When two deals happen back-to-back in the small finance bank space, it’s bound to spark talks of consolidation. More so, when the sector is constantly questioned for its ability to prove its business model and survive the long haul.

But before we can rush to spot a trend or label it, it is important to ask this critical question: what mooted the two deals? The slice-North East Small Finance Bank merger is easy to explain. It was a marriage, where the entity with capital didn’t have a viable business model, and the entity with business was starving for capital and, thus, the marriage was conceived.

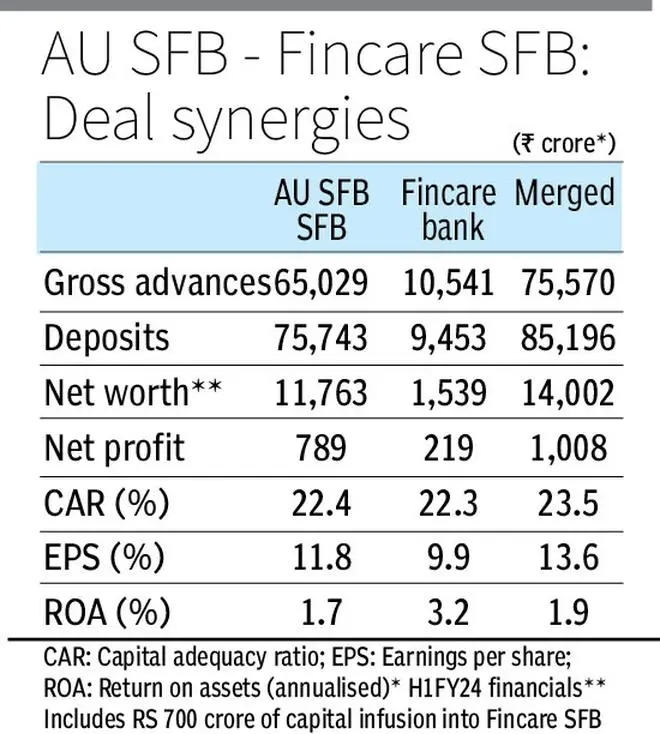

Those interpreting it as the regulator’s willingness to give a way out for fintechs or try out new models in the banking space may be reading too much between lines. As for the recent AU SFB-Fincare SFB merger, it’s not a mere pursuit of scale.

In a segment where average profitability or net interest margin is upwards of 7.5 per cent, AU is far below this number. The bank is also concentrated in the North and West India regions. The merger with Fincare will address both issues. For Fincare, there were different considerations. Being a heavily private equity promoted entity (like most SFBs), Fincare not only needs to give its investors a good liquidity option (new synonym for exit in the capital market language), but one which is also lucrative.

Utkarsh SFB, which listed a few months ago, priced its initial public offering at just around the book value, and this has practically set a new listing benchmark for SFBs. The merger with AU SFB, which values Fincare at 3.1x 12-months trailing book value, is the better option for investors of the bank vis-à-vis listing.

What these examples suggest is that there was a problem to solve, and the merger solved the problem. But are there more problems to solve to trigger a wave of consolidation among SFBs?

Resolving an issue

Scale is the latent advantage of any merger. But providence has revealed that mergers just to garner scale can be counterproductive. Tata Steel-Corus deal is the perfect example. In banking, mergers are more nuanced. ICICI Bank and HDFC Bank were on an acquisition spree in the early 2000s. Certainly, it gave them an edge in terms of scale, but it also ensured that the banks penetrated markets where they were otherwise not so strong.

Post the AU-Fincare deal, the gap between the No 1 player and one level below (fiercely competed between Ujjivan and Equitas) has widened significantly, and is equivalent to the size of at least 2-3 SFBs. Will this gap be filled by smaller SFBs folding into the larger ones or by acquisitions which could add value to the industry?

Nine NBFC-MFIs and a NBFC were licensed as SFB a decade ago in 2014. Shivalik SFB is addition in 2020 when it converted from urban cooperative bank to SFB. Fino Payments Bank is looking to become SFB. Two MFI heavy SFBs coming together is unlikely to solve the problem of scale or diversification, and seems unlikely here on because capital is not a constraint yet for most players.

Instead, segments such as housing, vehicle loans, small business loans and gold loans, could be areas of interest, given the requirement of SFBs to diversify the loan book. Even fintech could be an option. But what may be a deterrent is the valuations. It’s possible that some of these non-banks trade at a reasonable premium to SFBs. Also, integrating a non-bank with SFB could be more challenging than merging two SFBs from every viewpoint — whether the quality of book, operations and people.

To sum up, it’s a tough call to take. At one end, there is an imminent need to become large, especially if some SFBs are aspiring to become universal banks. But options ahead of them aren’t straightforward. While there is a trigger for consolidation, the means to it aren’t many and certainly not attractive in the current form. Who will resist the glitz of M&A and focus on organic growth will determine the serious players among SFBs.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.