From Covid lows, the stock of Tata Telecom has had an amazing ride. From the lows of March 2020, the stock is up a whopping 650 per cent. If you go back a few weeks/months in time prior to the crash when markets were buoying in optimism and trading at around all-time highs (till then), Tata Communications was trading at around ₹450. The returns since then too are quite spectacular, at near 300 per cent.

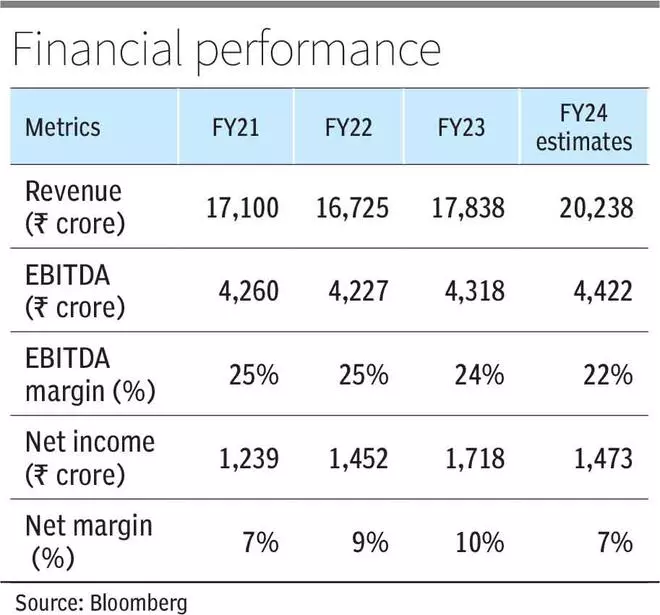

But here is one key thing for investors to note; the revenue CAGR for Tata Communications from FY20 to FY23 has been a mere 2 per cent, while EBITDA CAGR has been 9 per cent. As against this, the stock CAGR from pre-Covid highs to now has been 46 per cent. Valuations have expanded from trailing EV/EBITDA of around 6.5 times in January/February 20 to a pricey 13 times now. Even factoring for growth prospects, it is valued at one-year forward EV/EBITDA of 11.7 times. These are challenging valuations for telecom companies to sustain. Bharti Airtel, with much more diversified telecom business and superior EBITDA margins of 51 per cent as against Tata Communications EBITDA margins of 24 per cent (FY23), trades cheaper at one-year forward EV/EBITDA of 9.1 times.

Also read: Back to Ghar Ka Khaana in the markets?

What explains this dichotomy? This can be explained partly by long-term prospects for enterprise telecom connectivity and related digital solutions, and partly by investor exuberance. It is quite likely that the investor exuberance-driven upside in valuation will unwind in the future. For example, we are already seeing this happening in the IT services sector after the Nifty IT peaked in January 2022 when investor exuberance got way too ahead of fundamentals.

Also, it is important to note that while in general telecom is considered a relatively defensive business, pure-play B2B players like Tata Communications will be subjected to cyclicality, given that enterprise spending tends to be cyclical.

Hence investors who have ridden the upside in the stock can lock in on the gains and book profits. For new investors interested in the sector/theme, better entry points are likely sometime in the future.

Business

Tata Communications (erstwhile VSNL) is a Tier 1 internet service provider (or ISP) engaged in the business of providing enterprise core connectivity services and digital platforms (cloud and allied solutions). Globally, internet connectivity can be categorised into three parts – Tier 1, Tier 2 and Tier 3 ISPs. Tier 1 ISPs build, own and operate the core backbone of global internet. For example, if you watch a video hosted in a data centre in Iceland, your local internet vendor plays only a part in the transit of data from there to your computer or smartphone. Bulk of the transit is enabled by Tier 1 ISP that enable global connectivity via their under sea submarine optic cables. Tier 2 ISPs, which are large regional players, buy/pay for capacity from Tier 1 ISPs. Tier 3 ISPs are those engaged only in last-mile connectivity.

Also read: Agri-investment platforms: Should you plough through this risky option?

As Tier 1 ISP, Tata Communications owns one of the world’s largest subsea cable networks and also has a pan India domestic fibre network. Tier 1 networks are connected with every other network on the internet. Services encompass international and domestic private lines, virtual private networks, and enterprise internet connectivity services. For example, in enterprise internet connection services, Tata Communications connects to over 70 per cent of the world’s top content providers. Whether you are watching a video on Youtube or Netflix, there is a good chance the content transited through a Tata Communications network.

Tata Communications has presence in 190+ countries and territories around the world, and serves over 7,000 customers globally and at some level plays a part (transit) in connecting 4 out of 5 mobile subscribers world wide as well as connecting businesses to 80 per cent of the world’s cloud giants. This business is evolving with the rapid growth in cloud as well with the company scaling up on its operations by offering more nuanced solutions like on-demand connection services for enterprises. This business accounts for around 55 per cent of the company’s consolidated revenue.

While the scale is vast, the flip side is that much of the business is commoditised. For example, despite the vast volumes of growth in data consumption, the revenue for this segment grew only in single digits at 6.9 per cent in recently reported Q2 FY24. The revenue growth in recent years has also been only moderate.

Also read: Equity funds for first-timers

However, with an intent to achieve double-digit revenue growth, the company has, in recent years, implemented a strategic shift to digital platforms and solutions business. This segment, which accounts for around 30 per cent of consolidated revenue, consists of enterprise collaboration solutions (enabling better employee and customer experiences), cloud security solutions, and Internet of Things (IoT).

For example, one of the services the company successfully implemented was digitising street light infrastructure (remote control, brightness based on requirement) for a smart city in Saudi Arabia. By focussing on this segment, the company has branched out of typical telecom service into aspects of digital solutions business that other IT companies are engaged in. This business grew 30 per cent Y-o-Y in Q2FY24 including benefit of acquisitions, and 16 per cent excluding the same. This segment might explain some of the outperformance in the stock. The flip side for now in this is that this initiative is coming with negative impact on margins.

In recently reported 2QFY24, consolidated revenue increased 10 per cent Y-o-Y (includes acquisitions) to ₹4,872 crore, while EBITDA declined 10 per cent to ₹1,015 crore. EBITDA margins compressed by 465 basis points on cost pressures and impact of acquisition.

While company’s strategic initiatives hold potential, the business primarily remains telecom and related segments. At current valuation levels, the optimism from new initiatives is fully baked in. At the same time, risks from commoditised telecom business, impact to digital platforms business from global slowdown, and lower margins versus peers are not reflected.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.