Investors with a two-to-three-year investment horizon can consider investments in the stock of EID Parry (India). The Chennai-headquartered conglomerate has interests in sugar, nutraceuticals distillery and co-generation. Besides, the company also holds a 56.31 per cent stake in the country’s largest private sector phosphatic fertiliser and agro-chemicals maker, Coromandel International. EID is poised for a healthy growth on the back of expansion in its distillery business and steady performance from its agri inputs subsidiary – Coromandel International. The stock currently trades at about 22 per cent discount to its estimated value of ₹738 a share. We believe EID to be a value buy for investors with a moderate risk appetite.

EID Parry’s standalone business comprises sugar and allied businesses – distillery and co-generation and nutraceuticals. With respect to its sugar business, the company’s Parry Pure is among the largest sugar retail brands in the country. Besides retail, EID also has institutional business. Sugar prices globally have rallied in the past year, thanks to higher crude prices, as diversion towards ethanol tends to be higher in years when crude oil prices rule high.

While global crude oil prices have moderated by 20-30 per cent from the peak $120-plus levels, lower beet productivity in Europe, which is the third largest sugar producer, should support sugar global prices. Lower production in Europe should also augur well for India, as this opens export opportunities (subject to domestic safeguards and export restrictions) for Indian sugar makers. This should also alleviate any concerns over pricing pressure, given the record sugar production estimate of 36.5 million tonnes in the sugar season 2022, higher by over 16 per cent year-on-year. EID’s Sugar revenue for June 2022 quarter stood at ₹529 crore, compared to ₹341 crore last year. From a loss of ₹28 crore last June quarter, the segment’s loss narrowed to ₹15 crore in April-June 2022 period.

Even as volatility in sugar prices in the short term may have a bearing on the profitability, the benefit from the Government’s ethanol blended petrol programme (EBP) should compensate for lower sugar prices, in the event. The company last year added 60 KLPD distillery capacity, by way of a greenfield capacity at Bagalkot. With this, the total distillery capacity stands at 297 KLPD. The current distillery capacity is utilised for ethanol and extra neutral alcohol only. EID is in the process of adding another 120 KLPD distillery capacity at Sankili (Andhra Pradesh), which will be grain-based and the new capacity is expected to come on-stream by 4QFY23. This should help increase the company’s distillery revenue by 40-50 per cent. In FY22, the distillery revenue stood at ₹491 crore, with an EBIT (earnings before interest and tax) of ₹43 crore. The margins should trend higher this year, thanks to the incremental capacity and higher ethanol prices beginning June 2022.

Increasing power costs in the home market should provide a boost to the company’s co-generation segment. In the June 2022 quarter, the company generated 869 lakh units, compared to 276 lakh units the previous year. Realisation per unit of power also increased from ₹3.34 to ₹6.93. This helped the seven-fold increase in revenue to ₹64 crore year-on-year. From a loss of ₹19 crore last year, EBIT stood at ₹1 crore in June 2022 quarter. With power costs not expected to abate any sooner, this segment should continue to contribute to EID’s overall profits.

The company’s subsidiary Coromandel International, wherein it holds 56.31 per cent stake, is the largest private sector manufacturer of complex fertilisers (also called NPK complexes). The outlook for the fertiliser business remains steady, given that the Indian fertiliser industry continues to be subsidised by the Government, to insulate farmers from global price increases. With a fertiliser capacity of 4.5 million tonnes per annum (includes NPK complexes and Single super phosphate), Coromandel is an integrated manufacturer of complex fertilisers, thanks to its long-term tie-ups and overseas investments for inputs such as phosphoric acid and rock phosphate.

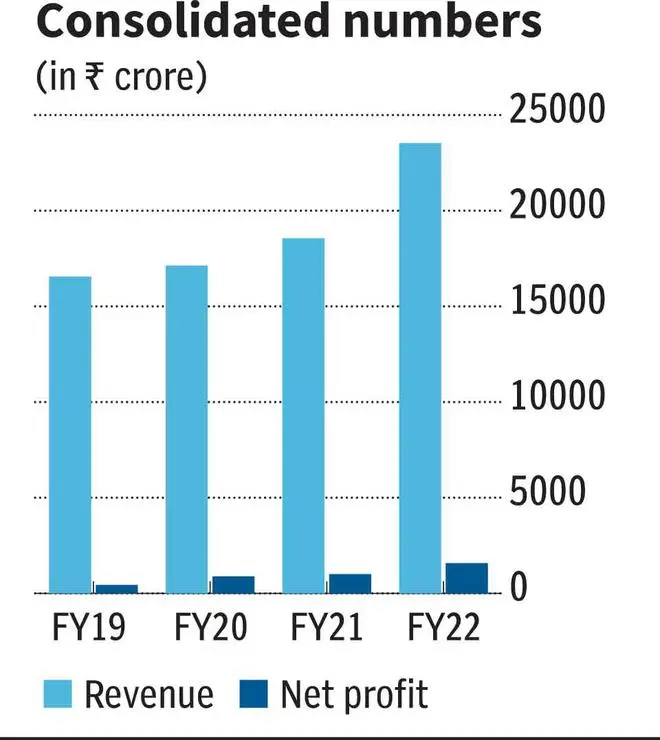

In June 2022 quarter, Coromandel International posted revenue growth of 56 per cent to ₹5,729 crore and net profit growth of about 48 per cent to ₹499 crore. The company’s profit is expected to grow at an average 15 per cent over FY22-24. This should help EID’s consolidated revenue and profits. Given Coromandel’s strong balance sheet with negligible debt and best-in-class return ratios (return on capital employed of 34 per cent in FY22), the stock has always commanded a premium to industry and its current valuation at 17 times trailing twelve-month earnings is justified.

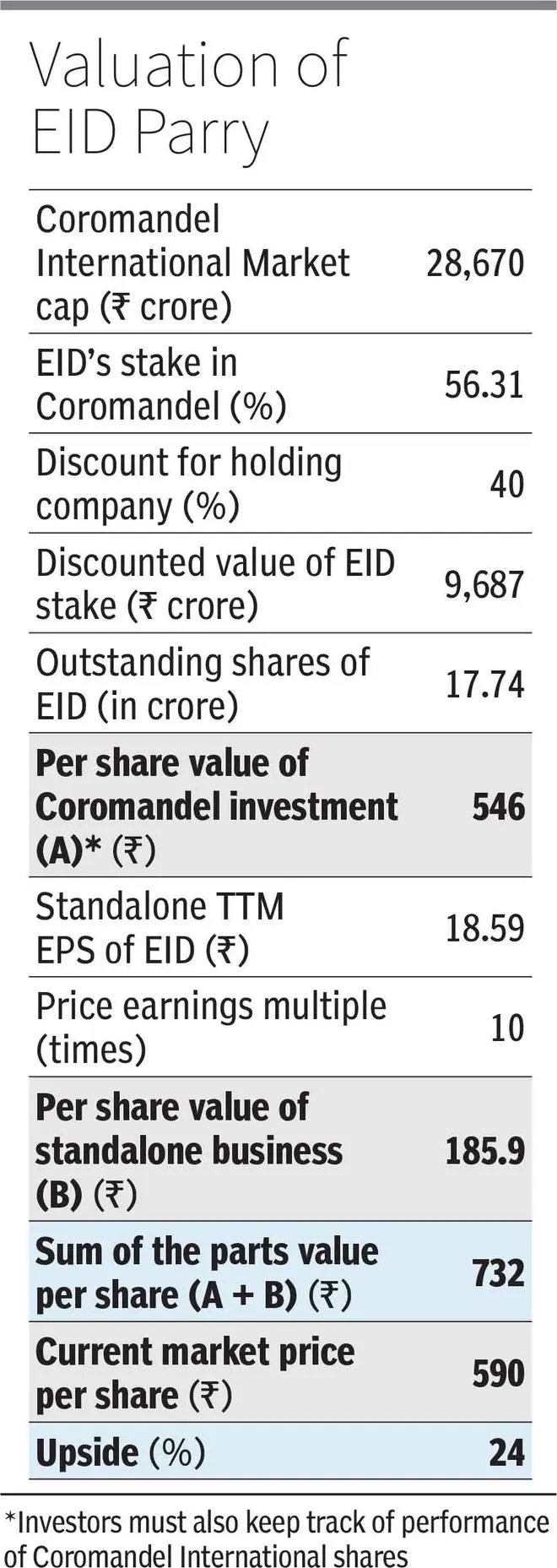

Attractive valuation

We have valued the company on a sum of the parts basis. EID holds 56.31 per cent stake in Coromandel International which is currently valued at ₹16,338 crore (Coromandel’s current market capitalisation is ₹29,015 crore). On a conservative basis, even after applying a 40 per cent discount to the current valuation, EID’s share in Coromandel works out to ₹553 per share. The stock currently trades at ₹605 apiece. On a standalone basis, the trailing 12-month earnings stood at ₹18.5 per share.

Applying a 10-time price to earnings multiple, we arrive at a value of ₹185 for the standalone business. Thus, the SOTP value for EID on a trailing earnings basis works out to ₹738 a share, which is an upside of 22 per cent from the current levels. Interestingly, the discount for holding companies has narrowed in the last few months, thanks to expectation of value unlocking by promoters in these entities. Any further narrowing of discount will offer more upside from current levels.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.