Insurance regulator IRDAI is pushing for reforms to make India a reinsurance hub, but achieving this goal requires more comprehensive changes, including Order of Preferences and taxation. While progress has been made, the pace of reforms remains debatable.

The recent changes in reinsurance regulations have signalled the regulator’s resolve to transformative changes to develop the Indian reinsurance market. However, the IRDAI can’t do the heavy lifting singlehandedly. There are aspects, such as taxation, that come in the way of making India an attractive destination for Foreign Reinsurance Branches (FRBs) though the GIFT City is aimed at solving these taxation woes.

Building an ecosystem for FRBs will also involve the regulator to take tough calls on whether capping volume of business is necessary for insurers cession with cross-border reinsurers (CBRs). Bringing a level-playing field on the tax rate front could be a game-changer and incentivise more FRBs to look at India.

While FRBs located in India (domestic tariff area) must play the game with a tax rate of 42 per cent, the Indian national reinsurer, GIC Re, is subjected only to 22 per cent tax on income.

“A reason why many people are not coming to India is that tax rates are still penal. If they can move towards creating a single tax regime for all participants — for onshore and offshore — that will make it a level-playing field and attract much more participants in the country,” said Shankar Garigiparthy, Country Manager & CEO, India, Lloyd’s of London.

“If reforms can continue to be implemented at good pace over the next two to three years, then India can achieve reinsurance hub status within next decade.” Lloyd’s of London has been operating as a FRB in India since 2017.

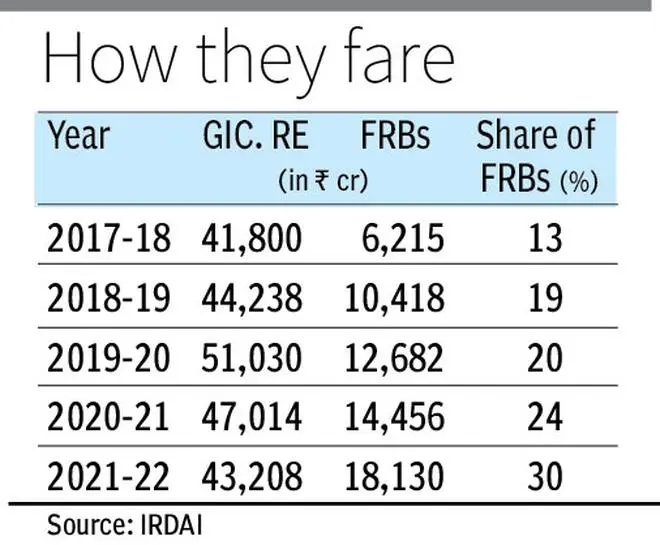

Notably, the FRBs — since 2017 when they started operations — have over the years steadily increased their share in reinsurance pie from about 13 per cent to 30 per cent in 2021-22.

On the contrary, India’s GIC Re has seen its share reduce from 87 per cent in 2017-18 to about 70 per cent in 2021-22. It would be even lower if one were to count the business written by CBRs in the overall pie.

It appears that the IRDAI, at present, is in favour of calibrated reforms and is proceeding cautiously to avoid unintended consequences, especially to the state-owned entities.

But the regulator needs to introspect why despite the opening up the reinsurance market for FRBs seven years ago, their overall share in the Indian market remains modest at only 10. Most of them had commenced business in 2017.

Recent changes

Significant among the latest changes is the IRDAI move to bring down the minimum capital requirement for FRBs to ₹ 50 crore from earlier ₹ 100 crore. This should encourage more FRBs to moving locations and writing business domestically, out of India.

Salil Das, Director of Reinsurance, Alliance Insurance Brokers, said that the reduction in the capital requirements for overseas reinsurers and the streamlining of the order of preference, are expected to lead to a rise in the number of reinsurers operating within India.

This is imperative, given India’s very own motto of ‘Insurance for all by 2047’. We certainly need more reinsurance support and thereby more reinsurance capacity.

Even the existing FRBs —largest in the world— may not want to or be able to absorb all the demand in the coming years, according to Garigiparthy.

“That’s where the new regulation is bringing an additional incentive for people to come in and set up business in India and support the growth of insurance market in India”, he said.

Another welcome change is the amendment on ceding company (insurer), which has been empowered not to cede with those reinsurers who decline to give a quote.

This would apply to all reinsurers including GIC Re, FRBs, IIOs (IFSC Insurance Office) and CBRs, said TA Ramalingam, Chief Technical Officer, Bajaj Allianz General Insurance.

On the existing cap—introduced in 2018–that places restrictions on insurers’ maximum cession that can be done with CBRs, Ramalingam said it would be preferred to have the cap calculated on the total reinsurance premium ceded and not on the premium ceded outside India. This, according to him, will help insurers negotiate better terms with CBRs.

GIFT City push

The latest amendment has narrowed the gap between capital requirements for FRBs wanted to establish in DTAs and the Gujarat GIFT City, where the minimum capital requirement to do the business is only ₹ 12 crore for reinsurers.

Garigiparthy said that the recent regulatory changes give an added impetus to those setting shop in GIFT City as they now can become at par with foreign reinsurance branches already existing in India.

“With the current regulation, they can be set up in GIFT City and treated at par with Lloyd’s, and other foreign reinsurance branches who are already operating in India”, Garigiparthy said.

The revised regulations is giving greater flexibility to foreign reinsurers— they can set up an entity in DTA region (under IRDAI) or in GIFT City.

Order of preference

While ensuring that GIC Re’s business interests as national reinsurer is not diluted, the latest regulation changes have brought down the levels of preferences from six to four.

One of things that would encourage more players to enter India would be removing the multiple tiers in the order of preference and making it very simple. Why should GIC Re be given preferential treatment when we are all supporting the same market asks Garigiparthy.

“Ultimately we want the order of preference itself be removed as reinsurance by its nature requires diversification of risk”, he added.

Providing a level playing field to foreign reinsurance branches, in terms of first preference and on the taxation front and introducing legal changes (distinguishing insurance and reinsurance within the Insurance Act) to reduce compliance burden, can go a long way in opening the sector for all and attracting more players into India. Will Government and IRDAI bite these reform bullets?

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.