Silver prices have declined five per cent in the past week to $20.8 an ounce, heading south further from a five-month high of $21.7 witnessed on November 14. But prices of the metal, which have slipped 10.3 per cent year-to-date, will likely witness a bullish run as silver production has slipped into a deficit against demand.

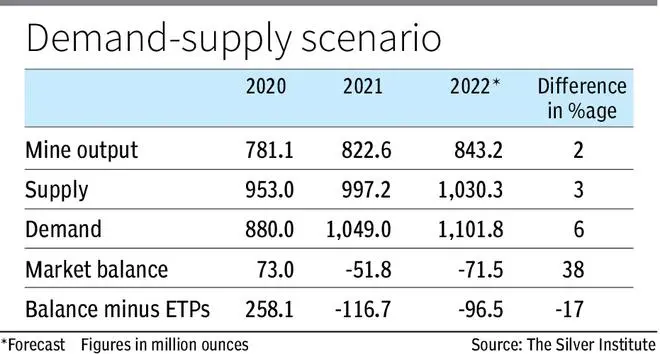

According to the Silver Institute, mine production will likely increase by 2 per cent this year to 843.3 million ounces (moz) against 822.6 moz last year. However, demand, including for industry, jewellery and investments, is projected to be five per cent higher this year at 1,101.8 moz (1,049 moz in 2021).

This leaves the market balance staring at a 71.5 moz deficit, a 38 per cent rise from 2021 when it was 51.8 moz. If investments are taken out of the calculations, then the net market balance will be a deficit of 96.5 moz against 116.7 moz a year ago.

Green energy support

“As far as silver is concerned, the price outlook remains bullish keeping the same time frame in mind. Silver production for the first time is witnessing primary deficit. The demand for silver led by the electric vehicles (EV) industry and green economy is expected to be upbeat in the coming years. But silver output has been suffering due to the continuous under-investment and the slower output of some non-ferrous metals like zinc,” said Kishore Narne, Head-Commodity and Currency, Motilal Oswal Financial Services Ltd (MOFSL).

“Silver demand is likely to increase following an uptick in polysilicon production – a key component of photovoltaic cells used for harvesting solar energy – which could support the metal’s price. Demand for silver in the manufacture of electric vehicles is also set to continuously rise,” said Narinder Wadhwa, National President, Commodity Participants Association of India (CPAI).

Analysts said silver dropped in the past week as the dollar rallied and investors paused to watch US Fed’s moves to tackle inflation. Consumption of industrial silver has been affected as the metal’s usage as an electricity conductor has been affected.

Inventories drop

But the outlook looks bullish as inventories at New York’s COMEX have dropped 70 per cent in the last one-and-a-half years, while stocks at the London Bullion Market Association fell for the 10th straight month.

“Silver inventory reportedly held in LBMA is around 870 moz (or 26,500 tonnes) valued at $16.3 billion. This is the lowest amount of silver held in the vaults since reporting started in July 2016,” said Wadhwa.

Out of the London Bullion Market Association’s holding of 26,500 tonnes, around 18,000 tonnes belong to silver exchange-traded funds (ETFs). “LBMA silver holdings have reached a dubious milestone of having dropped below one billion-ounce-level,” he said.

Prices volatility

“The amount of silver stored in vaults in London and New York monitored by the COMEX has fallen by around 25 per cent this year,” MOFSL’s Narne said.

Registered silver inventories in COMEX approved warehouses are 35 million troy ounces, near 5-year low, Wadhwa said.

Silver has, however, witnessed sharp volatility since the start of this year, marking a high of ₹73,000 and a low of ₹51,500. “Silver has the trait of both precious as well as an industrial metal and currently both these variables are triggering a move,” Narne said.

Wadhwa said silver is an interesting commodity due to its haven and industrial demand.

Narne and Wadhwa concurred on uncertainty over geopolitics driving up silver. Other factors are central banks’ actions to rein in inflation and a jump in physical demand.

Inflation concerns

The rise in silver was aided by the energy crisis, resulting in the shutdown of mines in Europe and a Chinese rally in base metals, said Narne.

“Inflationary concerns continue to be an overhang for major asset classes. Globally, central banks have taken an aggressive stance with regard to interest rates to calm the inflationary pressure. The Fed, EU, RBI and UK are expected to raise interest rates further to bring the inflation rate to near their respective tolerance range,” he said, pointing to hurdles in the metal’s uptick.

Barring India, inflation in most advanced countries is at multi-decade highs. The hike in interest rates has resulted in a sharp appreciation of the metal complex, Narne said.

“Gold-silver ratio is another important factor to look at. The ratio fell to 80 from the recent peak of 97 justifying the move in silver,” he said.

More deficits in the offing

Wadhwa said the deficit in silver is mainly due to an increase in consumption. “Sales of silver coins and bars for investment jumped by 36 per cent to 278.7 million ounces, the highest level since 2015,” he said.

A 16 per cent rise in total demand has resulted in the biggest deficit in decades, the MOFSL official said. “Demand in India, almost doubled in 2022 as buyers took advantage of low prices to replenish stockpiles drawn down in 2020 and 2021. It is expected that the strong demand from industries such as solar panels and automakers will lead to more silver supply deficits in the coming years, but not as large as in 2022,” he said.

Narne said in India, silver prices will rise to ₹64,500 a kg in the medium-term and its long-term target can be ₹73,000. “We expect silver prices to cross ₹80,000-82,000/kg level by second half of 2023,” he said.

On Monday, silver opened at ₹60,600 in Mumbai down from ₹61,320, the closing price on Saturday (November 19).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.