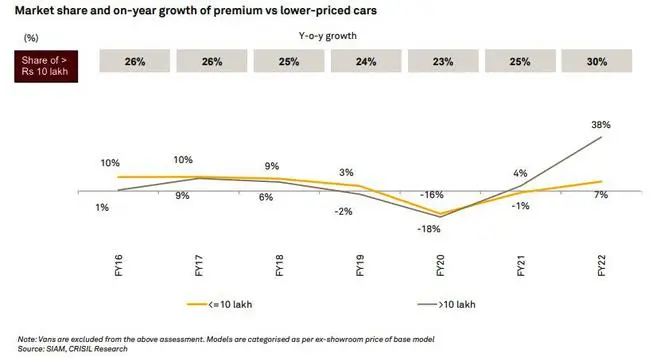

High-end cars and SUVs carrying a price tag of above ₹10 lakh reported a five-fold growth in sales as compared to lower-priced cars, according to a Crisil report.

The key reasons given for this were — the stark difference in income sentiment of the target consumers, a sharper rise in prices of lower-end cars, fewer options (some manufacturers exited the segment), and a slew of new launches in high-end models that are attracting more buyers.

Over the past two fiscals, the Covid-19 pandemic has changed the dynamics of many an industry. The passenger vehicles segment is one such. In FY22, cars priced above ₹10 lakh (or the premium segment) sold five times more than those with lower prices, and notched up about 38 per cent year-on-year growth compared with about 7 per cent y-o-y growth for the latter.

Consequently, the market share of premium cars increased 500 basis points (bps) to 30 per cent last fiscal from 25 per cent in FY21.

In India, lower-priced cars are bought by first-time users or those upgrading from used cars. With the pandemic impacting income sentiment significantly for entry-level car buyers, purchases and upgrades have been getting postponed, it said.

Price hike over safety norms

On top of muted income sentiment, there has been a 15–20 per cent cumulative increase in the sticker price of lower-end cars over the past four fiscals due to increased stringency of safety regulations (mandating ABS, front row airbags, speed warning alarms, seatbelt reminder, rear parking sensors, crash test norms) and the transition to BS-6 emission norms. These have also dragged sales down.

Sales of best-selling low-priced vehicles such as Maruti’s Alto, Swift, Baleno, Vitara Brezza, Celerio and Dzire; and Hyundai’s i10 and i20 (which cumulatively accounted for about 56 per cent of the lower-priced cars sold in FY19) have been on a decline for three fiscals now.

Source: Crisil Research

There were only about 39 models of lower-priced cars available last fiscal against 54 in FY16. Additionally, new launches in the lower-priced cars segment since FY20 contributed only about 15 per cent of volume share within the segment in FY22.

But the drive was different for higher-priced cars. Bestselling models such as Hyundai Creta, Maruti Ertiga and Ciaz, Mahindra Bolero and Scorpio, Honda City, Ford Ecosport and Toyota Innova (which cumulatively accounted for 68 per cent of the higher-priced cars sold in FY19) have witnessed a decline in sales since then.

Instead, new launches have outperformed. Though several models available were stable at 53-55 per cent, new launches since FY20 contributed significantly to overall sales volume in the segment. As many as 19 of them racked up 32 per cent of volume share within higher-priced cars in FY22. The higher-priced new models doing well are Kia Seltos, Maruti XL6, MG Hector, Mahindra XUV700 and Hyundai Alcazar.

Consumer preference has been gradually shifting from low-priced models that did well previously to similarly priced UVs. Some even prefer buying a used car in a costlier segment than spend an equivalent amount for a lower-segment car.

Looking ahead, higher-priced cars have a larger share at about 30 per cent versus the previous 25 per cent due to resilient incomes of affluent buyers and traction for new models, the report said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.