If there’s one segment in healthcare that was seen stepping up to the challenge during the peak of the pandemic, it was medical devices. From masks to personal protective equipments (PPEs) and syringes to ventilators – there was a visible emergence of the industry from the shadows of the pharmaceutical sector.

While the global crisis helped streamline the ecosystem in which this industry operates, the momentum gained during the pandemic could lose steam, caution industry-insiders, as they call for co-ordinated action on the ground, speedy approvals and better procurement, for instance.

The medical devices segment is getting more attention than in the past, but not enough, says Dr GSK Velu, Chairman and Managing Director, Trivitron Healthcare group of companies.

Import-friendly

“It is still easier to import a product, than make it here,” says Dr Velu, reiterating an observation he had made to businessline’s Pulse, five years ago. Medical devices need a separate department and staff who understand its unique features (that are different from the needs of the pharmaceutical industry); besides giving the industry the coordinated push needed to grow, he says.

A single window approval for products is required, compared to the present system that requires multiple agency approvals, depending on the product, he explains. On the manufacturing front too, he echoes an industry-experience when he says, it is easier to set up and operate in China, Turkey or Malaysia, Europe or the United States.

Rajiv Nath, with the Association of Indian Medical Devices (Aimed), points out, of the about 1,000+ factories set up during the pandemic to cope with the country’s heightened needs, about 300 have shut down and another 300 are expected to in, about six months. While this may be due to the drop in Covid-19-linked demand, he adds, they could have been repurposed and supported. Some of them have moved to non-medical businesses, unable to fund compliances etc needed in medical devices, he explains.

The factories shutting down were in segments like PPEs/overalls, oxygen concentrators, oximeters etc, says Nath. And their exit is “a loss to the country and the sector,” he adds.

The regulatory and business ecosystem has seen some traction, in the setting up of the Export Promotion Council for Medical Devices, medical device parks and PLI (production linked incentive) schemes. There is a draft New Drugs, Medical Devices and Cosmetics Bill, 2022; and there is an ongoing discussion on an entirely separate dispensation for medical devices.

While the air is still to clear on both these, there are existing recommendations that need to be implemented to support domestic manufacturers and make it viable for them to continue to make and sell in the country, says Nath.

Despite learnings from the pandemic, when the dependence on one country for products proved costly to the world - the present ecosystem in India is still largely “import-friendly”, say local entrepreneurs, adding that they were unable to compete in a system where low prices trump technical qualities when it comes to procurement.

No clear policy

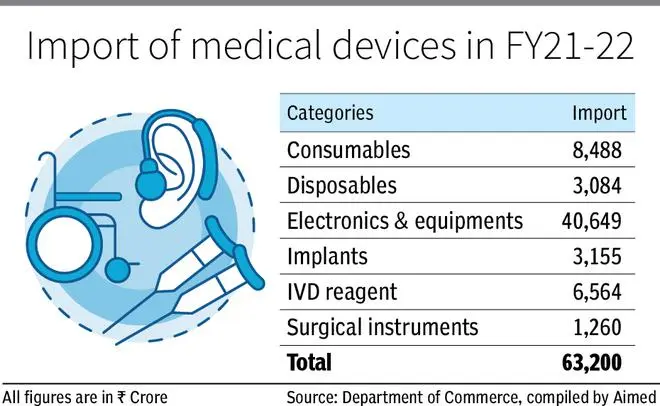

A key requirement is predictability, says Nath, pointing out that they have been waiting for many years now, for a well-defined policy governing medical devices. The medical devices industry stands at about ₹1,20,000 crore, with imports estimated to remain at ₹60,000-odd crore by March, he says. Last year, it was over ₹63,000 crore, and a lions share of the imports is shared between China and the United States, with the latter accounting for the high-end, more expensive products.

Varsha Rajesh, lawyer with Nishith Desai Associates, says, the pandemic was a catalyst and brought in greater streamlining of the medical devices sector. With features like the marketing code for medical devices, and the regulation of software as medical devices, that includes wearable devices, health apps etc, she says, this year could see more traction in the sector.

Agreeing that there are rules in place, Dr Sanjiiiv Relhan with the Preventive Wear Manufacturers’ Association of India, brings it back to the absence of an ecosystem and calls for better implementation of the rules, besides the checks and balances on manufacturers, their quality, sourcing etc. This was the best time for Indian entrepreneurs to offer an alternative hub for manufacturing, with quality products. The world is ready, but for that, the industry and regulatory system has to be upto scratch, he says. Otherwise they could lose ground, especially since other countries are rolling out the carpet for quality medical devices manufacturers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.