Investors with a long-term perspective can buy the shares of Oracle Financial Services Limited (OFSS). In our bl.portfolio edition dated August 24, 2021, we had recommended an accumulate rating on the stock when it was trading at around ₹4,400. While we were cautious on the IT sector in general, we had a relatively positive view on quality stocks within the sector that were trading at reasonable valuations. OFSS was one such stock. At the same time, since the stock had run up by nearly 30 per cent in 3 months into end of August 2021, we had recommended investors to accumulate the stock rather than buy in one go.

Since then , the stock has, however, corrected by 28 per cent (adjusted for dividends) versus the Nifty IT index down 21 per cent and well known IT services stocks being down 20 to 40 per cent. The company’s performance over the last one year has been a bit lumpy on a quarterly basis . Nevertheless, the decline in stock price cannot be entirely attributed to performance. The stock has, at times, over different periods, under-performed relative to industry due to lack of clarity on what its parent company — US-listed Oracle Corporation — plans to do with its 73 per cent stake in OFSS. There have been rumours on and off in the past decade that Oracle Corporation was interested in buying out minority shareholders and delisting OFSS, but so far those have not become reality.

Post decline in the last year, the stock now trades at a very attractive valuation of 11.5 times one year forward earnings (Bloomberg) versus five year historical average of 17 times. The company also has been consistently returning excess cash to shareholders and its current dividend yield is 6.4 per cent (amongst the highest in the sector). These returns are sustainable, given solid balance sheet position of the company, with net cash in its books at more than 15 per cent of its current market cap and free cashflows (FY22) at 7.5 per cent of current market cap.

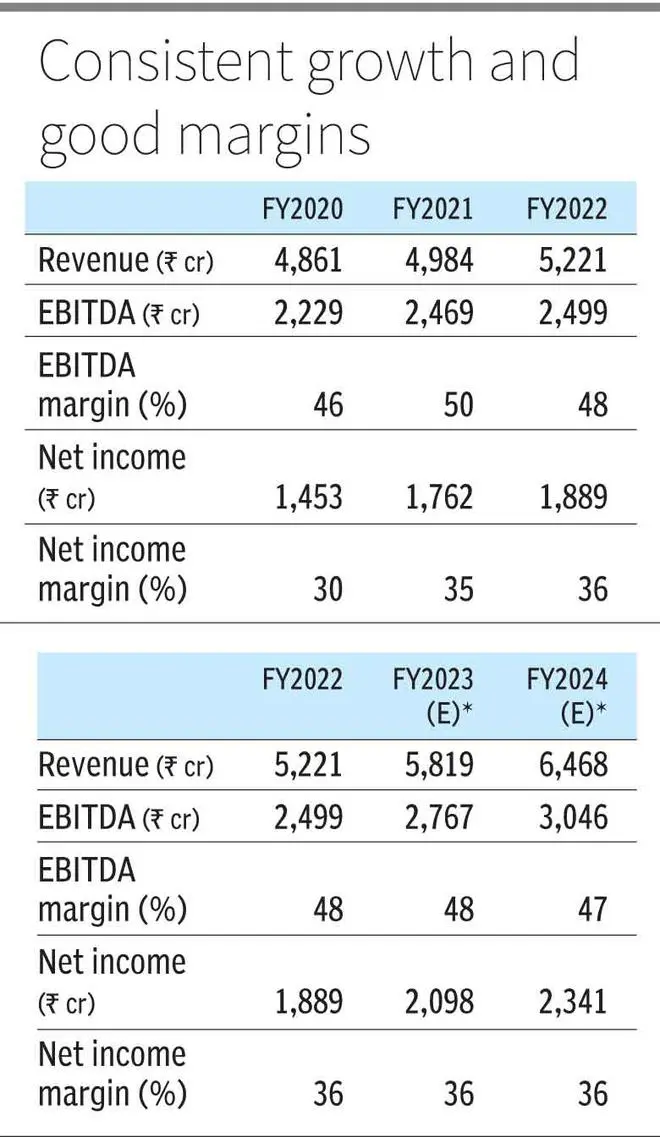

These are in a way depressed valuations for a tech company with consistent and stable performance across time periods, and also for a company with far superior operating margins when compared to most of the companies in the Indian IT industry. For example, in the recently concluded June quarter, OFSS reported operating margins of 45 per cent versus tier 1 Indian IT services companies reporting operating margins in the 15-23 per cent range for June quarter and even lower margins from tier-2 IT services companies.

While OFSS is differentiated and is a software products company and hence bound to have better margins, the point here is to highlight its relatively better operating metrics, in contrast to depressed valuations. Thus, it’s a good level now to buy the stock with a long-term perspective. Deriving good returns in the stock would either require a catalyst in the form of delisting by parent company, or will require some time (maybe even a few years) for market to arrive at fair value. . Hence investors willing to play the waiting game can buy the stock. Consistent progress on deal wins, which have been lumpy, can also be a catalyst.

Business

OFSS is a global leader in providing IT solutions to the financial services industry . It offers comprehensive banking applications across the spectrum of retail, corporate and investment banking to financial institutions. Its technology solutions cover end-to-end requirements (front to back office) in the financial services industry and also include risk management, analytics and forensic finance.

It is a software products company and earns revenue by way of licensing, consulting and maintenance fees linked to the product. Its flagship product is Oracle Flexcube. The company also earns some revenue from allied services and BPO. However, these currently form a small part with products revenue accounting for 90 per cent of total revenue. Within its products business, the company has been adapting well to the changing dynamics in the industry with the shift towards SaaS (software as a service). It has been making investments in this space and a large portion of its banking product portfolio is now available as a cloud service. In coming years the company expects to ensure availability of its entire products suite in the cloud. In FY22, OFSS signed its largest-ever multi-year SaaS deal with a tier-1 US bank.

OFSS is geographically well-diversified with 27 per cent of revenues from the US, 16 per cent from Europe, 25 per cent from APAC, 15 per cent from the Middle East and Africa, and balance from rest of the world. Typically in the Indian IT space, the US and Europe account for 80-90 per cent of revenues for many companies. OFSS’s much lower exposure to these geographies may work to its advantage as recession risks loom in these two major geographies.

Recent performance

In recently concluded June Q, OFSS reported revenue of ₹1,402 crore, operating income of ₹634.7 crore and EPS of₹56.97; up by 10, 20 and 2 per cent respectively on a sequential basis. Financial metrics showed decent improvement after decline in margins in earlier quarters. Deal wins at $26.2 million were down 11 per cent on a sequential basis. For a products company, deals can be lumpy, that’s not unusual. However, this is one factor that investors need to track on a quarterly basis.

Consensus expectations indicate improvement in the company’s deal momentum and financial performance. Current estimates indicate FY22-24 revenue and EPS CAGR of 11 per cent. Risk to these estimates emanate from looming global slowdown. Banking is a sector that is highly correlated to the fluctuations in the broader economy and thus may be hit when recession comes through in the next few quarters. But given that OFSS operates in segments that are critical to the regular functioning of banking activities, it may still fare relatively better without any serious damage to its deal pipeline. Further, the company’s cheap valuations and solid balance sheet offer sufficient margin of safety against these.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.