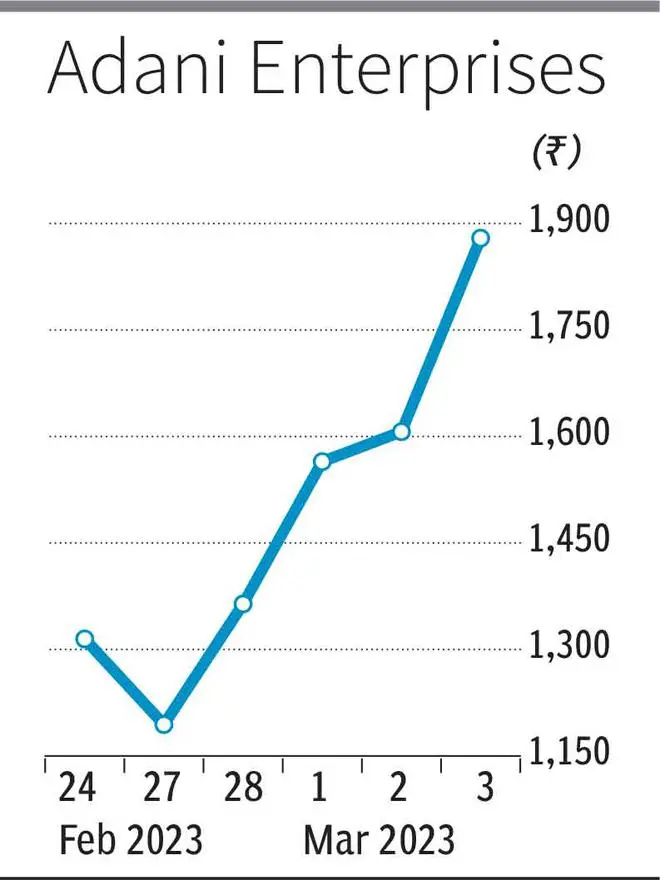

Adani Enterprises

Adani Enterprises, the flagship company of the Adani Group, occupied the second spot, gaining by a strong 42.9 per cent for the week, thanks to the investment by GQG Partners. Interestingly, the stock has corrected by over 71 per cent from its December 2022 peak price of Rs 4,165 a piece to a year low of Rs 1,193 on February 27. From a price earnings ratio of over 400 times, the stock, post-correction currently trades at 110 times, the company’s trailing 12-month earnings.

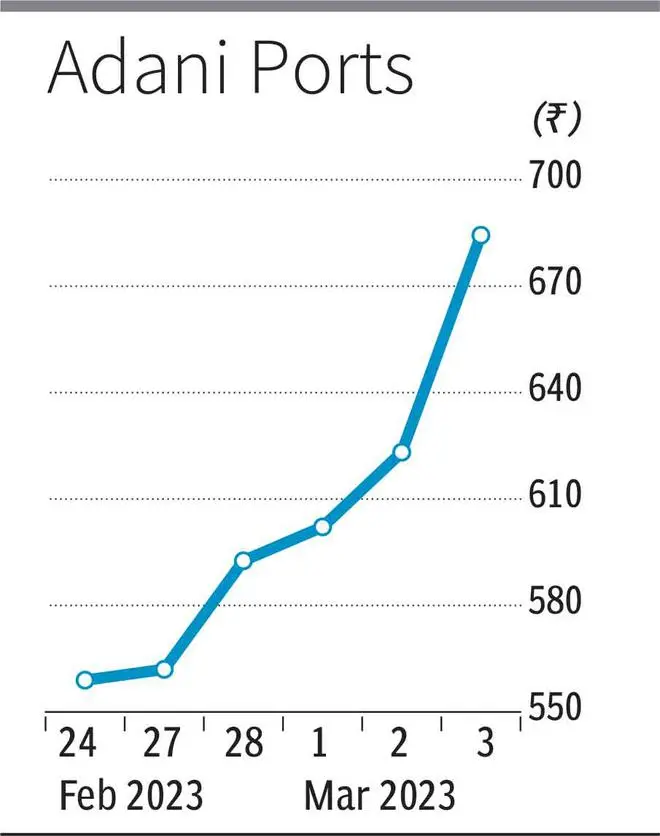

APSEZ

Adani Ports and Special Economic Zone, which is India’s largest port development company and has the country’s largest container handling capacity, witnessed a smart 22 per cent jump in its stock price over the last five trading sessions. The company, possibly the most valuable business under the Adani group’s fold with significant moat, not only operates ports in India, but has also spread its wings globally, with the acquisition of Israel’s largest port Haifa for $1.2 billion. Post the Hindenburg report, the stock price corrected from its September 2022 peak price of Rs 972 apiece to Rs 462. At the current price, the stock trades at 28.6 times its trailing 12-month earnings and about 3.2 times its book value.

Other stocks that rebounded strongly this week include Adani Green Energy (15.5 per cent), Adani Wilmar (15.4 per cent) from the Adani stable, and others such as JSW Energy (14.5 per cent), Bank of India (14.5 per cent), Ambuja Cements (13.5 per cent) and Anupam Rasayan (13.4 per cent) to name a few.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.