Linking Aadhaar with PAN from tomorrow (July 1, 2022) will attract a penalty of ₹1,000, according to a notification by the Central Board of Direct Taxes (CBDT) dated March 29, 2022. However, if PAN-Aadhaar is linked between April 1, 2022, and June 30, 2022, then the individual is liable to pay ₹500 as a penalty.

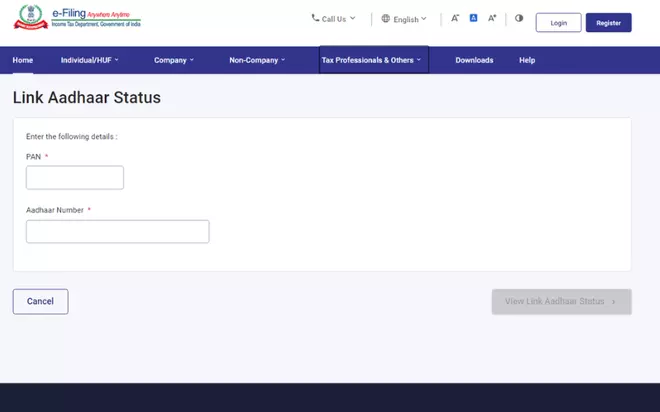

Steps to check PAN-Aadhaar linking status

Step 1: Visit the official website of the Income Tax Department: https://www.incometax.gov.in/iec/foportal

Step 2: Select ‘Link Aadhaar Status’ option from the menu appearing in the sidebar.

Link Aadhaar status

Step 3: Fill in your PAN and Aadhaar number details.

Step 4: Click ‘View Link Aadhaar Status’ and the status will be displayed on the screen.

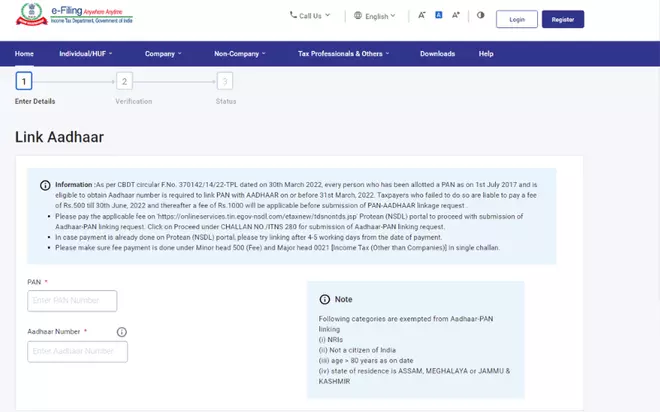

Here is how to link PAN with Aadhaar

Step 1: Visit the official website of the Income Tax Department: https://www.incometax.gov.in/iec/foportal

Step 2: Select the‘ Link Aadhaar’ option from the section menu appearing in the sidebar.

Step 3: Enter your PAN details, Aadhar card details.

Link Aadhaar tab

Step 4: Fill in the details required, including the mobile number and OTP sent to the registered mobile number and then select ‘Validate.’

On payment of the penalty, your PAN and Aadhaar will be linked. You can also check the status on the portal.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.