Notwithstanding 30 per cent tax on gains and TDS (Tax Deducted at Source) at the rate of 1 per cent, India remains among the top crypto markets in the world, a 2023 global report on crypto by Chainalysis says.

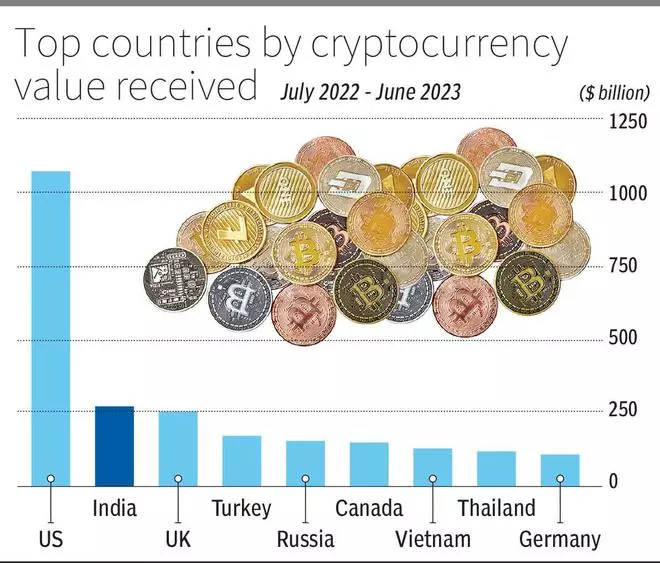

Chainanalysis, a US-based blockchain data platform, in ‘The 2023 Geography of Cryptocurrency Report’ said: “India leads the world in grassroots adaptation as measured by Global Crypto Adoption Index, but even more impressively has become the second largest crypto market in the world by raw estimated transaction volume, beating out several wealthier nations.” The US leads the table. The report pegged transactions in India at over $260 billion.

Further, it said that India’s emergence as a top cryptocurrency market comes in spite of regulatory and tax environment that can be challenging for the industry to navigate. Within the last year, regulatory agencies have provided more clarity on many issues, for instances formally decreeing that its money laundering rules will apply to cryptocurrency transactions. However, it said, India taxes cryptocurrency at a much higher rate than most other countries.

Indian Tax Administration uses the term ‘Virtual Digital Asset (VDA)’ for cryptocurrency and NFT. Effective from April 1, 2022, any income from transfer of VDAs is taxable at the rate of 30 per cent (plus surcharge and cess). The government also introduced TDS on VDA, with effect from July 1, 2022. Rate would be 1 per cent and would be deducted by any individual/HUF while buying any VDA.

Quoting various reports and using its own data analysis, the agency said that uneven implementation of TDS might be making it more difficult for home-grown Indian exchanges to compete. “While many exchanges operating in the country is required to collect TDS taxes from Indian users, many international exchanges aren’t doing so effectively, which may be drawing Indian users to them as opposed to exchanges focused primarily on India.” Accordingly, web traffic from India to international exchanges which was below 2 crore before July 2022, now has exceeded 2.7-2.8 crore.

“This trend underlines the importance of strictly enforcing local rules like TDS for all exchanges operating in a given country. Doing otherwise can create an environment of regulatory arbitrage that hurts the country’s native crypto industry,” the report added.

This report has come at a time when Finance Ministers and Central Bank Governors (FMCBGs) of G20 nations under India’s Presidency have adopted the roadmap for crypto regulation as proposed by International Monetary Fund (IMF) and Financial Stability Board FSB) in a synthesis paper. The roadmap is not in favour of a blanket ban on crypto-assets, while it vouches for a comprehensive regulatory and supervisory oversight as a better option.

The synthesis paper has advocated for comprehensive regulatory and supervisory oversight of crypto-assets, as opposed to a blanket ban to address macroeconomic and financial stability risks. It also pitched for using norms for money laundering to check the use of crypto assets for criminal and terrorist misuse.

To address risks to financial integrity and mitigate criminal and terrorist misuse of the crypto-assets, the paper said that jurisdictions should implement the Financial Action Task Force (FATF) anti-money laundering and counter-terrorist financing (AML/CFT) standards that apply to virtual assets and virtual asset service providers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.