Investor interest in small-cap funds is palpable right now. The fund category has turned into an overnight sensation. Small-cap funds have raked in more than 55 per cent of net inflows into the entire equity fund universe in the April-June 2023 quarter.

It is true that for investors with long-term goals, small-cap funds can play a key part in their wealth creation journey. But with markets at their buoyant best, many funds appear to be doing well just like a rising tide lifts all boats. Given the higher scope of alpha in small-caps, it is better to compare fund performance with category peers than just the benchmark, which is typically a wider basket of small-cap stocks.

We believe this may be a good time to rid your portfolio of under-performing funds and switch to better alternatives. Hence, investors holding units of Sundaram Small Cap Fund can exit the scheme based on sustained underperformance — short- and long-term point-to-point returns as well as rolling returns versus category. SIP returns, too, have lagged the category.

The last one year has witnessed the small-cap fund category clock an average 27 per cent rise, with the best fund performers rising by over 35 per cent. The 28-odd per cent return of Sundaram Small Cap (assigned 1 star by bl.portfolio Star Track MF Ratings) places it near the middle of the pack. Hence, investors can lock these gains and sell the fund units. Deploy the corpus in a staggered manner upon some market correction in consistent performers such as Nippon India Small Cap (5 stars) and SBI Small Cap (4 stars). Both the funds currently have some restrictions for lumpsum investments.

Note index funds and exchange traded funds (ETFs) in this space at this moment don’t offer worthy alternatives to well-run actively-managed small-cap funds.

Insipid show

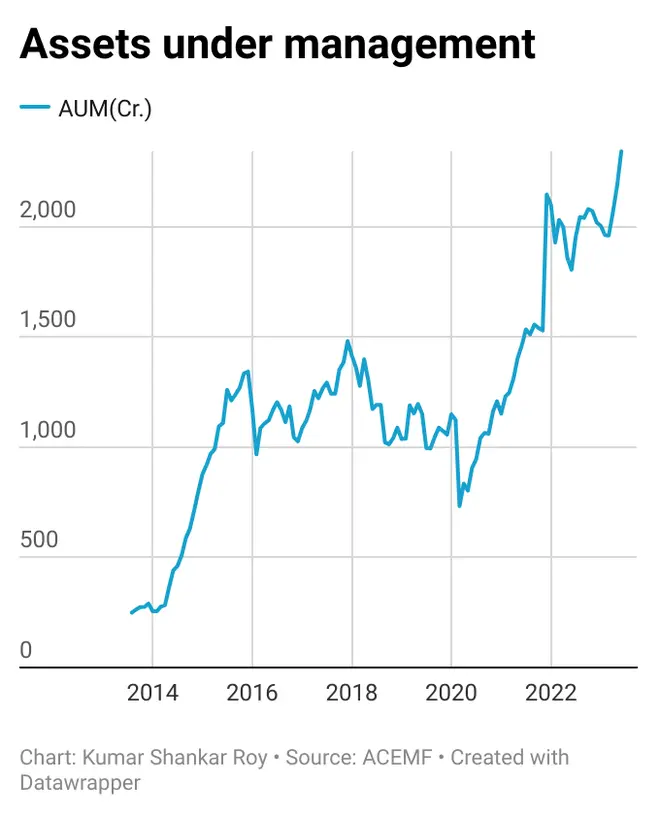

Among the oldest actively-managed funds, Sundaram Small Cap has, in different points in time, appeared promising but ultimately disappointed. In a nutshell, its relative returns are not in sync with the risk taken. Hence, the fund’s AUM even after 18 years is yet to cross the ₹3,000-crore mark.

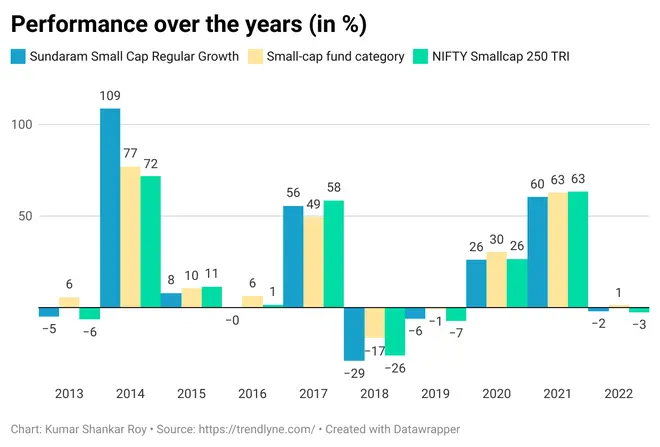

For Sundaram Small Cap Fund, in the last 10 years (2013-2022), barring 2014 (top quartile), the lows outnumber the highs by a wide margin in terms of annual returns (see table). The scheme has been in the bottom quartile on five occasions (2013, 2016, 2018, 2019 and 2022), lower-mid quartile in three instances (2015, 2020 and 2021) and once in upper-mid quartile (2017).

Compared to any other fund category, small-cap funds face big swings in returns. This means small-cap funds tend to swing between extremely good and terribly bad returns. When you win big but also lose frequently, returns can’t be great. For instance, Sundaram Small Cap posted negative returns in five out of 10 years. In 2018, when small-caps saw a big crash, the fund lost a whopping 29 per cent vs. the category average of -17 per cent. In fact, in each year that it has posted negative returns, it has lost more than the category. In 2011, another bad year for small-caps, the fund had lost 34 per cent, underperforming most peers. and in sync with benchmark losses.

Comparing rolling returns and return distribution of the fund versus its category also shows the gap. For the 10-year period (August 8, 2013 to August 8, 2023), the fund’s average rolling return for two, three, five and seven years is consistently lower than small-cap fund category. In the three- and five-year periods, chances of clocking negative returns for the fund were 19 per cent and 11 per cent — markedly higher than 13 per cent and 5 per cent for the small-cap fund category.

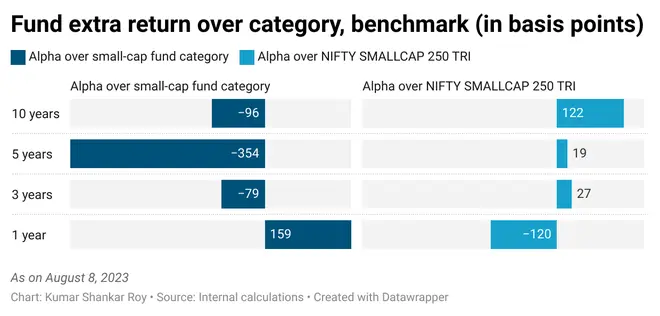

In terms of trailing point-to-point returns, Sundaram Small Cap is ahead of the category by 159 basis points in one year, but lags by 79 basis points in three years, by 354 basis points in five years and by 96 basis points in 10 years. Alpha over the benchmark is low in most cases. (see table)

SIP investors are not better off either, with long-term SIP returns of Sundaram Small Cap mostly lower than its category (see table).

Transition in progress

The fund’s strategy of investing has been focussed on buying ‘attractively valued high growth’ stocks using a stock selection approach that can be best described as bottom-up using in-house research. But the fund’s total expense ratio at over 2 per cent (regular plan) is too high given its below-category performance.

Recently, Principal Small Cap Fund was merged into Sundaram Small Cap Fund. There was a complete overhaul of portfolio management team around 2022. With the current managers steering the fund since December 2021 and November 2022, a stable track record may evolve over time but transition in terms of long-term performance could be a work in progress.

Selecting small-cap stocks in India is a very different ball game from choosing mega- or mid-caps. Small-caps require a bottom-up approach with an ear to the ground on governance and management moves. We prefer small-cap funds with specialist managers who ain’t juggling a battery of many other funds in the same fund house.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.