Even as soaring crude prices sent the country’s economy into a tizzy, it has sweetened the prospects for a few. One of the indirect beneficiaries of high crude oil prices is the Indian sugar industry. But how? Well, given India’s high import dependency for energy — nearly 80 per cent of its crude oil requirement through imports — the relentless increase in crude price has forced the Indian government to accelerate the Ethanol Blended Petrol (EBP) programme. For Indian sugar producers grappling with high input costs (sugar cane price is controlled by the government as is higher than in other leading producing countries), volatility in sale price and surplus sugar output, EBP is the panacea. The Government of India is targeting EBP of 20 per cent by 2025 (which is about 1,000 crore litres of ethanol). The country has already achieved 10 per cent blending and it will start rolling out 20 per cent blended petrol beginning 2023.

While we have discussed at length in the Big Story in BL Portfolio edition dated July 3 (https://tinyurl.com/2p7cwyb9) about how this will benefit the Indian sugar Industry as a whole, one of the key beneficiaries of the ongoing EBP programme is Balrampur Chini Mills.

As a leading, low-cost, integrated sugar producer, we believe the Kolkata-headquartered company with operations in Uttar Pradesh, one of the largest sugar cane producing States, to be well positioned to ride the EBP wave. Investors with a two-three year investment horizon and moderate-to-high risk appetite can consider investing a portion of their funds in the stock of Balrampur Chini Mills. At the current market price, the stock trades about 10.2 times and 7.8 times its consensus FY23 and FY24 estimated earnings. We believe Balrampur to be a good bet for three reasons.

Growth at a healthy pace

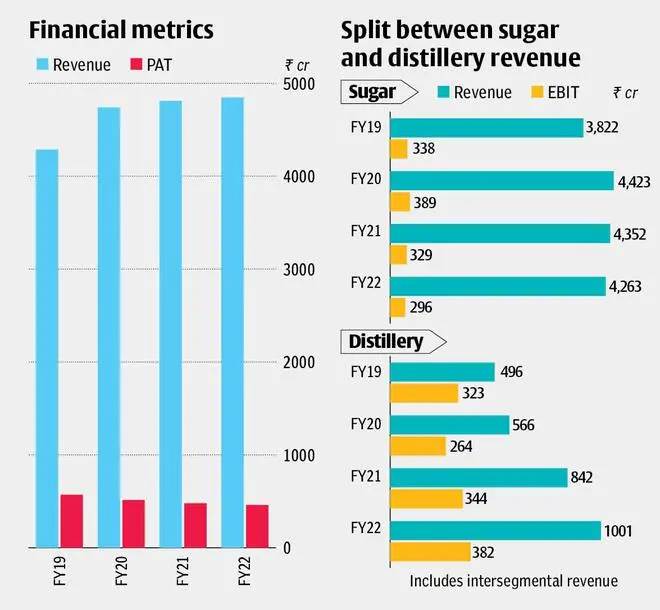

First, the company’s sugar segment is expected to grow at a healthy pace. Balrampur is among the most-efficient sugar producers in the country. With a total cane crushing capacity of 77,500 tonnes per day, the company crushed about 885 lakh quintals of sugar cane, producing about 90.96 lakh quintals of sugar. The cane crushed in FY22 was lower by 14 per cent compared to FY21, due to lower cane availability. However, the company is increasing adoption of new cane variety (Co-118). This along with expected increase in sugarcane crop cultivation (about 10-15 per cent) this year, should help the company continue to crush more cane in the ensuing season. The number of effective crushing days, after a blip in FY22 at less than 130 days, is expected to increase to 160-170 days in the next two years. Diversion of sugar for ethanol by the industry at large, from about 3.5 million tonnes currently to about 6 million tonnes by 2025, should help in moderation of sugar production and thereby support sugar prices and realisation for sugar producers. All these should help the company’s sugar business. In FY22, the company’s revenue from sugar segment stood at ₹4,263 crore, while the EBIT (earnings before Interest and Tax) was ₹296 crore, implying a margin of about 7 per cent. Sugar business accounted for about 81 per cent of the revenue and 46 per cent of the EBIT in FY22.

Besides sugar, the company has saleable co-generation capacity of 172.2 MW. However, reduction of tariff by the UP Electricity Regulatory Commission by ₹2/unit has made it unviable for units operating in the State, including that of Balrampur, and hence the company is currently operating the co-gen plant only during crushing season for captive use and sells the bagasse to paper manufacturers.

Expansion on the cards

Second, Balrampur is expanding its distillery capacity from the current 560 kilo litre per day (KLPD) to 1,050 KLPD. The incremental capacity is expected to come on stream by H2-FY22. This should help the company almost double its revenue from the distillery business, which was at ₹1,001 crore in FY22. The share of revenue from the distillery is expected to increase from the current 19 per cent to 35 per cent by FY24. Given the strong margins in the distillery segment, the EBIT is expected to almost double over the next two years from ₹382 crore in FY22. The EBIT margin for the segment was 38 per cent. Higher contribution from the profitable distillery segment will help improve Balrampur’s overall profitability and quality of earnings, besides providing stability to the company’s operations and financials.

Strong financials

Finally, the company’s strong balance sheet with healthy return ratios – Return on capital employed of 20.7 per cent and return on net worth – 19.7 per cent, sets it apart from debt-laden, similar sized competitors such as Shree Renuka Sugars. The company’s total debt in the books stood at ₹1,207 crore, of which ₹960 crore is short term. With total shareholders’ funds of ₹2,758 crore as of FY22, the total debt/equity was comfortable at 0.34 times. This is expected to improve with better profitability and higher contribution from distillery business.

In FY22, the company managed to reduce its debtors to ₹137 crore from about ₹245 crore in FY21. Inventory on the books was also marginally lower in FY22 at ₹2,201 crore, vis-à-vis ₹2,378 crore in FY21. The company has managed to generate positive operating cashflows over the last three years – ₹694 crore in FY22 vis-à-vis ₹649 crore in FY21.

Robust growth visibility, improvement in the operations and quality of earnings, with stable operations, makes Balrampur Chini Mills a good re-rating candidate.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.