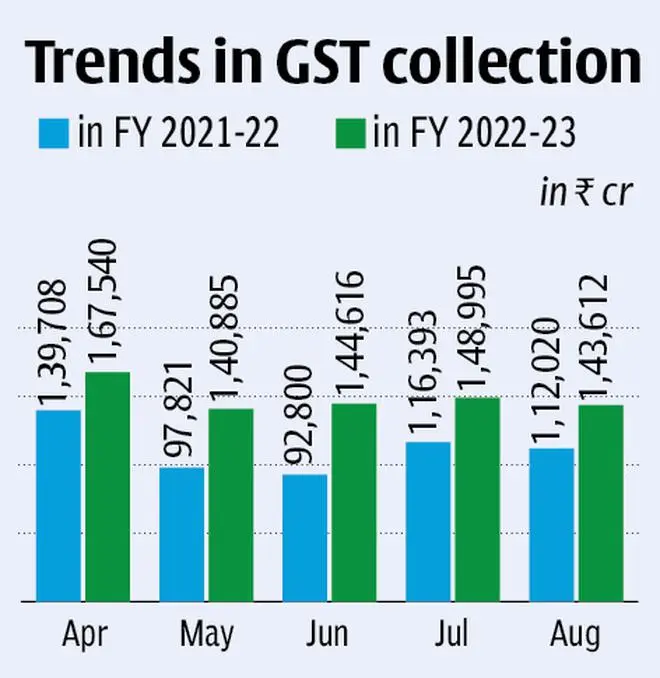

Collections from the Goods & Services (GST) in August has crossed ₹1.43-lakh crore, the Finance Ministry reported on Thursday. This is the sixth successive month of collections crossing ₹1.40-lakh crore.

Though the August number is less than ₹1.49-lakh crore of July, still it is 28 per cent higher than the GST revenues in the same month last year of ₹1.12-lakh crore. During the month, revenues from import of goods were 57 per cent higher and the revenues from the domestic transactions (including import of services) are 19 per cent higher than the revenues from these sources during the same month last year. Collections in August mean consumption and availing goods and services respectively in July.

Finance Ministry said that the growth in GST revenue till August over the same period last year is 33 per cent, continuing to display very high buoyancy.

“This is a clear impact of various measures taken by the Council in the past to ensure better compliance. Better reporting coupled with economic recovery has been having a positive impact on the GST revenues on a consistent basis,” it said. In July, about 7.6 crore e-way bills were generated, marginally higher than 7.4 crore in June and 19 per cent higher than 6.4 crore in June 2021.

‘Robust growth in economic activity’

On Wednesday, while commenting on the GDP number for the April-June quarter, the Finance Ministry said the growth in collections was supported by robust growth in economic activity along with various measures undertaken to prevent anti-evasion activities and encourage better compliance.

“The sustained growth in GST collections indicates that the growth momentum of the Indian economy has sustained even beyond Q1 of 2022-23,” it said.

Saurabh Agarwal, Tax Partner with EY India, said that while the GST revenue collections remain above ₹1.4 lakh crore for six consecutive months, a decline in cess collections by approximately 7 per cent compared to the last month indicates decreased demand for goods such as automobile, cigarettes and aerated beverages. Effectively, the robust GST collections can be said to have a minimal impact of inflation on India’s economy compared to the world,” he sadi.

Vivek Jalan, Partner with Tax Connect Advisory, feels amidst the global slowdown, a monthly collection of ₹1.40 lakh crore is the new normal. The latest number, among other things, reflects the impact of the GST rate increases implemented from July 18. The GST Rates in almost all sectors - food grains, dairy, solar equipments, printing ink, leather items, capital goods, infrastructure, real estate, hotels, hospitals, etc were increased.

Further, now the SGST Departments are also getting aggressive for collections as the period for compensation cess is already over and the Centre would no more compensate States for a shortfall in the revenues. Industry-wise action has of late been an area of interest to the revenue authorities. Therefore “it is imperative for Industry captains to have a close watch on developments in their Industry,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.