The logistics sector has been in focus for some time now due to government initiatives like Gati Shakti, National Logistics Policy and Dedicated freight corridor. In addition, technology is causing disruptions in the sector. Solid long-term prospects for Indian economy, growth in consumption and e-commerce trends bode well for the sector, especially the organised segment.

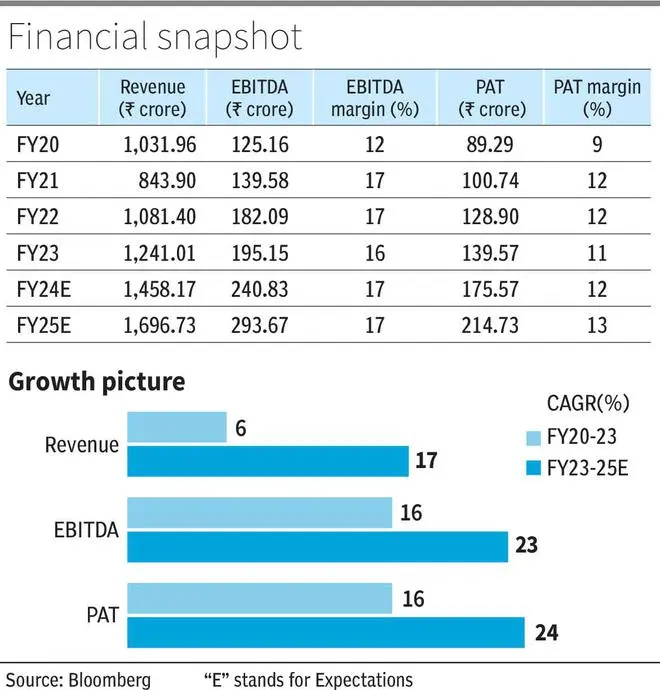

TCI Express is one of the logistics players well-positioned to tap this opportunity. It is India’s leading player in the express part truck load (PTL) market. This is reflected in consensus expectations (Bloomberg) of solid FY23-25 revenue and earnings CAGR of 17 and 24 per cent respectively. The forward PE of TCI Express is 34.3x against its 5-year average of 38.4x, while its forward EV/EBITDA is 26.5x against its 5-year average of 28.3x. Peer Bluedart is trading at a forward PE of 31.5x . While its premium is justified, overall its valuation appears to factor the positives. With risk reward evenly balanced, investors can continue to hold the stock for now.

Business

TCI Express started off as TCI XPS as a division of Transport Corporation of India (TCI) which later became an independent company and got listed in 2016. Here the focus is on express cargo distribution with greater emphasis on the emerging e-commerce business. According to the company, it has 7 per cent market share of the Express Industry in India. Express service is where non-bulk goods are moved, and the delivery time is less compared to non-express carriers.

The main services provided by TCI Express are Surface express (Road Transport), Domestic and International Air express and Rail express. TCI Express also provides B2B multi model distribution for e-commerce players, Customer to Customer express service and Cold chain express (pharma companies are its main clients). The top industries the company serves are pharmaceuticals, automobile industry, engineering, electronics, and lifestyle. Clients of these industries contribute around 55 per cent of the total revenue.

TCI Express has 82 per cent of revenue coming from Surface express while 18 per cent comes from other services (rail express, Air express, C2C express, Pharma Cold chain express). The company reported highest revenue achieved in any quarter till date in March 2023 quarter. This growth was driven by one, strong demand from SME and corporates, and second, higher utilisation of newly developed sorting facilities. The overall utilisation of FY23 was 84.25 per cent.

The key business drivers for the company are automation of the sorting centres, expansion of branches, having a diversified client base of both corporates and SMEs spread across industries and finally the government initiative to strengthen logistics sector and focus on infrastructure to provide seamless connectivity to remote rural areas.

The new sorting centre at Gurgaon was commissioned in March 2022. This centre is fully automated and one of the largest B2B sorting centres in India. The management will continue to implement the automation strategy in other sorting centres to enhance overall operational efficiency and ultimately to drive profitability further. TCI Express has 28 sorting centres and more than 500 express routes across the country.

The company has been continuously adding branches in order to gain business and increase presence. In 2017, it had around 500 branches across the country, now it has more than 950 branches. In FY23 the company opened 35 new branches. The management expects the new branches, although small, to generate good and profitable business. These branches are useful in adding small and SME customers which bodes well in the overall strategy of the company.

The company has a well-diversified client base of both corporates and SMEs/small customers in the proportion of 50 per cent each. The top 25 clients contribute to only 15 per cent of revenue.

Financials and outlook

Revenue grew 14.7 per cent YoY in FY23 to ₹1,241 crore, EBITDA rose 7.2 per cent YoY to ₹1,95.2 crore in FY23. EBITDA margin during the year was 16.2 per cent against 16.8 per cent in FY22. EPS rose 8.2 per cent to ₹36.2 per share.

The company has given a revenue growth guidance of 15-16 per cent for FY24 and margin expansion of 100 basis points is also targeted. The 100 basis points increase in FY23 could not be achieved as the company did not take a price hike in FY23. However, it has decided to take price hike in FY24.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.