The investments of sovereign wealth funds (SWFs) have seen a steady rise over the past few years.

Assets under custody (AUC) of such funds in public markets have risen to ₹3.65 lakh crore at the end of August from ₹3.08 lakh crore last year, data from NSDL showed. The total AUC was ₹1.62 lakh crore in August 2018.

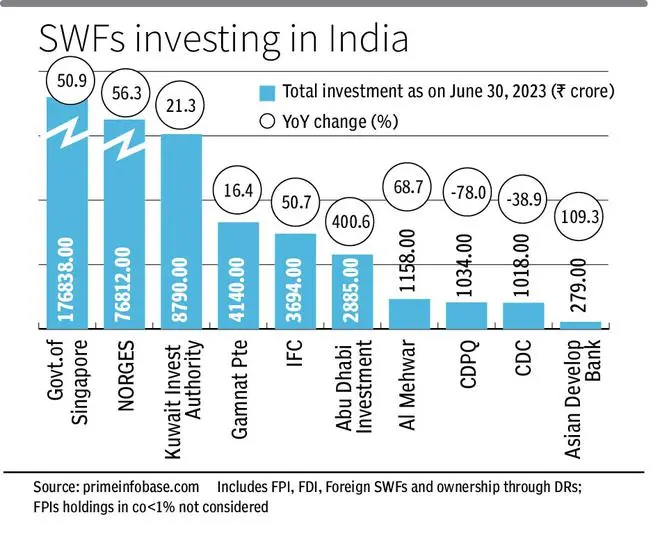

The total assets of six of the top 10 SWFs investing in Indian equities rose by more than 50 per cent in the year to June. The Singapore government was the largest SWF, with investments of ₹1.76 lakh crore at the end of June, followed by Norway’s Norges (₹76,812 crore) and Kuwait Investment Authority (₹8,790 crore), data from primeinfobase.com shows. Investment from Abu Dhabi Investment Authority rose 400 per cent to ₹2,885 crore, the most in percentage terms among the top 10 SWFs.

“Investments from the United Arab Emirates has picked up, while Saudi Arabia is looking at India more seriously given the strong inter-governmental relationships. Canadians have stopped investing in China and are reallocating to India and other emerging markets,” said Gaurav Karnik, National Leader Real Estate and Tax Partner, EY India.

Overtakes China

India has also overtaken China as the most attractive emerging market for investing in emerging market debt, according to a recent global survey by American fund manager Invesco. “India remains the fastest growing emerging market, with diminished risk owing to the T+1 settlement cycle, rapid urbanisation and increasing purchasing power as key drivers,” said Viraj Kulkarni, founder, Pivot Management Consulting.

SWFs directly invested $6.7 billion in India in CY22, up from $4.3 billion the previous year. The major sectors that have received direct investments include healthcare, entertainment, asset management and renewables, besides new-age and emerging sectors such as space. “The key evolution in the participation of SWFs and PFs is their transition from deploying money only as limited partners in private equity and public market funds managed by global GPs to investing directly in enterprises of interest. The extent of interest has grown meaningfully enough for many of them to establish a physical presence in India,” said a recent note by Nishith Desai Associates.

Saudi Arabia is now considering setting up an office for its SWF at GIFT City in Gandhinagar. Temasek Holdings is looking to invest $10 billion in India in the next three years.

Since 2020, SWFs have been granted tax exemptions under the Indian tax laws when they invest in specified infrastructure companies directly. Such exemption has also been extended to investments in units of InVITS and AIFs which invest in infrastructure companies. Such benefit is available for investments made prior to March 31, 2024, subject to a minimum holding period of three years.

“The exemption has not only increased the net return in the hands of SWFs, but has also acted as a catalyst for increasing SWF investments in the infra sector,” said Divaspati Singh, partner, Khaitan & Co.

Singh believes private markets work as a diversifier in SWFs’ portfolios due to various risk-return spectrums and asymmetric information.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.