Interest expenditure of many State governments has been spiralling high in the current fiscal as higher market borrowings and rising interest rates are pushing up the interest burden of State exchequers.

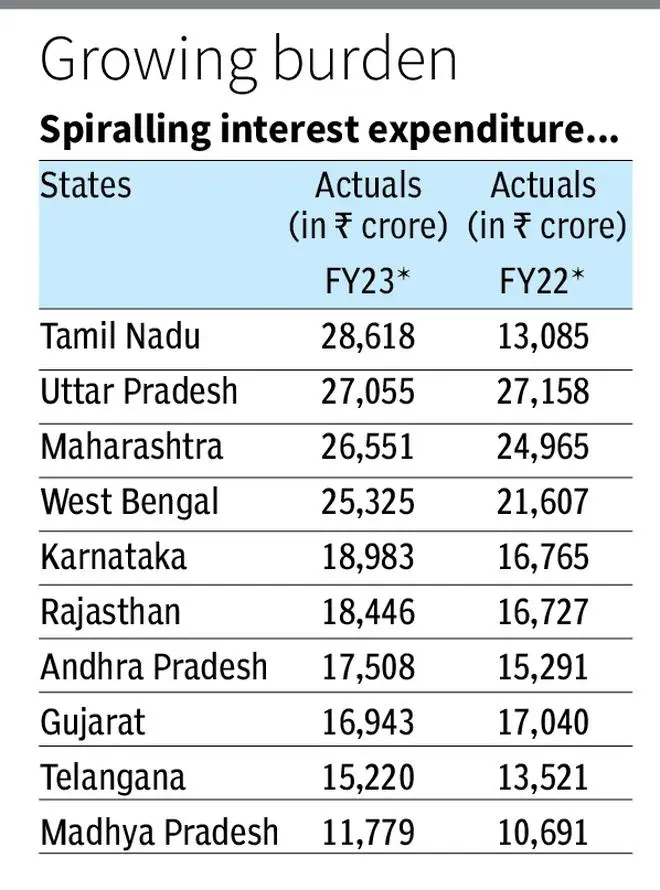

As per provisional figures of the Comptroller and Auditor General of India (CAG), the combined interest expenditure of 10 large States went up 17 per cent to ₹2.06-lakh crore in the first nine months of the current fiscal. The interest outgo during the same period of the previous fiscal stood at ₹1.77-lakh crore.

Tamil Nadu saw the sharpest increase in interest payments during the April-December period. The State’s interest expenditure was ₹28,618 crore in the first three quarters of the current fiscal compared to ₹13,085 crore in the corresponding period of the previous fiscal. Tamil Nadu has already spent 61 per cent of its budgeted interest expenditure for FY23 in the first three quarters as compared to 31 per cent during the same period of FY22.

Barring Uttar Pradesh and Gujarat, which saw a marginal drop in interest outgo compared to last year, all other States spent more on interest cost at the end of the first three quarters. While Tamil Nadu’s interest outflow was ₹15,533 crore higher in the first three quarters of FY23 compared to the corresponding period in FY22, West Bengal’s interest cost went up by ₹3,718 crore during this period.

Borrowings surge

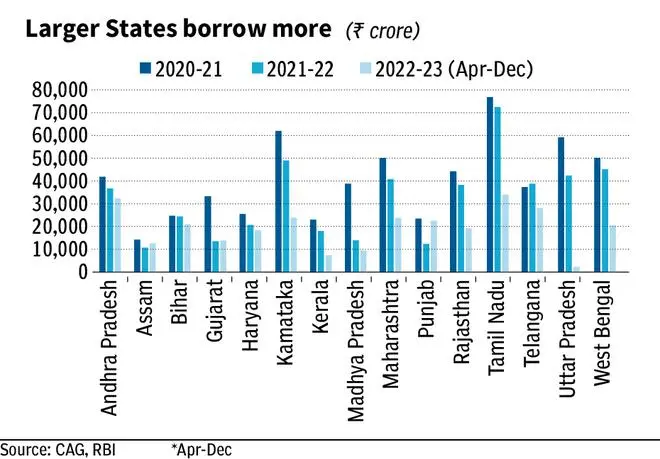

However, it is no surprise that Tamil Nadu has the highest interest payment outgo since the State borrows the most from market to finance its fiscal deficit. According to RBI’s recent report on State finances, Tamil Nadu budgeted ₹82,503 crore of market borrowings for FY23 as compared to Maharashtra’s ₹70,814 crore and Uttar Pradesh’s ₹64,650 crore. Tamil Nadu is also projected to have the highest outstanding SDL (State Development Loans) as of March 2023, at ₹5.32-lakh crore, followed by Uttar Pradesh (₹4.66-lakh crore) and Maharashtra (₹4.51-lakh crore).

Impact of rising interest expenditure

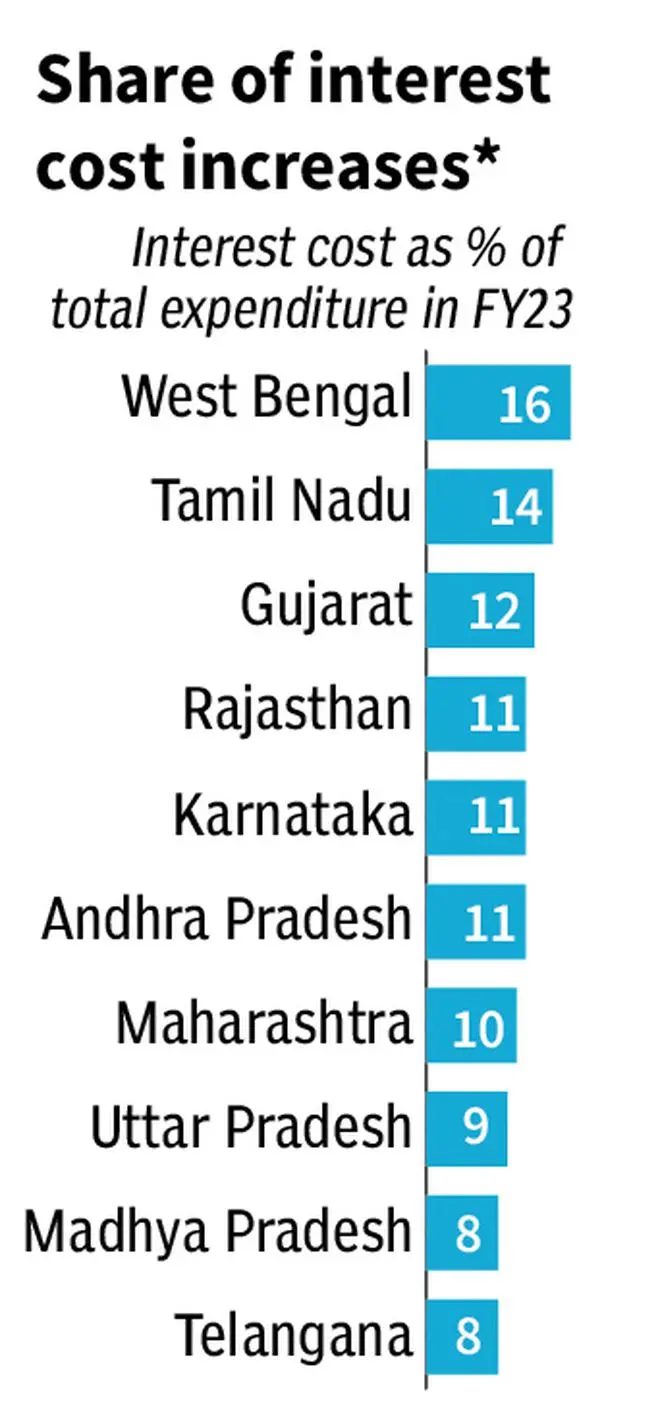

Increasing interest expenditure is likely to affect the ability of States to spend more on social sector and welfare schemes or lessen allocation to capex for meaningful asset creation. For instance, interest expenditure accounted for 16 per cent of West Bengal’s total expenditure during April-December this fiscal year. In case of Tamil Nadu, interest expenses stood at 14 per cent of the State’s total expenses during this period, rising from around 10 per cent in the same period of FY21.

It is to be noted that Tamil Nadu spent only 48 per cent of the budgeted capital expenditure (₹44,863 crore) in the first three quarters despite achieving robust growth in tax collections during this period. The State has already achieved 71 per cent of its budgetted revenue receipts of ₹2.31-lakh crore for FY23.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.