India’s agricultural production is likely to be affected by the El Nino-induced vagaries in the weather and climate. According to the Ministry of Agriculture and Farmers Welfare’s first advance estimates of the agricultural production, the output in almost all kharif crops, barring tur (pigeon pea) is lower.

This has triggered fears of an impact in the rural sector among various industries. However, some experts have ruled out any impact on the economy due to inflation in view of the measures taken by the Centre, including foreign trade policies.

Deficient monsoon

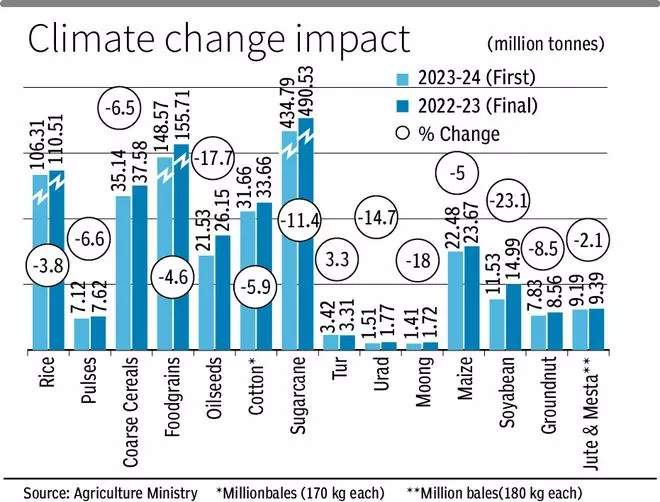

According to the Ministry, foodgrain production will be 4.6 per cent lower, while oilseeds output may decline by 17.7 per cent and that of sugarcane by over 11.1 per cent. Pulses production may drop by 6.6 per cent and that of nutri-cereals by 9 per cent, while cotton output will likely decline by 5.9 per cent.

The crops’ output has been pegged lower as the south-west monsoon, which withdrew last week, turned out to be deficient this year under the influence of warm ocean water phenomenon El Nino.

Former Commission for Agricultural Costs and Prices (CACP) Ashok Gulati dismissed concerns over lower kharif output saying the milk and livestock sectors are the biggest contributor to farm growth in the country.

“A little downward pressure on crops can be compensated by reasonably good output from livestock and fisheries. If that happens, I don’t think overall, it will be terrible,” he said.

MPC’s caution

The low kharif production estimate comes amidst declining water level in the 150 major reservoirs (lower than 10 years’ average). Besides, US weather agency National Oceanic and Atmospheric Administration has said 21 per cent of India is reeling under drought due to El Nino, which is expected to last until June 2024 — another cause for concern.

In its last meeting, the Monetary Policy Committee (MPC) cautioned that the unprecedented food price shocks are impinging on the evolving trajectory of inflation and that recurring incidence of such overlapping shocks can impart generalisation and persistence.

Madan Sabnavis, Chief Economist, Bank of Baroda, said “The situation is serious. I can see overall agri output less than 3 per cent in this scenario. It can shave GDP by 0.1-0.2 per cent.”

Agricultural production is the key to the rural economy ranging from automobiles, tractors, white goods, textiles, fast moving consumer goods, cement, steel, gold and smartphones. The purchasing power of rural India is a factor determining urban growth.

Rabi holds the key

Rohan Kanwar Gupta, Vice-President & Sector Head, Corporate Ratings, said automotive segments, two-wheeler and tractor in particular, derive a healthy proportion of their demand from rural areas.

“A decline in farm cash flows is likely to constrain rural demand and impact demand across automotive segments. A weakness in rural demand may also impact the upcoming festive season offtake and remains a monitorable,” he said.

DK Pant, Chief Economist at India ratings, said agriculture growth may be 2.5 per cent as the first quarter of the current fiscal is based on last season’s Rabi crops production that arrived from April. “But, any adverse weather shock in the current winter (rabi) season may affect the growth projection,” he said.

Shashank Srivastava, Senior Executive Officer, Marketing & Sales, Maruti Suzuki India Ltd, said lower agricultural output will weaken rural consumer sentiment and perhaps add to inflationary risks and higher interest rates.

“The lower rural income levels and the higher inflation will be obviously negative for the auto industry,” he said.

Further impact on rural areas

Consumer durable and electronic firms fear lower kharif crop production will impact demand for the entry or mass level segment. Kamal Nandi, Business Head and Executive Vice-President – Godrej Appliances, told businessline, “demand from rural regions has already been subdued. Mass segment has been de-growing . This will further impact demand from rural regions in coming quarters .”

FMCG companies have been cautious about rural demand recovery and some players have stated that they remain watchful of volatile global commodity prices as well as the impact of monsoon on crop output and reservoir levels.

Nuvama Institutional Equities, in a report on consumer goods sector release on October 23 said, ”Rural demand continues to be challenging. Some green shoots, which started in Q1FY24, seem to have witnessed a pause.”

Rahul Mehta, Chief Mentor, Clothing Manufacturers Association of India), said the garment industry is increasingly focussing on tier-2 and tier-3 centres for growth, “These centres are typically more dependent on agrarian economy. Any adverse impact or slowdown in agricultural incomes will cause a slowdown in the garment industry, affecting the industry as a whole,” he said.

Providing right signals

Trade analyst S Chandrasekaran said though the government has tweaked its trade policies and implemented stock limits in a vigilant manner, it needs to monitor physical arrival and price trend at agricultural produce marketing committee (APMC) yards to take precautionary policy measures.

“The checking out of coercive practices is inevitable and will enable income percolating in the rural areas,” he said.

Former Secretary of Agriculture Siraj Hussain said the lower estimate will provide the right signals to various stakeholders, including private trade. “These estimates also provide a context to various measures which have been taken by the government to check food inflation. Sharp drop in production of oilseeds and sugarcane proves that our surpluses can be affected by climatic events,” he said.

In its last meeting, the Monetary Policy Committee (MPC) cautioned that the unprecedented food price shocks are impinging on the evolving trajectory of inflation and that recurring incidence of such overlapping shocks can impart generalisation and persistence.

“There is no worry for rice because of ample stock with the government and inflation of rice has been checked. The government has also brought down wheat inflation as it has been unloading the grain from official reserves almost at its minimum support price (MSP),” said Gulati.

Elevate inflation

The Rice Exporters Association of India President BV Krishna Rao said though rice production was projected 3.8 per cent lower, the is no cause for worry as the domestic output can easily meet demand.

“In the case of pulses and edible oils, in which the country is not self-sufficient, the inflation will be elevated due to lower projected production,” said Pant.

Narinder Wadhwa, President, Commodity Participants Association of India (CPAI) said on the macro front, high food prices will fuel inflation and force RBI to respond with monetary policy changes. This can affect interest rates and subsequently influence the equity market.

Maruti’s Srivastava said lower rural income levels and higher inflation will be obviously negative for the auto industry. About 30 per cent of the auto sales are in the rural areas and 80 per cent of the overall sales is through financing.

Betting on rabi

The MPC said headline inflation is ruling above tolerance and its alignment with RBI’s target is getting interrupted. “Hence, monetary policy needs to remain actively disinflationary,” it said.

CPAI’s Wadhwa said the Government may have to intervene with subsidies or relief packages to support farmers, which can have fiscal implications.

The Centre and farmers seem to be betting on the rabi sowing with the area under all crops increasing by 17 per cent. However, El Nino is predicted to last until June 2024 and this could throw spanners in the works of the Government, particularly when the country heads towards elections in May 2024.

(Report anchored by Subramani Ra Mancombu with inputs from Prabhudatta Mishra, KR Srivats and Meenakshi Verma Ambwani, New Delhi; K Ramkumar and Suresh Iyengar, Mumbai; G Balachandar, Chennai; and KV Kurmanath, Hyderbad).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.