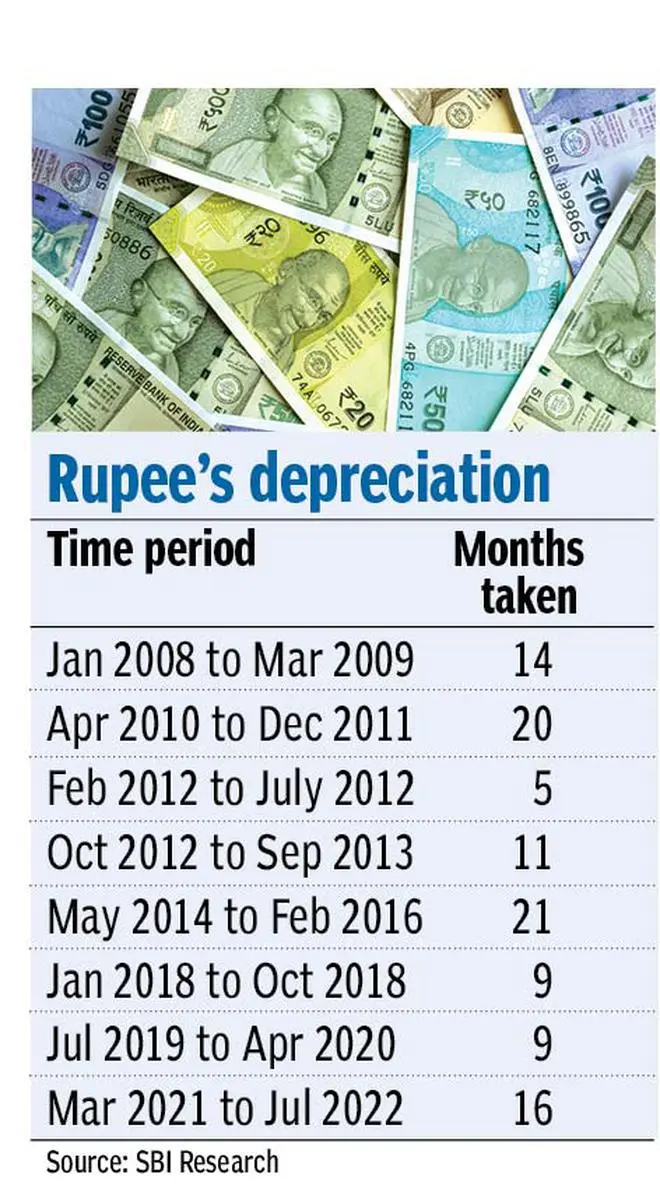

The worst of the rupee’s decline may be over. A research report by the State Bank of India found that there were only three instances where the pace of currency depreciation lengthened more than four quarters since the global financial crisis.

The report also said the Reserve Bank of India (RBI) has enough firepower left to support the rupee as it may not have used more than $30 billion in defending it.

The report noted that after the Russia-Ukraine war broke out, the RBI’s forex currency assets (FCA) — namely, forex reserves excluding gold, Special Drawing Rights — have declined by $59 billion.

However, foreign institutional investor (FII) outflows during the period totalled just $23 billion.

Thus, the rest of the decline can be attributed to a fall in the value of non-dollar reserves amid a steep and secular dollar appreciation, according to Soumya Kanti Ghosh, Group Chief Economic Adviser, SBI.

According to SBI’s economic research department (ERD) estimate, non-dollar currency may constitute 45 per cent of FCA.

“RBI might not have used more than $25-30 billion in defending rupee, given the increasing penchant of the regulator to intervene in NDF [non-deliverable forward]/ Future markets.... Rest of the decline might be purely because of valuation... Enough support for rupee is thus still available,” Ghosh said, adding that the worst of the rupee’s fall may soon be over.

He observed that the RBI has been actively managing system liquidity. It is also using spot intervention in the forex market as a policy tool to surprise the market

ECBs: Misplaced fears

Ghosh emphasised that fears of unhedged foreign currency exposure were misplaced as most companies that are raising external commercial borrowings (ECBs) have either sovereign windows (oil marketing companies), pass-through to parents (government-backed developmental financing companies in power, railways and so on) or public sector undertakings, which gives them a natural hedge character.

Additionally, natural hedge in terms of export receivables or other payments during the loan tenor offers cushion from currency market volatility.

“Corporates, in alignment with board-approved risk management policies, would have hedged a significant portion (even if not optimal) during the recent upheaval when rupee was facing volatility against a galloping USD, primarily on Euro and JPY (Yen) depreciation turf.

“With the current action of ECB (European Central Bank) raising the benchmark deposit rates by 50 basis points, we believe this should be accretive for INR (Rupee) through bringing parity in major Central Banks action,” the report said.

Major and better rated corporates also have the time-tested option of refinancing existing ECB obligations to remain unaffected by the exchange rate risk, it added.

“Not all the payments shown due and unhedged ($79 billion, as per March Financial Stability Report) are in the immediate vicinity (lumpy payments) and should be well distributed along at least a 5-year curve, giving the corporate entities much respite to repay out of future accruals along scheduled timelines.

“In the recent past, corporate profits have shown robust growth and the trend should continue well, fortifying repayment obligations sans hiccups,” Ghosh said.

CAD rise may be decade-high

The ERD opined that FY23 will be a challenging year since, as per its estimates, the current account deficit (CAD) will breach the 3 per cent mark to touch a decade high of 3.2 per cent of GDP,

India recorded CAD of 1.2 per cent of GDP in FY22, as against a surplus of 0.9 per cent in FY21, as the trade deficit widened to $189.5 billion from $102.2 billion a year ago.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.