When you hear an Indian say that they love to travel, you ought to take them seriously. We’re not saying this but the data is. Indians form the largest migrant population in the world and the remittance that they send home is also the highest. This immigrant population offers a good source of funds that can be tapped in a period of external account crises.

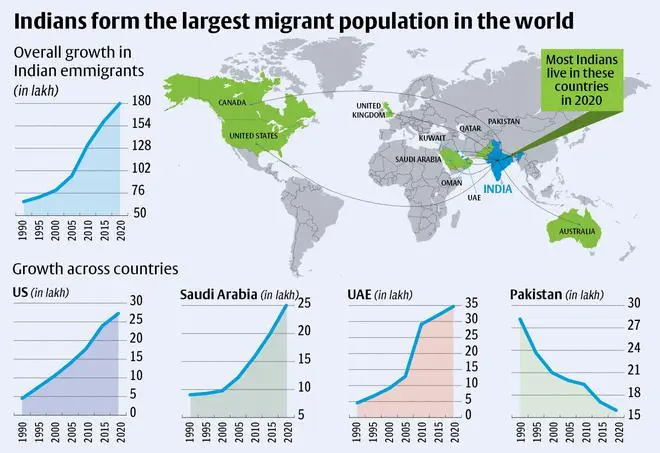

Analysis of the UN Migrant Stock Database shows that the population of Indians living abroad has grown steadily since 1990 to reach 1.80 crore by 2020. The average annual increase in the immigrant population in the three decades between 1990 to 2020 is 3.4 per cent but there have been periods when the exodus was faster.

For instance, the number of Indians living outside increased sharply since the beginning of this century. The fastest growth was witnessed between 2005 to 2010, which was also a period of economic prosperity for India. Improving wealth seems to have emboldened more Indians to seek residence abroad.

According to the UN World Migration Report (WMR) 2022, Mexico has the second-largest emigrant population in the world, but that is approximately 70 lakh people less than the Indian emigrants. Emigrants from China and the Syrian Arab Republic are next on the list.

The great Indian journey

So, where did these Indian go? The UAE appears to have been the most welcoming and had the maximum number of Indians in 2020 (34 lakh). The oil-rich nation presented a good opportunity for both skilled as well as semi-skilled workers to earn a living.

UAE became the third-largest host of Indian emigrants in 2005, after US and Pakistan. But between 1990 and 2020, its share of the Indian population grew by 657 per cent. It has been hosting the largest proportion of Indian emigrants since 2010.

Currently, India-UAE is the world’s third-largest international migration country-to-country corridor, after Mexico-US and the Syria-Turkey corridor. It is also interesting to note that India does not share a border with UAE, unlike the other two corridors.

The US was the next most attractive for Indians heading overseas. The rapid growth in technology and digital services in the US since the turn of the century needed plenty of educated and English-speaking manpower and Indians were more than ready to step in. Around 27 lakh Indians lived in the US in 2020. Saudi Arabia was next on the list as an emigrant destination in 2020, accounting for 25 lakh Indian emigrants.

But the most favoured destination for Indians between 1990 and 2005 was Pakistan. Around 28 lakh Indians lived in the neighbouring country in 1990. But the number has been declining steadily over the years to 16 lakh by 2020. On the other hand, Indians living in UAE, the US, and Saudi Arabia have shown a steady increase over the last three decades.

Apart from these four countries, places, where more than a lakh Indians resided in 2020, including Oman, Kuwait, Qatar, the UK, Canada, Australia and Nepal.

Money matters

An increase in migration is beneficial for India due to the remittance sent by overseas Indians and the money they park in Indian banks as NRI deposits. Both these factors help the country’s external balance.

According to the UN report, “In 2020, India, China, Mexico, the Philippines and Egypt were (in descending order) the top five remittance recipient countries, although India and China were well above the rest, with total inward remittances exceeding $59 billion for each country.”

Remittances are financial or in-kind transfers made by migrants directly to families or communities in their countries of origin. In 2020 alone, India received a remittance of $83.15 billion, the highest in the world. China, which is the second on the list managed to receive only $59.51 billion.

The top source of international remittance in the world is the US, which accounts for $68 billion of the total money. Indians form 5.5 per cent of the migrant population of the US. It is followed by UAE ($43.2 billion) and Saudi Arabia ($34.6 billion). Indians have a strong presence in all these countries.

World Bank data from 1975 to 2020 shows that international remittance inflow to India peaked in 2019, a year before Covid struck. In that year, India received a whopping $83.3 billion remittance. It increased steadily from 2017 to 2019, until it came down by $0.2 billion in 2020.

NRI deposits are another way in which Indian emigrants support the rupee and the economy. NRI deposits have grown from $40 billion towards the end of 2008 to $139 billion in April 2022, registering an average annual increase of 9 per cent. These deposits have averaged around $140 billion since 2020, despite the travails caused by the pandemic indicating that these flows can improve once the effects of the pandemic wear off.

Helping the rupee

Can these overseas Indian be harnessed to help the rupee which has been flailing of late?

Arun Singh, Chief Economist, Dun and Bradsheet says that the high foreign remittance to India is certainly a good sign. “Even though it came down marginally due to Covid, international remittances always aid the economy. In fact, it forms around 3 per cent of India’s GDP,” he says.

Singh agrees that the inflow of this money will stabilise the Indian rupee, which hit a record low in the second week of June 2022.

“There is a scope of bringing down the average transaction cost for Indians residing abroad. It is much lower in Mexico, which is the second-highest middle-low-income country receiving the highest remittance,” he says, addingthat the remittance will rise in the coming years, considering that many projections have predicted India overtaking China in terms of the population soon.

Sumit Shekhar, an economist with Ambit Capital believes that the increase in migration must encourage the Reserve Bank of India to reintroduce its 2013’s Foreign Currency Non-Resident (Bank) deposits policy, thereby allowing emigrant Indians to deposit surplus cash for a fixed interest rate. “

“The INR has depreciated at around 5 per cent against the USD in the past year. In such a scenario, the re-introduction of the FCNR(B) policy could provide some relief to the RBI. RBI successfully deployed the scheme during the taper-tantrum crisis in 2013 in order to keep a check on the volatility of INR and attract foreign deposits,” he says.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.