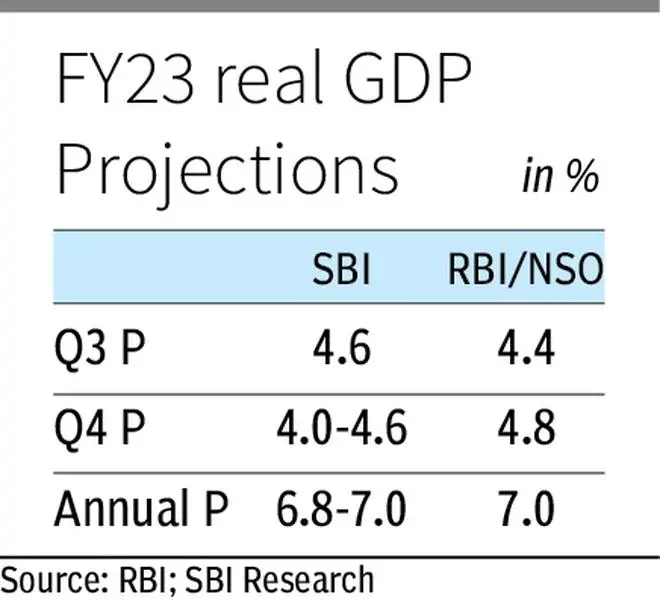

Indian economy was estimated to have grown 4.6 percent during the October-December quarter of the current financial year, said a research report by SBI.

This is higher than the 4.4 per cent growth projected by Reserve Bank of India (RBI) and National Statistical office (NSO), but lower than India ratings & Research’s (Ind-Ra) estimate of around 5 per cent. NSO will release the actual number on February 28.

India’s Gross Domestic Product (GDP) grew 0.7 per cent and 5.4 per cent in Q3 FY21 and Q3 FY22, respectively, while growth during the first two quarters of the current fiscal has been pegged at 13.5 per cent (Q1) and 6.3 per cent (Q2). For the whole of current fiscal, GDP is estimated to grow between 6.8 and 7 per cent.

“We estimate India’s GDP growth for Q3 FY23 at 4.6 per cent. This is based on an in-house SBI Artificial Neural Network (ANN) model,” SBI research report titled Ecowrap said.

ANN is a computational network model that has artificial neural networks like biological neurons that are linked to each other in various layers of the networks. These neurons are known as nodes.

SBI ANN model has been developed with 30 high-frequency indicators. ANN has been trained for the quarterly GDP data from Q4 2011 to Q4 2020. The research report has claimed that growth estimates of last two quarters based on ANN have been precise.

India Inc’s growth

The report further said that corporate results, excluding BFSI (banking, financial services and insurance), for Q3 FY23 shows de-growth in EBIDTA (earnings before interest, depreciation, tax and ammortisation) by 9 per cent year-on-year against 18 per cent EBIDTA growth in Q3 FY22, though the top line continued to grew at a healthier pace.

Net sales grew 15 per cent in Q3 FY23, while bottom line down around 16 per cent. Further, corporate margin seems to be under pressure as reflected in results of around 3,000 listed entities (excluding BFSI), on account of higher input costs with decreasing EBIDTA margin, on aggregate basis, from 15.3 per cent in Q3 FY22 to 11.9 per cent in Q3 FY23.

“These could pull down the manufacturing growth in Q3 FY23,” the report said.

Headwinds

It also mentioned that the geo-political uncertainty continues to rattle the global economic landscape.

With the Russian aggression into Ukraine completing a year this week, “we witness a domino effect coming in full force as tensions of formidable momentum, with meaty consequences for growth and prosperity for majority of world, take centre stage.”

Other than the lingering long war in Europe that dealt a heavy blow to food/energy/commodity security (with its pass-through effect yet to dwindle materially despite prices easing from their stratospheric highs seen in mid-2022), there are fresh points of conflict erupting primarily in Korean Peninsula and West Asia.

“We anticipate the multiple aggressions in these ‘points of conflict’ zones should keep the world powers at tenterhooks, allocating more resources to build capacity lest they suffer on many fronts going forward in these days of frenzied cacophony and above all, repricing of risk by financial institutions amidst such tumultuous times which could significantly alter the terms of trade through the year 2023,” the report said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.