India’s refining capacity is expected to increase to 443 MMT, from the present 250 MMT, by 2030. Engineers India Ltd (EIL) will likely be a beneficiary of this expansion as it plays this decade.

The stock has had a rough ride since the end of 2017 when it was trading around ₹200 . It is down around 60 per cent from those levels on account of delays in execution due to volatile crude price and sluggish capex cycle in the hydrocarbon space, which got further compounded due to Covid-19. However, the tide may be gradually turning now. The stock has seen some interest from investors in sync with the rerating in value stocks, especially PSU stocks, over the last year. Still trading at attractive valuations, the stock can be a value pick for investors in the current times of market volatility, given expectations for pick up in projects and improvement in margins. Company’s plans to diversify into new avenues such as green hydrogen related projects and few other growth areas are also worth watching.

Also read: Indraprastha Gas: Why you should accumulate this stock

Investors can look to accumulate the stock of Engineers India on dips on account of its defensive characteristics — such as healthy balance sheet, attractive valuations, robust order book and strong dividend yield. The stock currently trades at a one-year forward P/E of 11.4 times.

Business and outlook

Conferred with Navratna status and controlled by the Ministry of Petroleum, Engineers India is primarily engaged in providing engineering consultancy, EPC (engineering, procurement and construction) and project management services in the oil and gas and petrochemicals space. Here, the company is present in the entire hydrocarbon value chain (upstream, midstream and downstream).

In the consultancy segment, EIL provides services such as conceptualise, design, engineer and construct projects as per client’s specific requirements while projects in its turnkey segment require the company to manage end-to-end engineering and even EPC part.

Though consultancy segment used to have a higher share historically i.e. 70-80 per cent, the company now generates 45 per cent and 55 per cent of operating revenue from consultancy and turnkey (EPC) segments respectively. In the turnkey segment, it earns revenue on a cost-plus basis and management has guided EBIT margins of 3-4 per cent in the segment.

Further, about 90 per cent of company’s business is based in the domestic market while the rest comes from its consultancy assignments in countries such as Nigeria, the UAE, Oman and Mongolia.

EIL has a track record of being involved in setting up 20 out of 23 refineries and 10 (of 11) petrochemical complexes in India. Over years, the company has been preferred partner for oil and gas PSUs, such as ONGC, BPCL and HPCL. While keeping Oil and Gas at core, the company has been able to diversify its operations into sectors such as Fertiliser, Power, Mining & Metallurgy and Infrastructure.

Also read: Three stocks that outperformed in week ended January 13

During H1FY23, the company secured orders worth ₹565.5 crore (₹316.1 crore for consultancy and ₹249.4 crore for turnkey), which has been moderated compared to orders of ₹1450 crore in H1FY22. However, it sits on an order book worth ₹8,431 crore, which is around three times its trailing twelve month of revenue, providing revenue and growth visibility; the company expects to end FY23 with secured orders worth ₹4,000 crore. The order book comprises 55 per cent of orders in the consultancy segment and the rest in the turnkey segment.

Financials and valuation

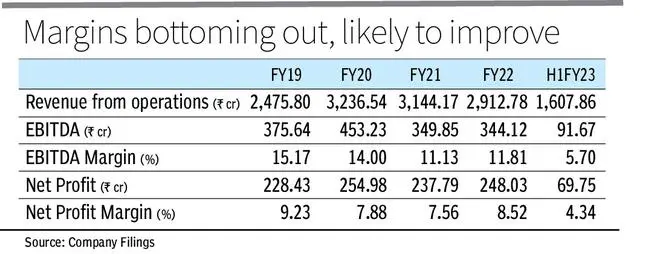

During H1 FY23, the company reported revenue of ₹1608 crore, up 17 per cent from H1 FY22. The revenue growth was mainly aided by 34 per cent revenue growth in its turnkey segment. However, revenues from consultancy segment have shown a de-growth of about 3 per cent owing to slow execution. EIL’s EBITDA margin has contracted to around 6 per cent from 12 per cent on account of low revenue share and EBIT margin contraction from consultancy segment. However, management has guided for improvement in the EBITDA margins on account of better execution and materialisation of pending change order (amendment to contract) from consultancy segment. Consequently, on the basis of consensus estimates, the company can end FY23 with EBITDA margin expansion to around 10 per cent.

Further, the company enjoys the net cash status on account of being involved in an asset-light business. EIL is a free cash flow positive company and has a healthy cash balance of ₹1,240 crore i.e., about 25 per cent of its market capitalisation. This enables the company to offer dividend yield of about 4 per cent to its shareholders.

The stock of EIL trades at 11.4 times its estimated one-year forward earnings i.e., around 11 per cent lower than its historical five-year average P/E of 13.2 times. Its one-year forward EV/EBITDA stands at 8.5 times i.e., 11 per cent higher than its past 5-year average 7.6 times.

Outlook

Oil and gas segment comprises around 94 per cent of the order book as per CARE report as on September 30, 2022. However, in the upcoming future, to reduce the cyclicality of business, while keeping oil and gas at core, management targets 15-20 per cent from sectors such as coal gasification, waste to ethanol for steel, green hydrogen, data centres and airports, the approximate timeline for which is not stated by the management.

Ultimately, despite the moderation in margins, investors can look forward to accumulating the stock of EIL on dips on account of its attractive valuation, debt-free nature, robust order book, strong dividend yield and healthy cash balance. Also, investors should consider risks such as slow execution and lower growth of Oil and Gas industry in the coming times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.