The road transport sector of India is known to be fragmented, with a lot of unorganised players. However, with the government regulation on E-invoicing — which states that any operator having turnover above ₹10 crore will have to generate e-invoice — leading to increased compliance, this seems to be in favour of organised players. VRL logistics, an LTL (Less than truckload) major, has been posting decent growth over previous periods.

The company is trading at a one-year forward PE of 21.4x while its historical average (2 year) is 31.3x and looking at its healthy margins, customer base of 7 lakh customers and expansion prospects, investors can accumulate this stock at current levels.

Business

The company is a major road transport provider (88 per cent of revenue) with other verticals (primarily bus transport) accounting for the rest. It however, wants to focus on the core business of road transport and is in the process of exiting other verticals. Within road transport, the company is a market leader in LTL segment, serving a pan-India market with 47 strategic hubs and 1,045 branches. With LTL standing for Less than truckload, LTL consignments consume less space and therefore the amount is charged for the space used. Under LTL, many different customers’ products are shipped in one truck. But since the delivery requires more planning, halts and unloading operations, the per unit and per mile cost will be higher than FTL (full truck load). Net-net, LTL provides scope for higher margins.

VRL Logistics has customers across industries e.g., FMCG, Leather products, Metals, Textiles, etc. It is a pure-play road transport service provider with no other business heads now unlike its peers such as Mahindra Logistics and TCI, which are into supply chain management also, along with road transport.

The tonnage capacity of the company is 75,084 tonnes, with 5,193 own vehicles. In Q2 FY23, the company handled 9,66,000 tonnes of goods, which was a 7 per cent rise over Q1 FY23 and 14 per cent growth YoY. The company also has storage facilities in all its branches. It plans to expand its operations in North, East and North-Eastern markets and is planning to start 20 to 40 new branches every quarter for the next 2-3 years. It plans to tap the business of unorganised players who may be facing pressure due to e-invoicing norms.

The company states that it wishes to grow organically by gaining more volume and therefore has not taken a rate hike while maintaining realisation per tonne at a steady rate. The EBITDA margin guidance given by the company is 16 per cent and it has no plans to hike the freight rates currently unless the margins drop below 15 per cent. It has stated that the sale of bus business will fetch it ₹190 crore additional cash flows which will be used to clear the net debt of ₹164 crore. This will make VRL Logistics a net cash company by FY23.

The company has spent around ₹170 crore on account of Capex in the first half of FY23 and plans to spend similar amount in second half of FY23. It procured 600 vehicles in first half of FY23, and another 600 vehicles will be procured in second half and remaining by September 2023.

Recent performance:

Revenue for Q2 FY23 was ₹732.95 crore, a 15 per cent growth YoY. The EBITDA of the company was ₹101.4 crore in Q2 FY23, 12 per cent lower than Q2 FY22. The EBITDA margin of the company for Q2 FY23 is 14 per cent, which is 4 percentage points lower than Q2 FY22 which was 18 per cent.

The main reason for decline in EBITDA seems to be hiring charges which rose to 10.16 per cent of revenue from 7.25 per cent of revenue YoY. The toll expenses have also surged to 7.33 per cent of revenue in Q2 FY23 from 6.14 per cent YoY due to increase in the number of toll plazas, toll charge rate, and increase in kilometres covered. Vehicles running, maintenance and repair cost registered a marginal decline of 1.17 per cent as a (percentage of revenue) .

Valuation

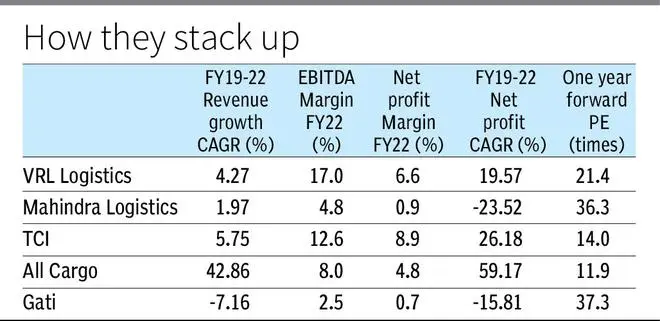

VRL Logistics is currently trading at a one-year forward PE multiple of 21.3x while its 2-year historical average is 31.3x, a discount in valuation. Its peer Mahindra Logistics is trading at a one-year forward valuation of 36.5x while its historical 2-year average is 41.2x.

VRL Logistics registered a FY19-22 revenue CAGR of 4.27 per cent, and net profit CAGR of 19.57. Its discounted valuation vis-a-vis better growth and profitability as compared to some peers (refer table) makes the company a good bet in the logistics space and investors can accumulate the stock.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.