It is quite uncommon to see a stock such as Bajaj Finance correct by 24 per cent post its March quarter (Q4 FY22) results. For long it has been the favourite among investors, particularly in the financial services space and the steady melt down in its stock prices post Q4 results nudges one to think if all is well with Bajaj Finance.

The good part is that the lender remains a structurally strong play in the consumer finance space. Virtually with little competition to destabilise its leadership position and the lender having weathered the pandemic reasonably well augers well for investors. But here’s the not-so-comforting part.

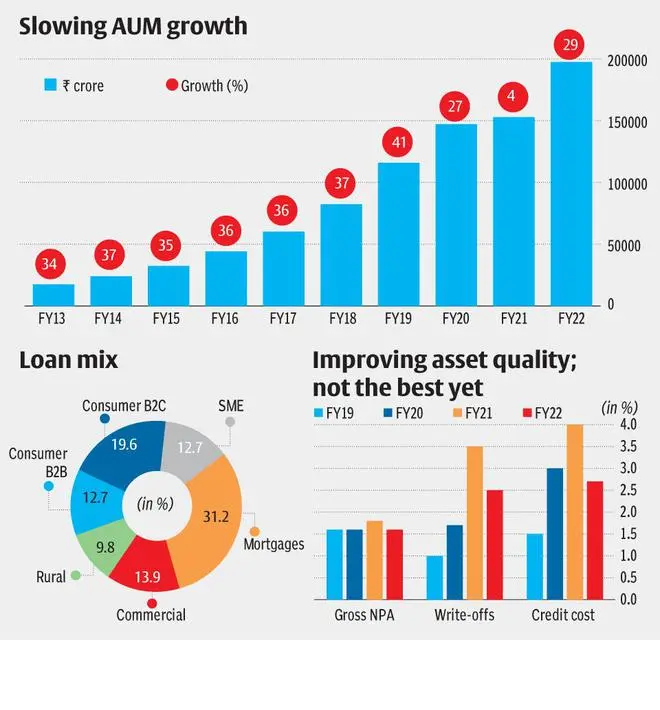

For a company that grew upwards of 30 – 35 per cent year-on-year in terms of its loan book, the growth rate may taper going forward. With focus now on building its digital fortress of products, platforms (app and web) and customer retention, and Bajaj Finance’s own base swelling to a point where quality should take precedent over quantity, it would be prudent for investors to bake in lower valuations. Currently at 6.2 times FY23 price to book, Bajaj Finance’s asking rate has shrunk by 22 per cent post results. If the trend of slowdown in pace of customer acquisition or new loans additions persists, there could be more correction in valuations. Investors can use these corrections to accumulate the Bajaj Finance stock. Despite slower growth, the lender’s favourable positioning in the market, which is unlikely to be challenged, makes for a case to buy the stock in dips.

But here’s the catch. Can Bajaj Finance stock be the multi-bagger that it was in the last decade? Quite unlikely. Bajaj Finance is in the spot as HDFC Bank, where size will be a dominant factor. For a non-bank with almost ₹2 lakh crore of loan book, it will have to tread carefully on growth here on.

Business model

At a time when buying air conditioners or washing machines on credit was uncommon, Bajaj Finance almost made it a norm and popularised the concept of zero-interest credit. This was in the lender’s first phase. In the second phase, also the periods of fast growth (FY13 – FY19), when Bajaj Finance grew its loan book almost ten-fold from ₹17,500 crore to ₹1.15 lakh crore, it took the lessons from consumer durables lending business to across products. From beauty parlour visits to buying furniture to subscribing to Bjyu’s online classes, Bajaj Finance was present everywhere.

It also tied up with RBL Bank and DBS to co-issue credit cards, though Bajaj Finance on a standalone basis also gives tough fight to credit cards. This period also marked the company’s foray into housing finance space and with this, the lender has a strong bouquet of credit products to address different segments of borrowers.

By late FY20, Bajaj Finance started facing competition from an unseen corner – the fintechs. Their freebies and cashbacks started eating into its pie of customers. The trend became prominent during the pandemic and hence the need to accelerate its digital penetration become important.

Bajaj Finance 3.0

In October 2020, Bajaj Finance unveiled its plans to become the ‘moment of truth’ company across all products and services and a quarter later it chalked out its foray into the digital space. Calling it the omnichannel framework, the intention was to serve, retain and grow its customer base in a digital or offline mode as per the customer’s preference.

The app is targeted at retail and commercial customers and cross sell products of its Bajaj Finserv such as insurance and mutual funds. Bajaj Finance is in the process of replicating its digital offerings on the website for better customer reach and engagement. The aim of the digital platform is to retain customer and to that extent it is more a cost model rather than revenue generators. Same is the logic with the payments business, a complete roll out of which is due in FY23. But will this accelerate customer acquisition rate?

Way forward

The intention behind fortifying the digital presence is to bump up the customer acquisition, a metric key for loan growth and profitability. However, since mid-FY20, slowdown in Bajaj Finance’s business became quite evident, though the bounce back led by revenge buying (or revenge selling from Bajaj Finance’s perspective) was quite strong. However, the recovery is not holding up adequately, as it did in the past - whether the periods post demonetisation or GST roll out in FY17 and FY18 respectively. But then would it be prudent for the lender to replicate its historic growth levels? Not quite.

At a loan book size of ₹1.95 lakh crore as on Q4 FY22, Bajaj Finance will be tasked with juggling between growth, profitability and asset quality. The regulator’s intention also is that large NBFCs grow in a calibrated manner. Having dismissed the option of seeking a bank license for at least three years, contending with slower pace of growth may be the new normal for Bajaj Finance, especially given that the credit cost and write-offs remained high for a consecutive year in FY22. Investors need to view FY23 as a period of a healing and normalisation of asset quality, which itself may restrict Bajaj Finance from ambitiously growing its loan book. In that case, Bajaj Finance’s need to command super-normal valuations premium will be questioned.

Valuations

In the last five years, HUL has traded at upwards of 40 times price to earnings. Despite constant competition and periods of slower than expected growth, it has held on to its premium. Bajaj Finance stock is very similar to HUL. It may remain the most expensive stock in the financial services space. The company’s ability to raise funds at the lowest cost (6.7 per cent in Q4) and maintain its overall net interest margin consistently in the 9 – 10 per cent range are its key positives.

Yet in absolute terms, despite the 22 per cent correction in valuations, which brings the stock to 6.2 times FY23 estimated book, there is a case for a further valuation correction.

Investors were willing to shell out top dollar for the stock for its ability to consistently outpace peers in terms of growth. With that factor likely to be missing in the near- to medium-term, a correction in valuation is but logical. However, given Bajaj Finance’s management pedigree, its execution ability and leadership position, which even banks haven’t been able to dent meaningfully, we recommend our readers to use the corrections to accumulate the stock.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.