UPI refers to the Unified Payments Interface launched in 2016, and supports digital money transfers. To set up a UPI, users will have to have a bank account that offers the UPI facility.

Users will have to download apps that support UPI, including BHIM (Bharat Interface for Money by the National Payments Corporation of India), and private market players such as GooglePay, PhonePe and Paytm.

BHIM on Google Play

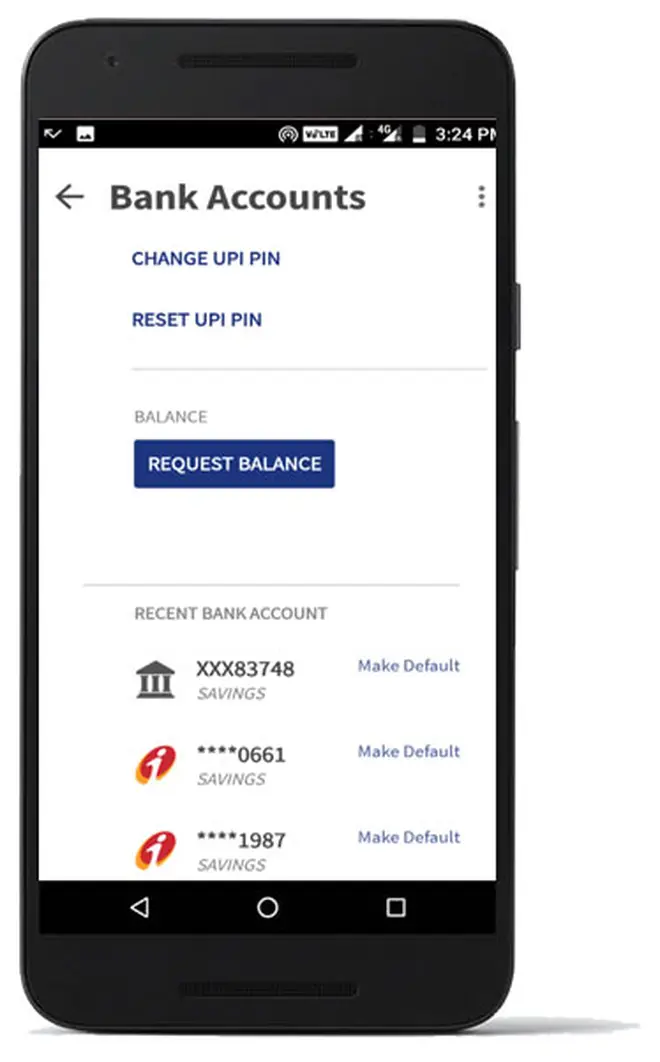

The application asks the user to choose a preferred language. They will also have to select a mobile number registered with their bank account.

Then, users will have to link their bank accounts after verification and create a UPI PIN to access the app.

Bank account linked to UPI

Here, the process of registering a UPI account is complete, and a virtual payment address (VPA) is created. It allows users to transfer money, pay their utility bills, and check transaction history.

Transaction history on BHIM

It also supports payments through QR codes.

Scan to pay feature

Check this out: UPI hits record high in April

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.