Markets have been in a corrective mode and remained rangebound for the last one-and-a-half year.

In the small-cap category, the benchmarks haven’t showed any progress in the last 20 months.

The Nifty Small Cap 250 TRI and the S&P BSE 250 Small Cap TRI are trading at 16-17 times trailing earnings.

Considering the above factors, now may be an advantageous moment to invest in small-cap stocks through the fund route.

SBI Small Cap can be considered by investors with a medium to high risk appetite for the long-term (10 years and above). This fund is among the best in the category and has been performing consistently since its inception in 2009. Despite being a small-cap fund, the fund handled the portfolio smartly by keeping risks at moderate levels.

Investors can consider SBI Small Cap to meet long-term financial goals via systematic investment plan (SIP) route.

Superior performance over long-term

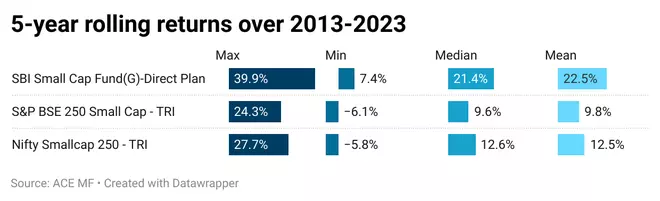

On a rolling five-year returns basis, the fund has generated an average return of nearly 22.4 per cent over the 10-year period (2012-2023), placing it on the top within the small-cap category. Notably, the fund has not recorded a single negative return on five-year rolling basis over the same period.

Despite volatility in the markets, SBI Small Cap has outperformed its benchmark—S&P BSE 250 Small Cap TRI—on a five-year rolling basis in the past decade. Further, when five-year rolling returns are taken over 2013-2023, it has delivered in excess of 15 per cent returns nearly 71 per cent of the times.

To understand how the fund has been containing risks better than the markets, we can examine the upside and downside capture ratios which indicate how the scheme has been participating in rallies and containing downside risks.

SBI Small Cap has a downside capture ratio of just 58.6, indicating that it falls far less than the benchmark. The upside capture ratio is 83.5, suggesting that it may not fully participate in rallies. But, on the whole, the fund managers have been delivering robust returns over the long-term.

A score of 100 in both ratios indicates that a fund rises and fall in line with the benchmark.

Also read: Majority of Indian large-cap funds failed to beat benchmark in 2022: SPIVA scorecard

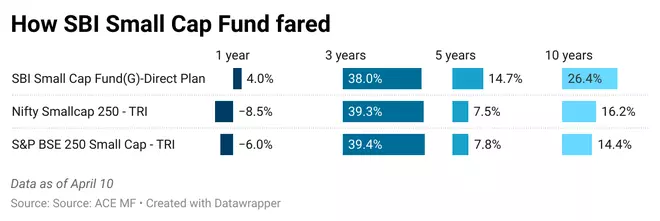

Even on a point-to-point basis, SBI Small Cap has delivered an annual return of 14.7 per cent and 26..4 per cent over the previous 5-year and 10-year period, respectively.

Off-beat moves

The fund does not load up on banks or financial services sectors like many other funds do. SBI Small Cap invests in segments that hold long-term prospects in line with the country’s economic growth.

Capital goods/industrial manufacturing, consumer goods, consumer services and chemicals are among the top holdings of the fund.

SBI Small Cap had not parked its money in software, pharma, or even automobiles and ancillaries to play the broader market rally from March 2020 to September 2021, resulting in a lag in comparison to its benchmark over a three-year period.

Also read: Mutual fund distributors Vs Registered Investment Advisors: How should you choose?

It is hard to pinpoint the style followed by the fund. But, overall, the fund seems to prefer cyclical sectors in its portfolio.

But in a market characterised by high volatility, it has delivered positive returns over the last one year, especially when the benchmark is in red.

The fund had 70-75 per cent in small-caps, with mid-caps accounting for a bulk of the remaining holding. However, the scheme has brought down the exposure to around 67 per cent levels in recent months.

SBI Small Cap takes cash position in excess of 5 per cent most of the time and can go up to over 9 per cent during volatile markets. In February 2023, portfolio has a little over 7 per cent in cash and equivalents.

Also read: HAL: Why this stock is a good investment opportunity for the long-term

The fund’s exposure to individual stocks is less than 5 per cent most of the time. There are 50-60 stocks in the portfolio most of the time. Thus, the fund’s exposure to stocks is quite diffused.

There can be periods of underperformance because of the fund’s focus on cyclicals and also due to the inherent volatility that characterises small-cap stocks.

For the investors with a long-term horizon, the fund holds the potential to deliver top-notch returns.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.